Whitepaper eldnation.com

Workforce

Field

Service

Future

OF

THE

THE

The Future of the Field Service Workforce • 2eldnation.com

Introduction

Across industries from retail to healthcare, customers expect a awless, highly

personalized experience whenever they interact with a company. According to a recent

study, customer experience has overtaken product and price as the main way businesses

dierentiate themselves.

1

A positive customer experience can build lasting loyalty but

today’s consumers are more ckle than ever, and won’t hesitate to switch to a competitor if

they’re dissatised.

New technologies are powering all of these customer experiences—from point-of-sale

machines that enable self-checkout in a retail store to interactive kiosks for patient check-in

at a medical clinic.

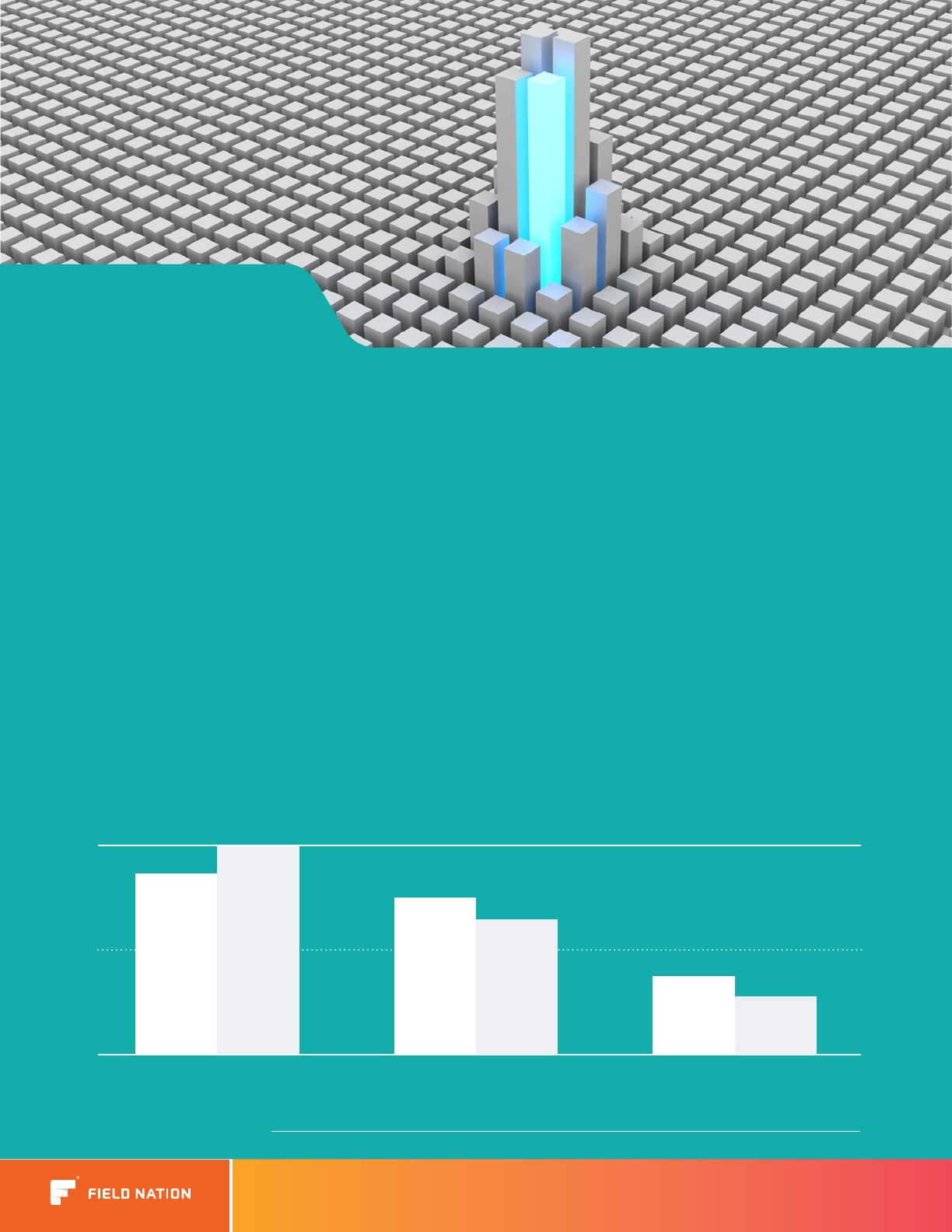

How important are the following to your business strategy –

Now and in 2020? Average out of 100 points.

