Fact Sheet

U.S. Department of Labor

Employee Benefits Security Administration

January 2024

ADJUSTING ERISA CIVIL MONETARY PENALTIES FOR INFLATION

Background

EBSA is responsible for administering and enforcing the fiduciary, reporting and disclosure provisions of

Title I of the Employee Retirement Income Security Act of 1974 (ERISA). Under Part 5 of Subtitle B of

Title I, EBSA has the authority to assess and collect a number of civil monetary penalties. ERISA civil

monetary penalties are for a specific or maximum dollar amount provided by statute. Percentage based

penalties such as ERISA section 502(l) (violations of fiduciaries) and 502(i) (certain prohibited transactions)

are not civil monetary penalties.

The Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015 (2015 Inflation Act)

requires EBSA to adjust ERISA’s civil monetary penalties annually for inflation. ERISA monetary penalties

assessed by a court (e.g., sections 502(c)(1) and (3)) rather than EBSA are not adjusted for inflation under

the 2015 Inflation Act.

Calculation of Inflation Adjustments

Prior to enactment of the 2015 Inflation Act, EBSA periodically adjusted ERISA civil monetary penalties,

based on the date of violation. The 2015 Inflation Adjustment Act required a one-time catch up inflation

adjustment for post November 2, 2015 violations assessed on or after August 1, 2016 and an annual

adjustment thereafter beginning in 2017. Annual inflation adjustments are based on the percentage increase

in the Consumer Price Index-Urban (CPI-U) for the October preceding the year of the adjustment and the

prior year's October CPI-U. The new penalty amounts generally are published in the Federal Register by

January 15 of the year of adjustment. For example, the percentage increase in the CPI-U from October 2021

to October of 2022 generates the inflation adjustment for penalties assessed the day after the adjustment is

published in the Federal Register in January of 2023.

