Whitepaper eldnation.com

Independent

Contractor

Workers’

Compensation

THE

AND

Workers’ Compensation and the Independent Contractor • 2eldnation.com

Introduction

In today’s gig economy individual workers seek to maximize their income and manage

their own careers. This trend is expected to grow well into the future. Companies that

want to compete need to shift and embrace these workers and the special regulations

that govern them.

This whitepaper dives into the world of workers’ compensation from its inception to

the present day with a focus on how independent contractors t into the workers’

compensation scheme.

What’s Workers’ Compensation?

Traditional workers’ compensation provides medical and

wage replacement benets for injured employees. When

an employee is injured in the course of employment,

they are generally covered by an employer’s workers’

compensation insurance subject to a few exceptions. If

the injured worker is not an employee but an independent

contractor, traditional workers’ compensation may not

apply unless the contractor purchased their own workers’

compensation insurance.

History & Purpose of Workers’ Compensation

Prior to the enactment of workers’ compensation,

employees were forced to sue their employer for

negligence to collect damages. The negligence standard

is a high bar for an employee to prove, so the process

was ineective. Many employees could not win their

cases and ended up relying on state social security and

unemployment benets to get by. As a result, states

began passing workers’ compensation legislation

throughout the 20

th

century to create a balance

between worker and employer rights.

Workers’ Compensation and the Independent Contractor • 3eldnation.com

Wisconsin passed the rst comprehensive workers’

compensation law in 1911, while Mississippi was the

last state in 1948. These early laws require employers

to provide medical and wage replacement benets for

injured on-the-job workers. If the injured employee

accepted these benets, they forfeit their right to sue

the employer – what is referred to as an “exclusive

remedy.” In other words, an injured worker who seeks

workers’ compensation gives up their right to recover

tort damages for negligence or other claims for a

“lesser” recovery of workers’ compensation.

Basic Workers’ Compensation Requirements

In the majority of states, coverage under the workers

compensation statute is required for private and public

employments. Each state enacts their own statutes, rules

and regulations, and vary on what thresholds of coverage

are required. States also oer exceptions to workers’

compensation. Many states provide exceptions for sole

proprietors–people who own their own business– or

casual employees such as seasonal workers.

There are two ways to ensure workers’ compensation is

administered–by private insurance or collective funding.

Most states allow for private insurance while some states/

jurisdictions are monopolistic fund states such as North

Dakota, Ohio, Washington, Wyoming, Puerto Rico, and

the U.S. Virgin Islands. In these jurisdictions, the states’

administers exclusively fund the workers’ compensation

program. To determine what each state requires, look to

each state’s statutes.

Workers’ Compensation and

the Gig Economy

Workers’ compensation functioned as planned when a

conventional employer-employee relationship existed.

But, the 21st century brought about a new relationship

for workers. Technology created a new type of on-

demand workforce - what industry experts call the

gig economy.

Instead of traditional nine-to-ve jobs, workers began

turning to software platforms to nd well-paying jobs

that provide the worker with exibility. Companies retain

a worker to do a one-time assignment or task instead of

hiring a W2 employee. This helps companies reduce costs

and allows workers to pick up work when and where they

need it.

Companies nd that the gig economy is more ecient

and helps reduce operating costs associated with full-

time employees. As a result, there are a growing number

of workers who are not participating in the traditional

workers’ compensation system. This is partly due to many

workers no longer qualifying as an “employee” under state

statutes, so they are not covered by a company’s workers’

compensation requirements.

Relationship of Gig Workers and Independent

Contractors with Workers’ Compensation

To avoid buying workers’ compensation coverage, some

companies - especially in high risk occupations - sought

to retain independent contractors to avoid paying the

high workers’ compensation rates. This practice became

pervasive within the long haul trucking industry.

Most states allow sole proprietors to “opt out” of the

workers’ compensation system. Some trucking rms

allowed (encouraged) their drivers to declare themselves

“independent contractors” and opt out of the workers’

compensation system. The drivers would lease the

tractor from the trucking company who would arrange

for each load, instruct the driver where to go and when,

and contract them to the trucking company on a full time

basis. By using independent contractors the trucking

rms reduced their personnel costs by 20% (the workers’

compensation rate). The independent contractor driver

would receive slightly higher pay and everyone was

happy...until a driver had a claim.