43

50

37

34

20

16

Experience Products Price

TODAY 2020 TODAY 2020 TODAY 2020

1

Walker Customer Experience report: https://www.walkerinfo.com/Portals/0/Documents/Knowledge%20Center/Featured%20Reports/WALKER-Customers2020.pdf

The Future of the Field Service Workforce • 3eldnation.com

All tech companies are in

the service business

As technology transforms how companies interact with

customers, eld service organizations face particular

challenges in adapting their business models to meet

rising customer expectations. The need for skilled

technicians to deploy and maintain the technology

required to create engaging customer experiences has

never been greater. At the same time, companies are

challenged to nd new ways to cost-eectively source the

talent they need in the tightest labor market in decades,

with unemployment at a 50-year low.

2

Workers in skilled

trades such as electricians and HVAC technicians, along

with IT sta, have the most in-demand skills in today’s

labor market.

3

Original equipment manufacturers (OEMs) of the

technology products facilitating self-service customer

experiences face a competitive global market with intense

margin pressure. As a result, many manufacturers now

provide services to supplement their traditional product

oerings and generate an ongoing revenue stream beyond

the initial device purchase. These OEMs have traditionally

been “pure-play” service providers focused solely on

service oerings for the products they manufacture. But,

this dynamic is changing as customers prefer a “one-stop-

shop” for services across all of the product lines they have

deployed.

Contracting with value-added resellers (VARs), third-party

maintainers (TPMs) and managed service providers (MSPs)

is an increasingly popular way for companies to source

eld-service talent because these providers act as a single

source for all services. In addition, they typically deliver

these services at a lower total cost to end customers than

multiple service contracts with OEMs because of their

leaner cost structure.

While established market categories exist for manufacturers

and service providers, the lines between these companies

are blurring, and many manufacturers now oer a

combination of hardware and services to their customers.

