If required, payment must be made electronically and this form must be e-filed. DOR encourages you to use our safe and secure electronic payment options.

Please visit revenue.nebraska.gov for information regarding paying online.

Mail this form and payment to: Nebraska Department of Revenue, PO Box 98915, Lincoln, NE 68509-8915

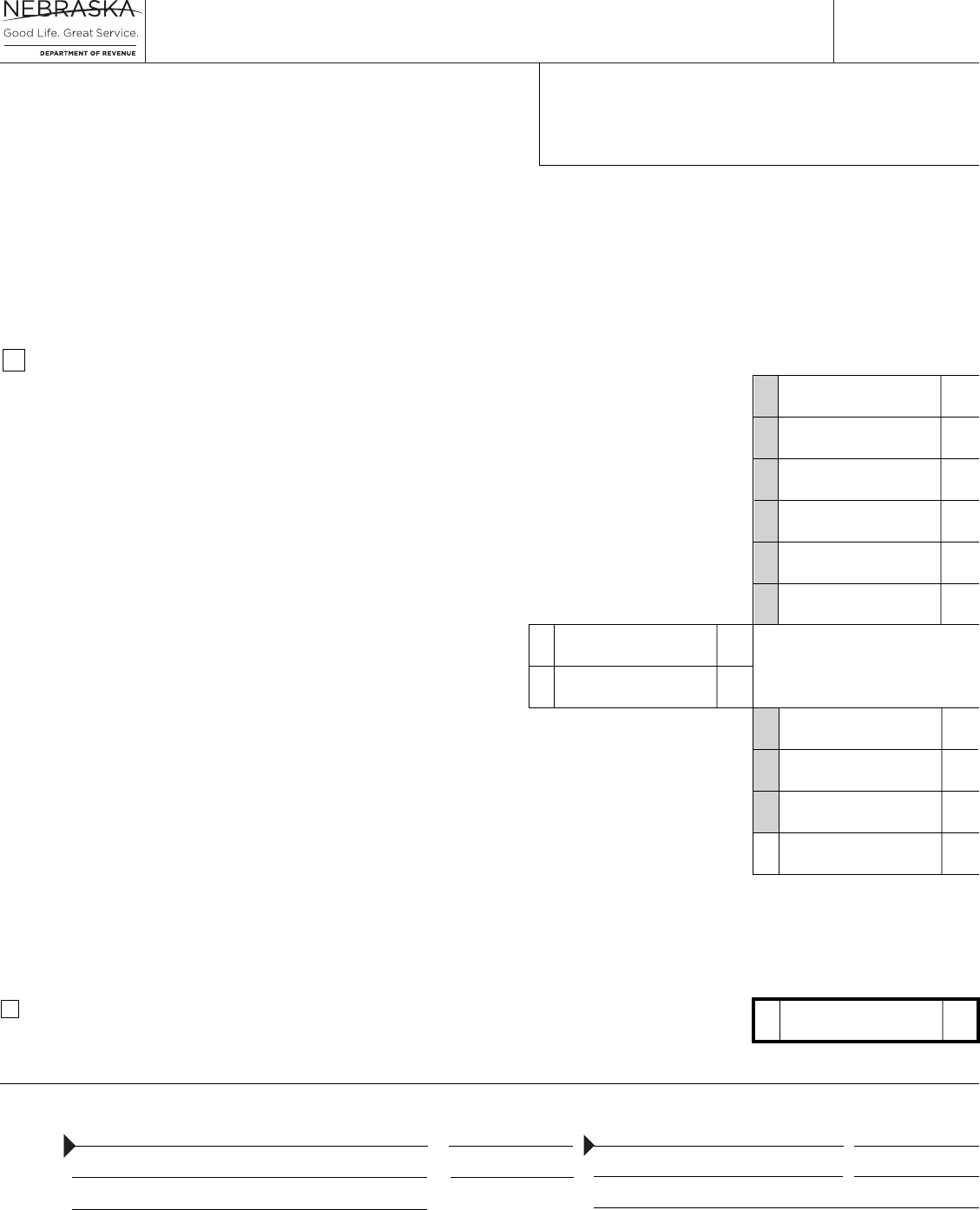

FORM

941N

Name and Location Address Name and Mailing Address

Please Do Not Write In This Space

Due Date

Reporting Period

Under penalties of perjury, I declare that, as taxpayer or preparer, I have examined this return and, to the best of my knowledge and belief,

it is true, correct, and complete.

sign

here

Check this box if you no longer make payments subject to income tax withholding in Nebraska.