Workers’ Compensation and the Independent Contractor • 4eldnation.com

As an employee of the trucking rm, the driver would have

received workers’ compensation benets including wage

replacement and medical costs. But by opting out, the

driver commonly had no wage replacement and relied upon

their personal health insurance plan for medical costs. If

the driver was providential, the accident was caused by a

third party, who had adequate automobile liability and the

driver could recover/sue for damages. The problem was that

it often took years for a lawsuit to be concluded, meanwhile

the driver would le bankruptcy and end up relying upon the

social welfare safety net programs of the state.

The second problem was that after an injury the

independent contractor would attempt to renounce

their independent contractor status and assert

employee standing if they did not have medical and

disability insurance. In addition to the contractor or

the contractor’s family, the assertion may come from

third parties subrogated to the workers’ compensation

benets such as health insurers, governmental entities

who fund the social safety net. These risks were likely not

contemplated by the organization that contracted with

the independent contractor.

States soon took action to avoid the “independent

contractor” scheme and enacted rules to determine if a

person really was a “de facto” employee or a bona de

independent contractor.

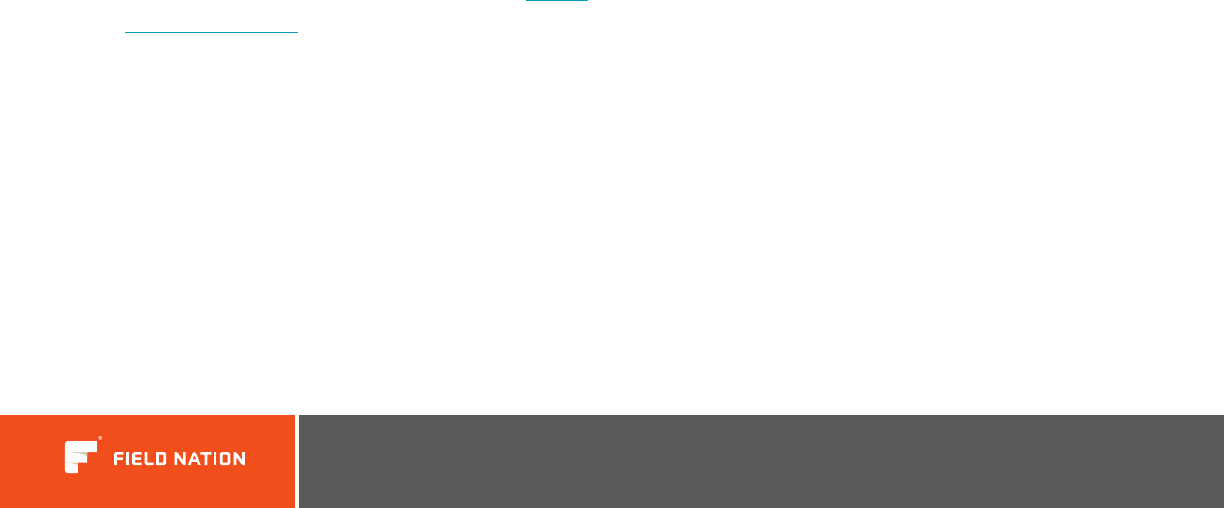

Independent Contractor or Employee:

The Control Issue

As more companies hired independent contractors,

legislators had growing concerns for tax payments,

misclassication, health insurance requirements and

workers’ compensation requirements. So, states created a

The right to control the means and

manner of performance

01

Control over the premises where the

work was done

04

The mode of payment

02

The right of discharge

05

The furnishing of tools and materials

03

Employee or Independent Contractor?

g. 1-1

For example, Minnesota

developed a ve factor test

1

to determine if a worker is

an employee or independent

contractor. The test involves

analyzing the following ve

factors:

Workers’ Compensation and the Independent Contractor • 5eldnation.com

framework to include people who may classify themselves

as an independent contractor as an employee.

The degree of control one party has the right to exert over

another has become the primary factor to consider and is

the prime indication the individual is an employee and not

an independent contractor.

To analyze the control factor in a particular situation,

courts weigh multiple factors such as: if the worker is

required to comply with instructions such as when, where

and how the work is to be done; if the person was trained

by the employer; if there is a continuing relationship;

if the employer pays for travel, supplies, or tools; if the

relationship is sporadic or frequent; if the worker is

required to report to the employer, and so forth.