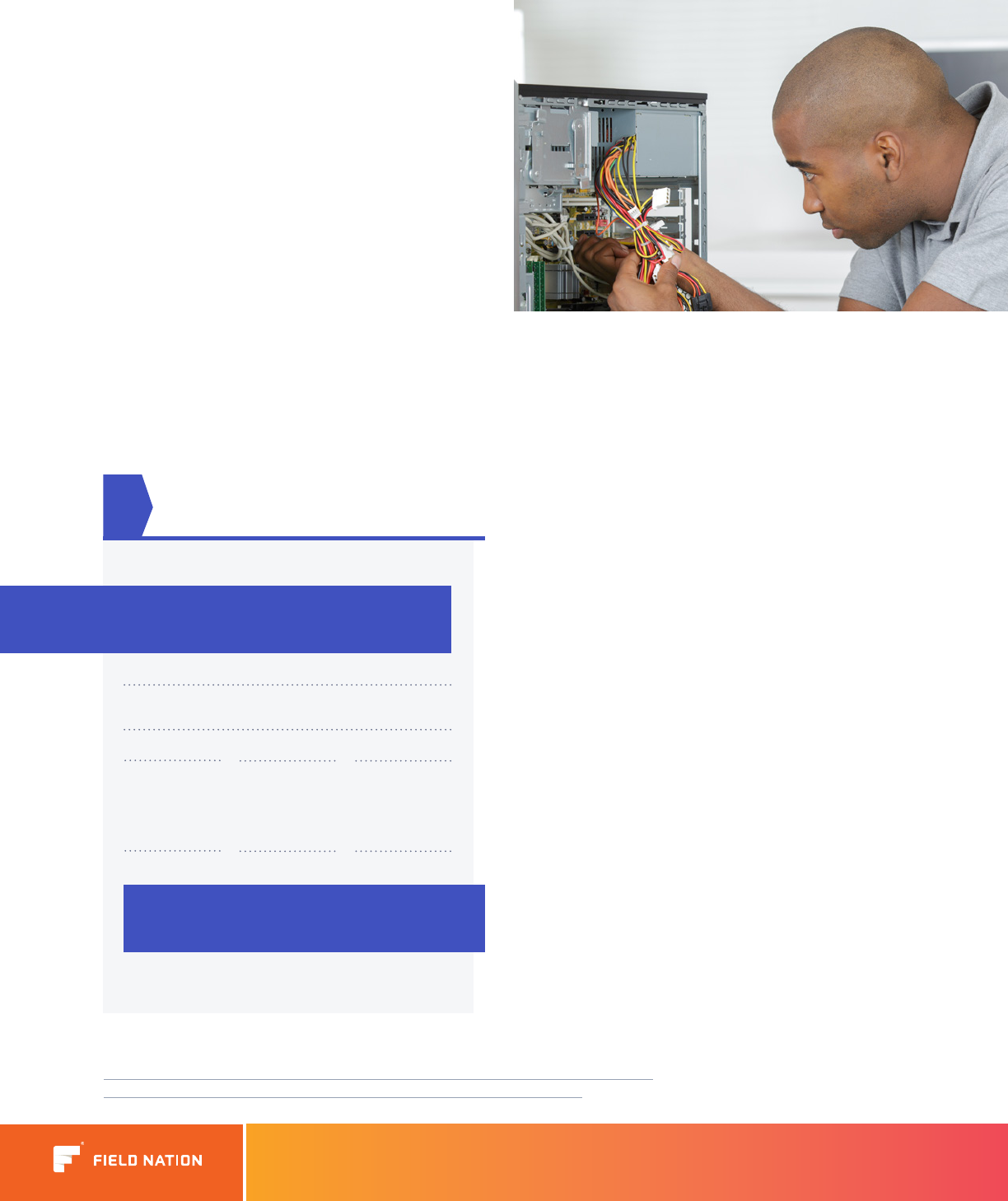

Traditional sources of eld

technicians that serve end customers

Field Service Technicians

Original Equipment Manufacturers

Value-

Added

Resellers

3rd Party

Maintenance

Firms

Managed

Service

Providers

End Customers

2

http://nymag.com/intelligencer/2019/05/jobs-report-april-analysis-unemployment-rate-hits-50-year-low.html

3

https://www.manpowergroup.co.uk/wp-content/uploads/2018/07/MG_TalentShortage2018.pdf

The Future of the Field Service Workforce • 4eldnation.com

Evolution of the field service

labor market

Traditional Model: 100% full-time employees

The traditional eld service stang model—used by end

customers, OEMs and service providers alike—includes

hiring full-time employees with specic skill sets. This

model of 100% full-time employees has high xed costs,

particularly given the rising cost of health insurance,

training costs and other employee benets. In addition,

the eld service industry’s evolution from xed-price

agreements to event-based pricing makes it dicult to

anticipate revenue and plan appropriate stang levels.

With increased uncertainty in revenue, companies

risk over-hiring sta and diluting their prot margins.

Furthermore, the larger a company becomes, the more

dicult it is to optimize employee utilization. For example,

if a company has 900 workers in the eld, it would be

nearly impossible to keep all 900 employees working 40

hours a week consistently due to uctuations in demand

for dierent skills and dierent projects. In addition, the

company would have to pay overtime to cover spikes

in work.

The traditional stang model also limits growth. Today’s

customer experience-driven industries require a wide

variety of specialized technical skills. However, OEMs and

service companies typically focus on one segment of the

market and hire accordingly. For example, a manufacturer

of printers and copiers generally hires technicians who

can service printers and copiers. They do not have the

in-house expertise to service a customer that needs

assistance with a networking project, and will miss that

revenue opportunity. Customers want a one-stop-shop for

service across their technology portfolio, yet it is nearly

impossible for manufacturers and service companies to

deliver all of the specialization required using 100% full-

time employees. Furthermore, the traditional model does

not allow service businesses to keep up with seasonal

spikes in demand, which is another lost opportunity for

companies using an inexible stang model.