If you are not licensed to report Nebraska income tax withholding, or are changing name and/or address information, see instructions.

1 Wages, tips, other compensation, gambling winnings, pensions and annuities, nonresident

personal services, and construction services subject to Nebraska income tax withholding ........ 1 00

2 Nebraska income tax withheld for the reporting period identified above .............................. 2

3 Adjustments of income tax withheld for preceding quarters of calendar year. Show a reduction

of liability in brackets. Do not adjust for any previous year or report deposits on this line .. 3

4 Adjusted total (line 2 plus line 3) ................................................................................................. 4

5 Nebraska incentive compensation credits (see instructions – if none, enter -0-) ......................... 5

6 Subtotal (line 4 minus line 5) ........................................................................................................ 6

7 First monthly deposit ...................................................................... 7

8 Second monthly deposit ................................................................. 8

9 Total tax due (line 6 minus lines 7 and 8) .................................................................................... 9

10 Penalty (see instructions) ............................................................................................................. 10

11 Interest ( % per year of line 9 amount if paid after due date) .......................................... 11

12 Previous balance with payments received through 12

Check this box if your payment is being made electronically.

13 Balance Due (total of lines 9 through 12). Pay in full with return ................................................ 13

Authorized Signature Date Signature of Preparer Other than Taxpayer Date

Title Daytime Phone Address Daytime Phone

Email Address Preparer’s PTIN

( )

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

Nebraska ID Number

Retain a copy for your records.

Nebraska Income Tax Withholding Return

• Read instructions on reverse side.

• Please use e-file and pay electronically at revenue.nebraska.gov.

( )

8-009-1967 Rev. 11-2021

Supersedes 8-009-1967 Rev. 11-2020

RESET

PRINT

Who Must File. A taxpayer must le a Form 941N if:

1. You have an oce or conduct business in Nebraska, and pay

wages, gambling winnings; or

2. You make payments to nonresidents performing personal

services in Nebraska; or

3. You have an oce or conduct business in Nebraska and pay

pensions or annuities to Nebraska residents who request that you

withhold Nebraska income tax from those payments; or

4. You are required to withhold Nebraska income tax from

construction contractors.

Prior to ling any deposits or returns:

1. You must apply for a Nebraska income tax withholding number

on a Nebraska Tax Application, Form 20; so that

2. An income tax withholding certicate will be issued by the

Nebraska Department of Revenue (DOR); and

3. A Form 941N must be e-led or mailed to DOR. DOR will

not mail the Form 941N to anyone required to pay and le

electronically or to anyone who has e-led Form 941N for a

prior quarter. If you have questions about electronic ling or

payment options, visit revenue.nebraska.gov.

Even if you temporarily do not have payments or income tax

withholding to report, Form 941N must be led for each reporting

period. See the Nebraska Circular EN for more information.

Cancelling an Account. If you are no longer making payments

subject to Nebraska income tax withholding, check the box

immediately below your name and location address. A nal Nebraska

Reconciliation of Income Tax Withheld, Form W-3N, will be mailed

to you. The Form W-3N must be led even if you did not make any

payments subject to Nebraska income tax withholding.

Annual Filers. If the Nebraska income tax you withhold is less than

$500 a year, you may be licensed to le on an annual basis. Annual

lers may e-le or le the preidentied paper Form 941N. Only lines

1 and 2 must be completed.

Filing and Payment Information. Start with the rst calendar

quarter or year in which you are required to withhold state income tax.

Quarterly returns are due the last day of the month following the close

of the quarter.

If DOR has assigned you an annual ling status, your return is due by

January 31 of the following year.

A Form 941N is required even if no payments were made that were

subject to income tax withholding. Paper lers should mail this return

with payment to the Nebraska Department of Revenue, PO Box 98915,

Lincoln, Nebraska 68509-8915.

All taxpayers are encouraged to pay and le electronically the Nebraska

income tax they have withheld. See revenue.nebraska.gov for these

options. Checks written to DOR may be presented for payment

electronically. Taxpayers may be mandated to pay and le returns

electronically. You will be notied in writing if this requirement

applies to you.

Preidentified Return. This return is to be used only by the employer

or payor whose name is printed on it. If you have not received a return

for the tax period, and will be ling a paper return, visit DOR’s website

to print a Form 941N. Complete the ID number, tax period, name, and

address information. DOR will not mail Form 941N to anyone required

to pay and le returns electronically, or to anyone who has e-led

Form 941N for a prior quarter. Paper lers, review line 12 to determine

if a previous balance or credit exists when ling a paper return. When

e-ling, check line 6 to determine if a previous balance or credit exists.