The Internal Revenue Service (IRS) also published

guidelines concerning what is or what is not an

independent contractor. The general rule is that an

individual is an independent contractor if the payer

has the right to control or direct only the result of the

work and not what will be done and how it will be done.

However, whether a work relationship is considered to be

an independent contractor or de facto employee depends

on the facts in each case.

Alternate Employer: Hiring Contractors

through Third Parties

Companies can also retain the independent worker

through a third party, who acts as contractor and

subsequently sub-contracts with the on demand

worker. Albeit, slightly more of a risk, the worker

obtains an occupational accident insurance policy

(wage replacement program), and the third party

has a workers’ compensation policy that provides a

certicate of insurance along with an alternate employer

endorsement naming the company as an insured. In the

rare occasion the worker attempts to bring a workers’

compensation claim to the purchasing company, the third

party contractor workers’ compensation coverage would

provide the protection.

The alternate employer endorsement is an important

element in the risk management program. The alternate

employer endorsement aords the alternate employer

both workers’ compensation and Employers’ Liability

coverages. Workers compensation coverage protects

the alternate employer in the event it is required to pay

benets to an injured on demand worker. Employers’

liability coverage insures the alternate employer against

lawsuits brought by injured workers.

Election and termination

of coverage

A company can elect to provide workers’ compensation

coverage for individuals who would otherwise

automatically be excluded under the law. When workers’

compensation coverage is elected, the insured person

becomes a “covered employee” as dened in the statute.

The company may also terminate coverage of individuals

State Opt-Out Provisions

Workers’ compensation insurance is not

required for people excluded under state law.

Each state sets certain types of workers who

are excluded from workers’ compensation

requirements. These categories are numerous,

detailed, and vary greatly by state. Thoroughly

review the workers’ compensation law in

your state to determine whether any of these

categories apply to your particular situation.

!

Workers’ Compensation and the Independent Contractor • 6eldnation.com

for whom they had elected to provide coverage. When

coverage is elected or terminated, the company must

give written notice to the insurer. Coverage becomes

eective the day after the insurer receives notice,

or on the date stated in the notice. The person for

whom coverage is elected will be listed on the workers’

compensation insurance policy.

If a business functions as a general contractor or

otherwise contracts with subcontractors, a general

contractor is liable to the injured employee of the

subcontractor if the subcontractor does not have workers’

compensation insurance. Therefore, when a business

analyzes its insurance needs, it needs to consider

its potential exposure for injuries to subcontractors’

employees, even if the business is exempted and not

otherwise required to have workers’ compensation

insurance. The business itself must provide workers’

compensation for its employee regardless if the owner of

the business can opt-out.

Workers’ Compensation Premium Audits

For companies who use independent contractors and

issue 1099s, they encounter another issue. Workers’

compensation insurance companies routinely undertake

a workers’ compensation premium audit to determine

all persons who may be entitled to le a claim under the

policy to be contemplated in the workers’ compensation

insurance premium.

Understandably, insurers want to collect premium for

those who may give rise to a claim. Companies, on the

other hand, equally fervent in minimizing their costs do

not want to include those who should not be covered.

Standard payroll audit rules are any independent

contractor without evidence of workers’ compensation

the contract price is included as payroll in the carriers

workers’ compensation payroll audit.

But, look to the rules in each state regarding opt-out

provisions for sole proprietors or partners. In some states

the independent contractor may formally opt out of

coverage requirements or include a certicate of insurance

for employers to avoid being charged for the exposure.