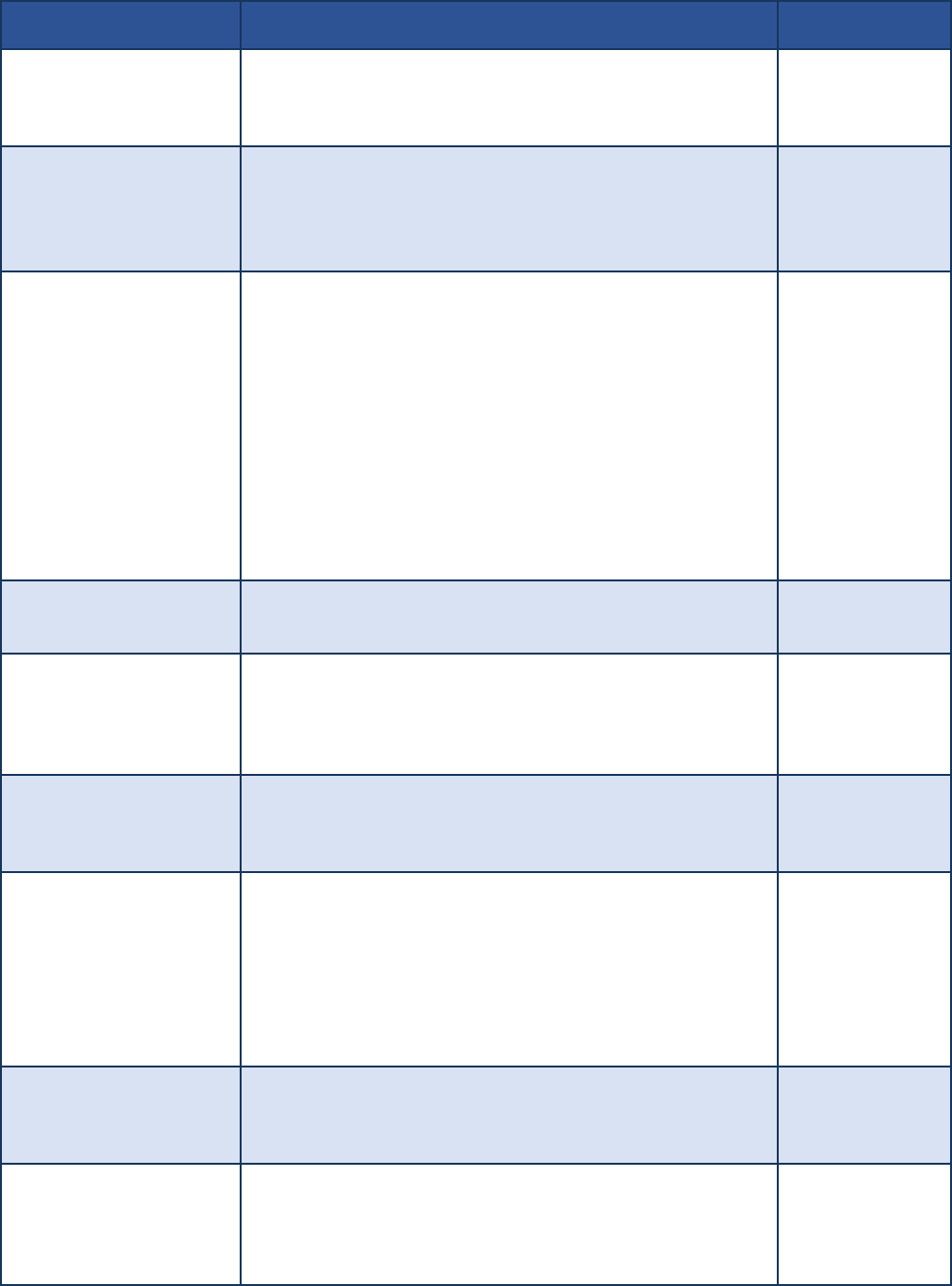

Current Year Inflation Adjusted Penalty

The table below shows the penalty amounts enforceable by EBSA for penalties assessed after January 15,

2024 for violations occurring after November 2, 2015. See, 89 FR 1810, 1819-1820 available at

https://www.federalregister.gov/documents/2024/01/11/2024-00253/federal-civil-penalties-inflation-

adjustment-

act-annual-adjustments-for-2024.

2

ERISA Penalty Statute

Description of ERISA Violations Subject to Penalty

Penalty Amount

ERISA § 209(b)

Failure to furnish reports (e.g., pension benefit statements)

to certain former participants and beneficiaries or maintain

records.

Up to $37 per

employee

ERISA § 502(c)(2)

• Failure or refusal to file annual report (Form 5500)

• Failure of a multiemployer plan to certify endangered or

critical status under ERISA § 305(b)(3)(C) treated as

failure to file annual report.

Up to $2,670 per

day

ERISA § 502(c)(4)

• Failure to notify participants under ERISA § 101(j) of

certain benefit restrictions and/or limitations arising

under Internal Revenue Code § 436;

• Failure to furnish certain multiemployer plan financial

and actuarial reports upon request under ERISA § 101(k);

• Failure to furnish estimate of withdrawal liability upon

request under ERISA § 101(l); and

• Failure to furnish automatic contribution arrangement

notice under ERISA § 514(e)(3).

Each statutory recipient who is not furnished a timely notice

is a separate violation.

Up to $2,112 per

day

ERISA § 502(c)(5)

Failure of a multiple employer welfare arrangement to file

report required by regulations issued under ERISA § 101(g).

Up to $1,942 per

day

ERISA § 502(c)(6)

Failure to furnish information requested by Secretary of

Labor under ERISA § 104(a)(6).

Up to $190 per

day not to exceed

$1,906 per

request

ERISA § 502(c)(7)

Failure to furnish a blackout notice under section 101(i) of

ERISA or notice of the right to divest employer securities

under section 101(m) of ERISA.

Up to $169 per

day

ERISA § 502(c)(8)

Failure by a plan sponsor of a multiemployer plan in

endangered status to adopt a funding improvement plan or a

multiemployer plan in critical status to adopt a rehabilitation

plan. Penalty also applies to a plan sponsor of an

endangered status plan (other than a seriously endangered

plan) that fails to meet its benchmark by the end of the

funding improvement period.

Up to $1,677 per

day

ERISA § 502(c)(9)(A)

Failure by an employer to inform employees of CHIP

coverage opportunities under ERISA § 701(f)(3)(B)(i)(I) –

each employee a separate violation.

Up to $141 per

day per employee

ERISA § 502(c)(9)(B)

Failure by a plan administrator to timely provide to any

State the information required to be disclosed under ERISA §

701(f)(3)(B)(ii), regarding coverage coordination – each

participant/beneficiary a separate violation.