Name and/or Address Changes. If the business name, location, or

mailing address is not correct, strike through the incorrect information

and plainly print the correct information. If you e-le, mailing name

and address changes can be made during e-ling. Location name and

address changes must be made by completing a Nebraska Change

Request, Form 22. Note: If you are licensed for sales tax under this

same number, the location address must be the same one used for the

sales tax permit (cannot be a PO Box number).

If this is a name change only, and the ownership or FEIN number has

not changed, indicate “Name change only.” If this is: an ownership

transfer or change; a change in legal form; or your Federal ID number

has changed – the new owner, partnership, LLC, or corporation

must complete and return a Nebraska Tax Application, Form 20.

The former owner, partnership, LLC, or corporation must cancel all

permits, licenses, and certicates by ling Nebraska Change Request,

Form 22.

Penalty and Interest. There are penalties and interest for failing

to timely remit income tax withheld. The penalty is 5% per month or

fraction of a month the return is late, up to 25%, of the tax due amount.

A $25 penalty can also be levied for failing to timely le Form 941N.

Interest is calculated from the due date to the date the payment

is received. Refer to Revenue Ruling 99-20-2 and Regulation 21-016

for applicable interest rates and additional information.

Monthly Deposits, Form 501N. If the Nebraska income tax

withheld is more than $500 for the rst or second month in a quarter,

you must make a monthly deposit. If you make the payment

electronically, do not le Form 501N.

If a monthly deposit is required for the rst month of a calendar

quarter, a deposit for the second month is also required, even if the

amount of income tax withheld is not more than $500.

Line 1. Enter the amount of wages paid this quarter. If a prior period's

wages were reported incorrectly, it is not necessary to le an amended

Form 941N. Refer to the Form W-3N instructions to report wages paid

during the entire tax year. See line 3 instructions if the income tax

withholding was reported incorrectly.

Line 2. Enter the total amount of income tax withheld for Nebraska

during the tax period.

Line 3. Adjustment of Income Tax Withheld (Quarterly

Filers). Use line 3 to correct errors in income tax withheld from

payments paid in earlier quarters of the same calendar year. When

paper ling, explain by attaching a statement that shows:

1. What the error was;

2. The quarter in which the error was made;

3. The amount of the error for each quarter;

4. The quarter when you found the error; and

5. How you and your payees have settled any overcollection or

undercollection. If you are adjusting income tax withholding

for a qualied military spouse, see revenue.nebraska.gov. Under

“For Businesses,” click on “Income Tax Withholding.” From this

page, click on “Nebraska Income Tax for U.S. Servicemembers,

Their Spouses, and Civilians Working with U.S. Forces.”

Do not use line 3 to adjust income tax withholding for earlier years.

If you have requested that an overpayment from a previous year’s

Form W-3N be transferred to this year, do not use the resulting

credit until it appears on the previous balance line of Form 941N.

Line 5. This credit is only available to taxpayers under the Nebraska

Advantage Act or the Invest Nebraska Act who have completed their

qualication audit and have earned compensation or wage benet

credits and taxpayers under the ImagiNE Nebraska Act who have

previously led a an ImagiNE Nebraska Act Incentive Computation,

Form 1107N showing that they have achieved levels and earned

compensation credits. The amount of credits used against income

tax withholding cannot exceed the lesser of income tax withholding

attributable to new employees at the qualied project or qualied

location, or the amount of credit reported on the taxpayer’s income

tax return and carried forward into the quarter. Attach the Incentive

Withholding Worksheet. When e-ling, this credit is shown on line 4

of Form 941N. DOR will not allow this credit to oset an income tax

liability until a 0.5% administrative fee is paid on the amount of credit

used. The fee is computed on an ImagiNE Nebraska Act Payment

of Fees for Incentive Credit Use, Form 1107F. The Form 1107F

must be led with DOR and the fee is to be paid separately from the

Form 941N.

Line 12. A balance due or credit resulting from a partial payment,

math or clerical errors, penalty, or interest on prior returns may be

entered in this space by DOR. The interest shown includes interest

on the unpaid income tax withholding calculated through the due date

of this return. If the amount owed is paid before the due date, interest

will be recomputed and credit will be given on your next return. If

the amount entered by DOR has been satised by a prior payment, it

should be disregarded when calculating line 13.

Contact DOR if you have questions regarding a credit or balance due.

When e-ling, a previous balance is shown on line 6 of Form 941N.

Instructions