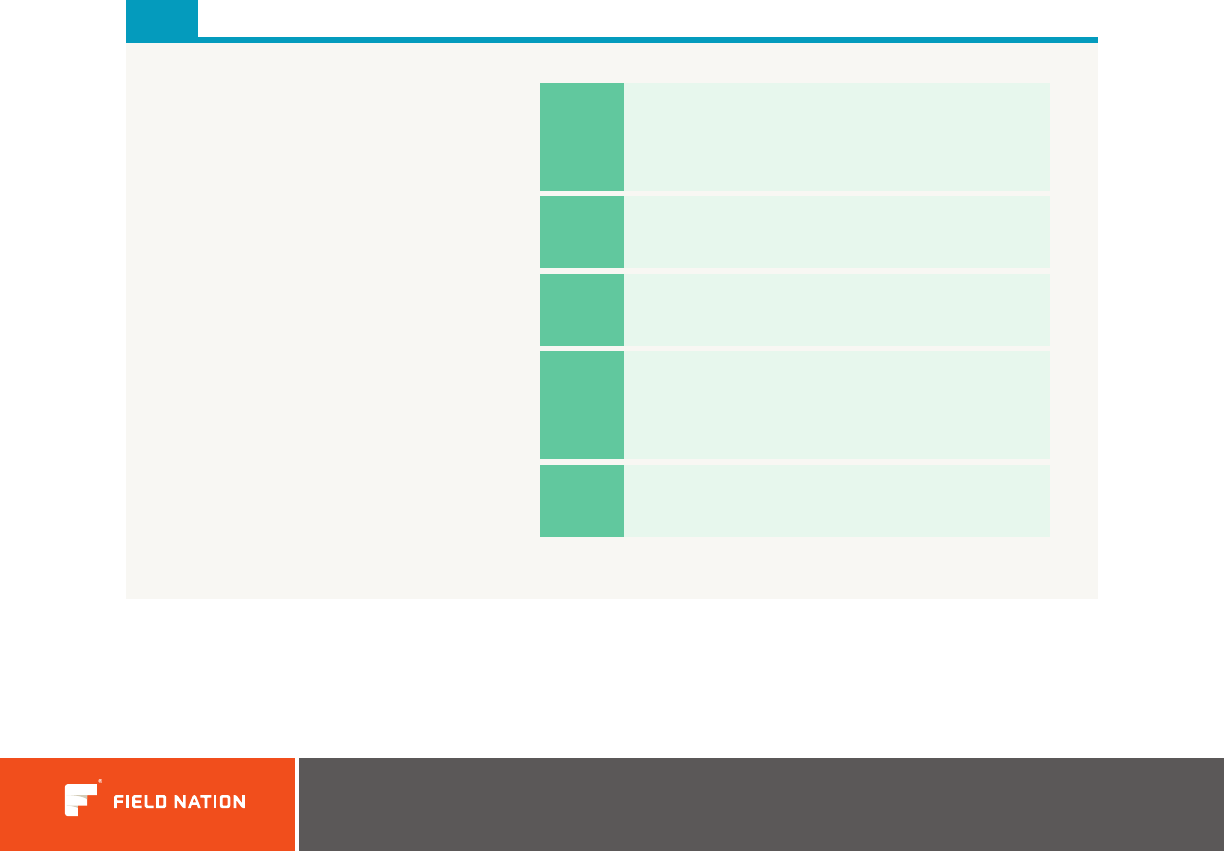

g. 1-2

Employer Reported Workplace Injuries

and Illness 2016

2

2.9

million

nonfatal workplace

injuries reported

in 2016

2.9

cases

per 100 full-time

employees

890,000+

work injuries resulted

in days away

from work

Most impacted Industries

3

Retail Agriculture

Health care Manufacturing

Workers’ Compensation and the Independent Contractor • 7eldnation.com

The contingent workforce and use of independent contractors is becoming the regular

course of business. As the gig economy continues expanding, companies that want to

compete need to shift and embrace contingent workers and the special regulations that

govern them.

What is the solution for hiring

temporar

y workers?

The past ten years have reinvented a number of

occupations into independent workers who control when

and how they work. Increasing amounts of jobs are not

location dependent, completed at home or with a worker’s

own tools. Local taxi services have been revolutionized

with companies like Uber and Lyft. Other industries are

also undertaking a transformation on how business is

conducted such as Airbnb or TaskRabbit.

The insurance community, insurance regulators and state

legislatures are adapting laws and regulations to address

“gig economy” workers to reduce the adverse eect of an

injured worker not having adequate wage replacement

and medical coverage for an on the job injury.