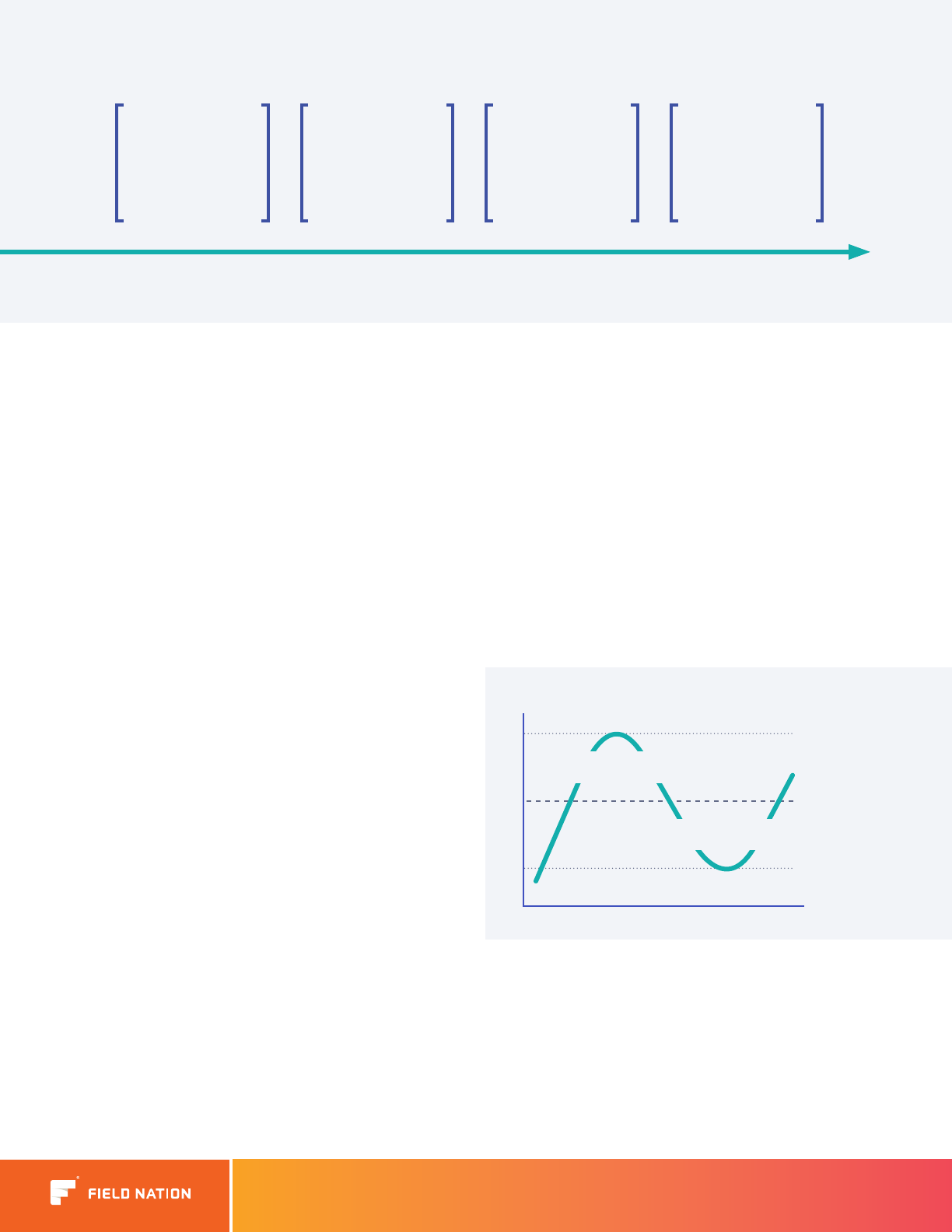

Max full-time

employee

WORK COMPLETED

TIME

Additional costs of meeting demand:

Overtime, contracting, etc.

Additional costs of idle time:

Decreased productivity, disengagement

Workload

Fixed Workforce Model Variable/Blended Workforce Model

100% full-time

employees

Outsourced

Direct-to-technician

Managed in-house

Field service

network

Min full-time

employee

Full-time employee

Capacity

The Future of the Field Service Workforce • 5eldnation.com

Outsourced Model

During the Great Recession, many companies began

outsourcing their eld service function to third-party

service businesses in response to market pressure

to shrink their full-time workforce. In addition to

cost reduction, the outsourced model allowed these

companies to focus on their core business, rather than

managing a large eld services organization.

Field service outsourcing was popular for many years

and oered several advantages over the traditional xed

stang model. However, its limitations also became clear

as many companies encountered issues over the quality

of service delivery, and sought more visibility and control

over work outcomes.

Cost Growth Opportunity

Quality Risk

$$$$

! ! ! !

The limitations of the

outsourced model

became clear as many

companies encountered

issues over the quality of

service delivery...

The Future of the Field Service Workforce • 6eldnation.com

Direct to technician: Preferred vendor networks

(managed in-house)

In the past several years, the eld service industry moved

away from both the 100% full-time employee and 100%

outsourced models. The modern approach to eld service

stang has evolved toward using a blend of full-time

and contingent labor. This trend takes advantage of

the emerging “Gig Economy” and the growing number

of self-employed technicians that organizations use to

complement their full-time employee base.

The direct-to-technician model gives companies more

control over quality of delivery while allowing them to

reduce costs, typically by 30 to 40 percent over full-

time workers. Initially, companies have begun using this

approach by creating and maintaining their own

preferred contractor networks.