Up to $141 per

day per

individual

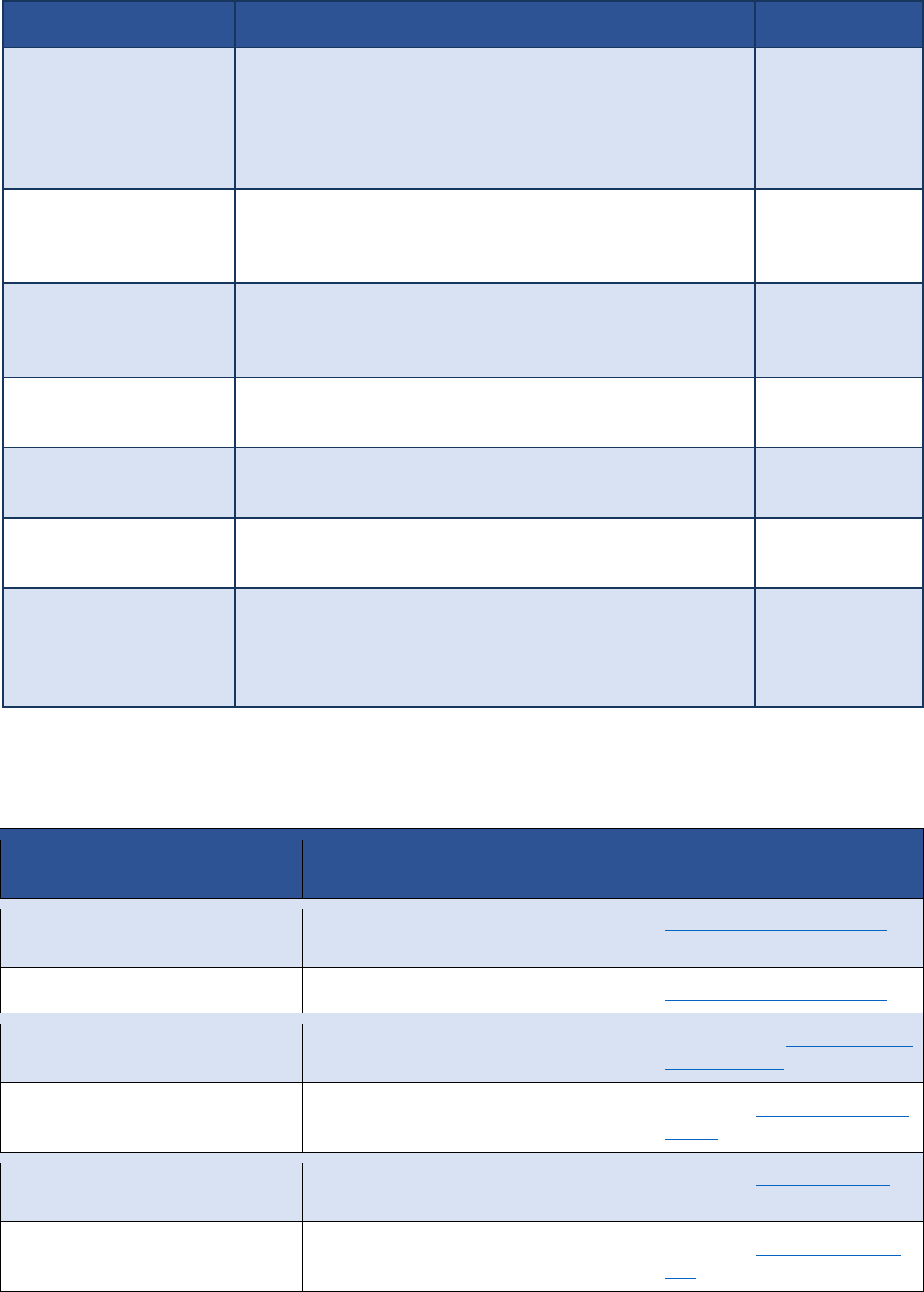

3

ERISA Penalty Statute

Description of ERISA Violations Subject to Penalty

Penalty Amount

ERISA § 502(c)(10)(B)(i)

Failure by any plan sponsor of a group health plan, or any

health insurance issuer offering health insurance coverage in

connection with the plan, to meet the requirements of

ERISA §§ 702(a)(1)(F), (b)(3),(c) or (d); or § 701; or §

702(b)(1) with respect to genetic information.