While insurance companies and regulations catch up with

the by-the-job worker, what can companies do to mitigate

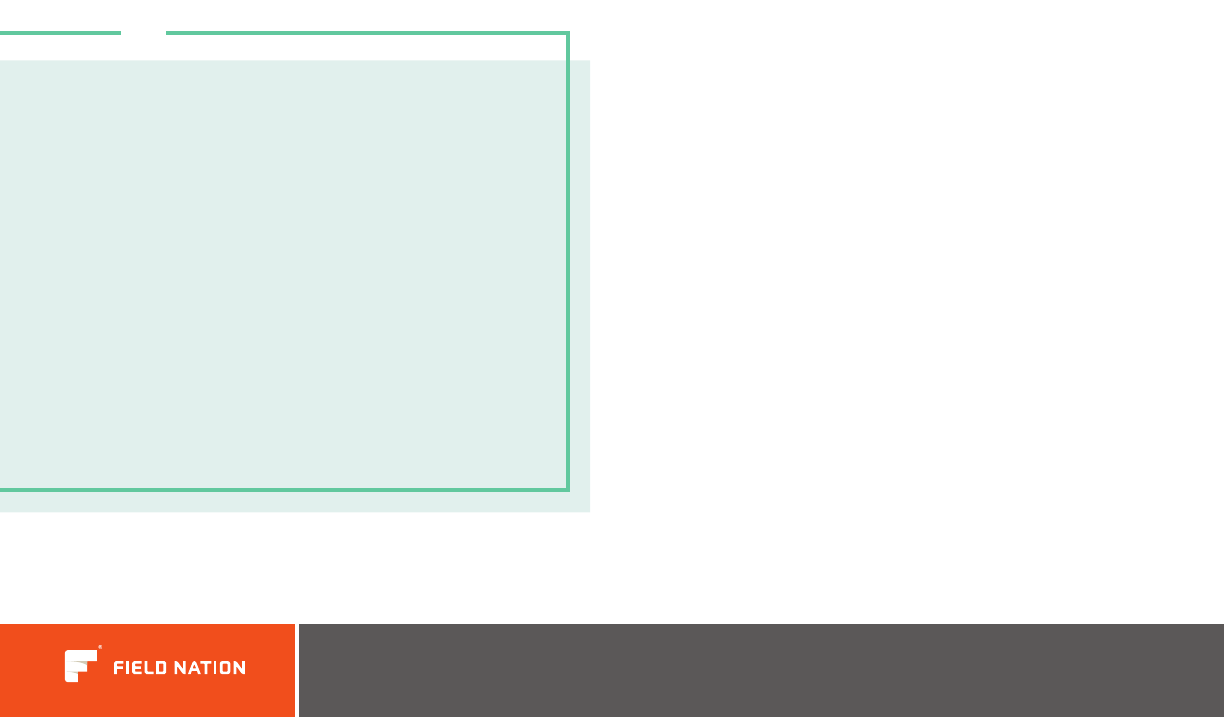

the risk of hiring such workers? There are essentially three

approaches companies can take to minimize work related

injury costs.

Conclusion

Low Risk:

Require independent workers to purchase workers’

compensation for themselves and not “opt-out” of

the workers’ compensation system even if eligible,

before work begins.

Medium Risk:

Retain the independent worker through a third

party, who acts as contractor and subsequently

sub-contracts with the on demand worker.

High Risk:

Contract with an on demand worker and either not

require any indication of workers’ compensation

or “opt-out” arrangement. If the on demand

worker has any employee or attempts to pursue

renouncing their independent contractor status,

the company may be required to provide the worker

with workers’ compensation benets. In addition,

the workers’ compensation premium auditor

may include the 1099 compensation as workers’

compensation payroll in the company’s audit.

1035-01 • © 2018 Field Nation, LLC. All Rights Reserved • 8eldnation.com

Source.

Manage.

Engage.

About Field Nation

Field Nation connects businesses with service providers and partners with

them to complete projects. Field Nation combines marketplace co

verage with

project management tools to deliver on-site expertise anytime, anywhere.

Whether companies of 1 or 1,000 need to manage internal sta projects,

contingent workforce tasks, or source local service providers for immediate

needs, Field Nation is the number one choice to get work done.

Co

-

authored by Mark Flaten of American Risk Services, Inc., and Alex Kroeger

SOURCES

DISCLAIMER

Field Nation does not provide legal, tax or accounting consultation, or advice. Field Nation has provided you with this information or material strictly for

purposes of understanding and using its platform. This material is designed to be accurate and informative, but should not be considered to constitute legal

advice. It is Field Nation’s recommendation that you seek appropriately specialized professional consultation regarding the information contained herein.

1. Newland v. Overland Express, Inc., 295 N.W.2d 615 (Minn. 1980); Werneke v. Lakeside Lawn & Landscape, 65 W.C.D. 615 (2005).

2. https://www.bls.gov/news.release/archives/osh_11092017.pdf

3. https://www.bls.gov/iif/osch0060.pdf