In this model, the hiring company is

responsible for:

Sourcing

company recruits its own workers through networking, job

boards, LinkedIn or other methods.

Managing work

hiring company assigns the right worker to the right job and

ensure all SLAs are met.

Managing workers

hiring company is responsible for onboarding, training,

credentialing, issuing 1099s, ling payroll taxes in all

applicable states, paying contractors and procuring insurance.

While a direct-to-technician model is attractive from

a cost and exibility standpoint, a “do-it-yourself”

approach is far more complex and potentially risky

than it may appear on the surface.

This model generally requires a dedicated vendor

management team to handle the complexity involved

with managing hundreds, or even thousands, of eld

service contractors. From a technology standpoint,

do-it-yourself solutions quickly become outdated, are

dicult to maintain and are cumbersome to integrate

with other tools.

Cost Growth Opportunity

Quality Risk

$$$$

! ! ! !

The Future of the Field Service Workforce • 7eldnation.com

Platform-enabled, direct-to-technician model

A new workforce model has recently emerged that gives

companies the cost advantages of a direct-to-technician

approach without the complexity of managing a contingent

workforce. Used by both OEMs and third-party service

providers, the platform-enabled, direct-to-technician

model improves both the eciency and quality of

service delivery.

This model provides the benets of a

network of pre-qualied technicians

and access to a platform that ooads

the complexities of contractor

management, including:

Sourcing

Platforms continuously curate technicians based on a real-

time rating system so that customers can connect with the

top tier of service professionals nationwide. Companies

have access to eld service professionals with a variety of

specialized skills and certications, saving recruiting time and

minimizing the risk of hiring someone that is not qualied

to do a particular job. In addition, matching algorithms help

identify top talent quickly, and reviews provide access to

feedback from companies that have worked with technicians

in the past.

Managing work

Platforms provide visibility into in-ight work so dispatchers

can manage any work orders that are at risk. They also track

project budget against actual spend, and provide pricing

insights to attract the right workers with standard pricing in

their area.

Managing workers

The platform-enabled approach automatically handles

issuing 1099 forms, ling taxes and paying contractors.

Streamlining workforce onboarding

Curating a list of well-prepared technicians requires some

work up front when adopting a platform, but platforms,

by necessity, oer services and technology designed to

train technicians on how to successfully use their product.

Furthermore, because technicians are increasing platform

workload, they are incentivized to do the work accurately or

risk future jobs. Platforms also allow clients to add their own

employees or third-party vendors so that they benet from

the eciency the platform provides across all talent types in

the organization.

Cost Growth Opportunity

Quality Risk

$ $$$

! ! ! !

The Future of the Field Service Workforce • 8eldnation.com

Choosing a eld service network and platform

New platform-enabled, eld service communities are

emerging in response to the market need for cost-ecient,

high-quality eld service talent. Here are a few essential

qualities to look for:

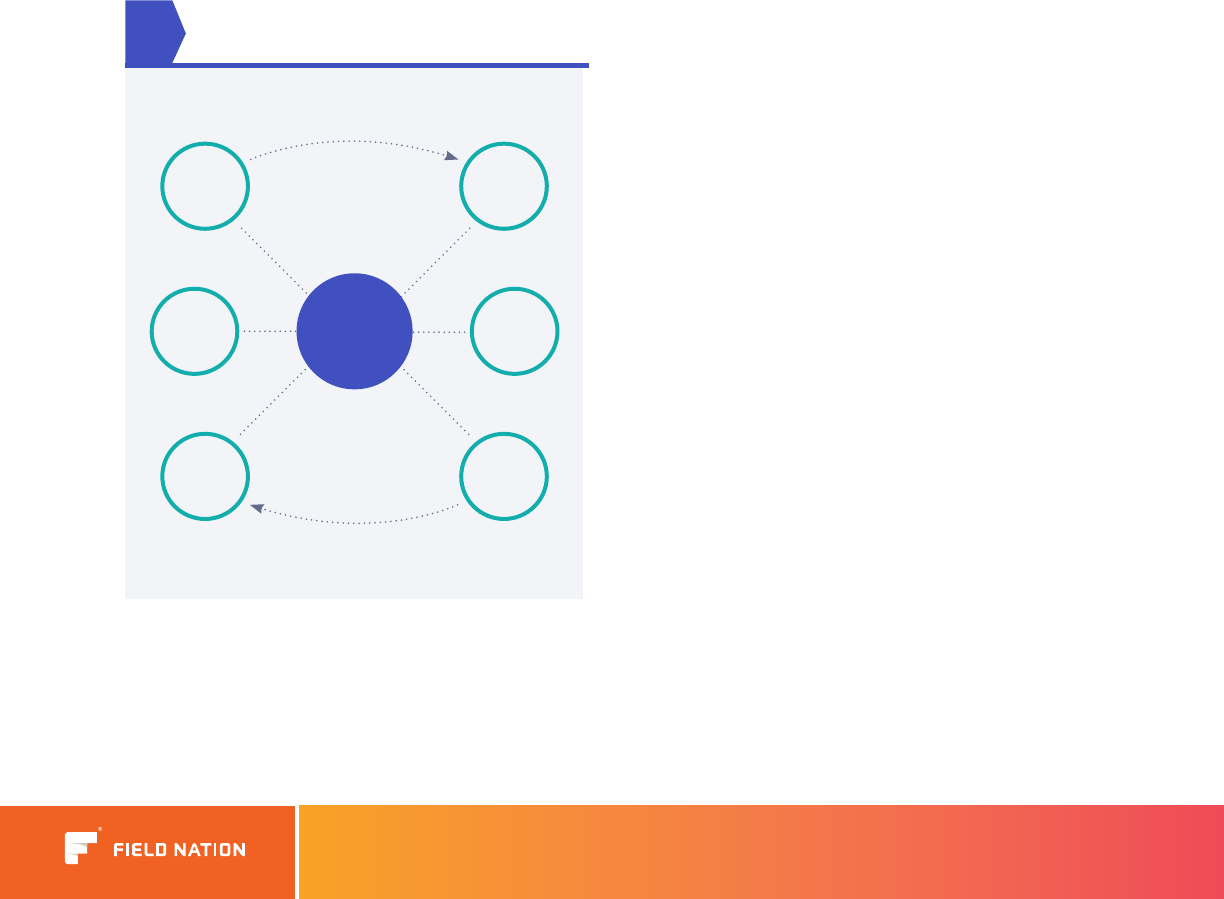

Number of technicians

Look for a network with more than 10,000 members and

expertise in the specialized skills you need. Like social

networks, these eld service networks take advantage of

a powerful “network eect.” As new technicians join the

network, more value is created for all of the hiring companies

looking for eld service talent. Likewise, as more eld service

jobs are posted, the more technicians can benet from being

part of the network. Thus, the network with the most critical

mass will provide the most value for all.

Fill time

Fill time, or the time required to assign a technician to a job,

should be measured in minutes. Leading platform-enabled

communities have average ll times of 8 minutes or less,

whereas nding technicians on craigslist, Indeed, Monster or

other job boards can take hours.

Service level agreement (SLA) compliance

Look for an SLA compliance rate of 99%+. This is one of the

ways to ensure consistency and quality of the technician base.

Fault rating

Fault rating represents how often a technician causes a

problem on the job, and is a key measure of marketplace

quality. Leading platforms have less than .02% at-fault rating

by including pre-qualied technicians who will complete work

correctly the rst time, and weeding out ineective providers.

Conclusion

Access to specialized contingent labor — combined with a

platform that takes the complexity out of managing a

blended workforce—makes it possible to fulll customer

demand in a way that would be time- and cost-prohibitive

with other stang methods. Using a platform-enabled eld

service network, companies can optimize the cost and quality

of their eld service workforce while setting themselves up

for growth.

Marketplace

Supply

Supply

Supply

Demand

Demand

Demand

Value

Value

Network eect

eldnation.com 1122-01 • © 2019 Field Nation, LLC. All Rights Reserved • 9

Source.

Manage.

Engage.

About Field Nation

Field Nation connects companies with thousands of highly-skilled IT

contractors to complete on-site projects throughout North America.

With Field Nation companies can source, manage, and engage onsite

talent in one place.

About the Author

MYNUL KHAN, FOUNDER & CEO, FIELD NATION

Mynul Khan founded Field Nation

in 2008 when he identied a need

for a contingent workforce platform

for onsite eld service companies. With a background

in programming and data analysis, and an anity for

growth hacking, Mynul’s experience drives Field Nation’s

growth strategy and motivates him to grow the Field

Nation team. Mynul has a B.S. in Computer Science and is

actively involved in technology decisions as well as strategy

direction. Today, Mynul focuses on aggressive company

growth and expanding opportunities around the world

through regional partnerships and local incubators.