$141 per day per

failure during

non-co

mpliance

period

ERISA §

502(c)(10)(C)(i)

Minimum penalty for de minimis failures to meet genetic

information requirements not corrected prior to notice from

Secretary of Labor.

$3,550 minimum

ERISA §

502(c)(10)(C)(ii)

Minimum penalty for failures to meet genetic information

requirements which are not corrected prior to notice from

Secretary of Labor and are not de minimis.

$21,310

minimum

ERISA §

502(c)(10)(D)(iii)(II)

Cap on unintentional failures to meet genetic information

requirements.

$710,310

maximum

ERISA § 502(c)(12)

Failure of CSEC plan sponsor to establish or update a

funding restoration plan.

Up to $130 per

day

ERISA § 502(m)

Distribution prohibited by ERISA § 206(e).

Up to $20,579

per distribution

ERISA § 715

Failure to provide a participant or beneficiary a Summary of

Benefits Coverage under Public Health Services Act section

2715(f), as incorporated into ERISA section § 715 and 29

CFR 2590.715-2715(e).

Up to $1,406 per

failure

Where to Find Inflation Adjustments for Prior Years

See the table below to locate the relevant inflation adjusted penalty amount for prior years:

Violation occurring

Penalty assessed

Where to find inflation

adjusted penalty amounts

On or before November 2, 2015

Date of violation not date of assessment

determines penalty amount.

29 CFR 2575.1 and 2575.2

After November 2, 2015

On or before August 1, 2016

29 CFR 2575.1 and 2575.2

After November 2, 2015

After August 1, 2016, but on or before

January 13, 2017

Appendix 1, 81 FR 43429,

43457 - 43459 (July 1, 2016)

After November 2, 2015

After January 13, 2017 but on or before

January 2, 2018

Appendix, 82 FR 5373, 5384

- 5385 (January 18, 2017)

After November 2, 2015

After January 2, 2018 but on or before

January 23, 2019

Appendix, 83 FR 7, 15 - 17

(January 2, 2018)

After November 2, 2015

After January 23, 2019 but on or before

January 15, 2020

Appendix, 84 FR 213, 221 -

222 (January 23, 2019)

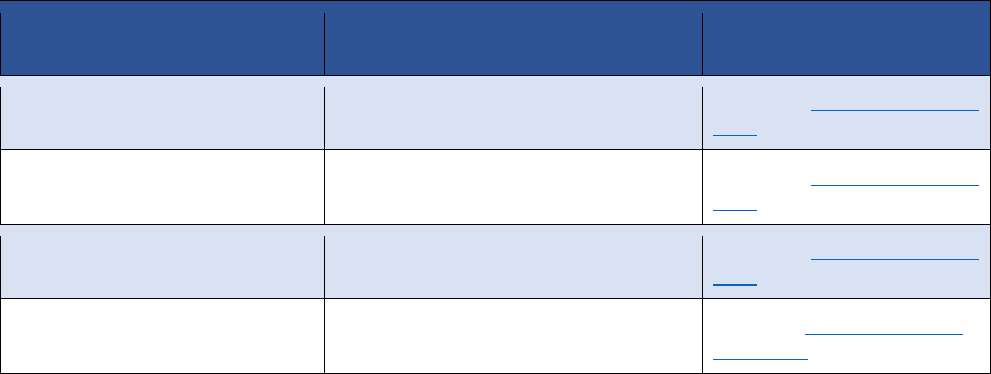

4

Violation occurring

Penalty assessed

Where to find inflation

adjusted penalty amounts

After November 2, 2015

After January 15, 2020 but on or before

January 15, 2021

Appendix, 85 FR 2292, 2300-

2301 (January 15, 2020)

After November 2, 2015

After January 15, 2021 but on or before

January 15, 2022

Appendix, 86 FR 2964, 2971-

2972 (January 14, 2021)

After November 2, 2015

After January 15, 2022 but on or before

January 15, 2023

Appendix, 87 FR 2328, 2337-

2338 (January 14, 2022)

After November 2, 2025

After January 15, 2023 but on or before

January 15, 2024

Appendix See, 88 FR 2210,

2219-2220 (January 14, 2023)