International Overview Training:

Post-2017 Tax Reform

Topic IV

Global Tax Org Chart –

Post Tax Cuts and Jobs Act of 2017

Overview

Global Tax Organizational Charts (GTOCs) provide

key information to issue teams about a company’s

tax planning strategies

• Understanding a taxpayer’s tax planning objectives is

key in issue identification

GTOCs use standard symbols in industry to

represent different types of entities for US tax filing

purposes

• Review of taxpayer’s GTOC structure provides valuable

exam risk information (i.e., what US compliance is

required and what types of global tax structures are in

place)

3

Overview (Cont’d)

Transactional flow analysis using a company’s step

plan org charts may assist in exam risk identification

• Details matter – transactional analysis of step plans

provides key insight into taxpayer’s filing position

regarding an acquisition, disposition or restructuring

transaction

4

Learning Objectives

At the end of this lesson you will be able to:

A. Identify taxpayer's objectives in global tax

planning

B. Interpret a taxpayer’s GTOC

C. Use GTOCs to identify taxpayer’s planning

objectives

5

A. Taxpayer's Objectives in

Global Tax Planning

Basics of Strategic Global Tax Planning

In conducting and structuring business operations, a

Multinational Enterprise (MNE) may consider its

strategic global tax plan.

A company’s strategic global tax plan could strive to:

• Increase Earnings Per Share (EPS)

• Minimize Effective Tax Rate (ETR)

• Manage cash and expenses

• Manage tax risks

7

Basics of Strategic

Global Tax Planning (Cont’d)

Sustained, predictable improvements in EPS

• Increase share price and total market capitalization

• Possibly boost executive compensation when tied to

EPS

Reduce Tax Expense

• Tax expense directly reduces net income, which

unfavorably lowers EPS

Control Costs

• Companies try to manage costs efficiently (including

taxes) to produce shareholder value

• Tax costs can be managed efficiently through

permissible planning

8

How Do Taxpayers Achieve Global Tax

Planning Objectives?

Reduce ETR, for example, by:

• Generating income in offshore low tax jurisdictions

• Reducing net income by borrowing and other strategies

− Minimizing exposure to IRC 163(j), 267A, Global

Intangible Low-Taxed Income (GILTI) and Base Erosion

Anti-Abuse Tax (BEAT)

• Maximizing income taxed as Foreign Derived Intangible

Income (FDII)

• Maximizing income subject to the participation exemption

• Minimizing US and foreign income taxes

• Utilizing past and current foreign losses for tax benefit

• Because certain foreign earnings when repatriated no longer

bring FTCs, US MNEs may affirmatively plan into Subpart-F

for high tax CFCs, which would bring back FTCs.

9

How Do Taxpayers Achieve Global Tax

Planning Objectives? (Cont’d)

Manage tax risks within global tax strategy

• Strategic planning that is integrated into the business

strategy

• Minimization of tax and treasury risks

• Shift tax risk to lower tax jurisdictions

• Tax risk may come from a variety of sources including

business model, transaction flows, tax law changes, tax

planning, execution and maintenance of transactions,

people, etc.

• Shifting intangible property and related income to lower tax

jurisdictions, while avoiding 367(d) exposure

10

IRS Objective: Understanding US MNE’s

Tax Planning Strategies

Pre-TCJA in absence of Indefinite Reinvestment

Assertion (IRA):

• Securities and Exchange Commission (SEC) reporting

companies would need to estimate how much of their

foreign earnings would eventually be repatriated

• A tax accrual was made for earnings which were designated

to be repatriated in the future

– This tax expense increased ETR

11

IRS Objective: Understanding US MNE’s

Tax Planning Strategies (Cont’d)

In general, prior to TCJA, foreign subsidiaries were presumed to

repatriate all earnings to USP for US GAAP purposes. The

future tax on such earnings was included for book purposes

even though not yet subject to tax. However, an MNE could

make the indefinite reinvestment assertion (IRA)* that its

earnings were indefinitely reinvested if USP had specific plans

for reinvestment of those earnings. As such, an MNE could

defer and plan when GAAP financial statements included the tax

liability on foreign subsidiary earnings.

As noted in Topic III, post-TCJA, MNEs will still assert IRA or it

may be required to report certain tax expenses in its US GAAP

financial statements that otherwise would be deferred (e.g.,

deferred tax liability for foreign withholding taxes, deferred taxes

on foreign currency movements related to withholding tax

liability and deferral of foreign earnings for state tax purposes.)

*Formerly known as permanently reinvested income or “PRI”

12

IRS Objective: Understanding US MNE’s

Tax Planning Strategies (Cont’d)

Reviewing the GTOC will help issue teams

understand taxpayer tax planning goals and identify

potential issues

Keep in mind, a low ETR can be due to legitimate tax

planning

13

IRS Objective: Understanding US MNE’s

Tax Planning Strategies (Cont’d)

It is important to note:

The bottom-line questions for issue identification in

the international area are:

• Are beneficial tax attributes being generated?

• Which entities are generating the beneficial tax

attributes?

• How are the beneficial tax attributes generated?

• Where are the beneficial tax attributes being utilized?

• When evaluating Income Shifting issues: who bears the

risks generating the tax attributes?

A low ETR does not indicate abuse but may suggest

further inquiry is required

14

How Can GTOC Analysis Help?

Many LB&I MNE cases are complex and fact

intensive

Comparing taxpayer provided Beginning of Year

(BOY) and End of Year (EOY) GTOCs will assist in

identifying organizational changes for the year under

exam

For issue clarification, creating org charts,

transactional flow charts, and formal written

narratives will help you:

• Organize your thoughts

• Identify unknown but needed facts

• Ask pertinent questions

• See the big picture

15

How Can GTOC Analysis Help? (Cont’d)

Use organizational charts, transactional flow charts,

and written narratives to communicate the facts of

your case

These tools assist you in communicating with:

• Managers

• Subject Matter Experts

• Counsel

• Specialists

• Taxpayers and Representatives

16

How Can GTOC Analysis Help? (Cont’d)

Your documented analysis will:

• Demonstrate your knowledge of the case

• Create a record of your work on the case

• Support your conclusions

• Serve as the basis for obtaining agreement or for

sending a well-developed factual case to Appeals

• Assist in understanding how a tax exam adjustment will

impact taxpayer’s ETR

17

How Can GTOC Analysis Help? (Cont’d)

Proper labeling is important!

Distinguish the type of entity (e.g., Controlled Foreign

Corporation (CFC), Check The Box (CTB),

Disregarded Entity (DE), Foreign Disregarded Entity

(FDE), Controlled Foreign Partnership (CFP), etc.)

• DEs and FDEs, are “disregarded” from their owner for US

income tax purposes but are “regarded” for legal

purposes. (e.g., single member Limited Liability Company

(LLC), Disregarded Entity which Checked

-the-Box, etc.)

Show actual direct ownership

• It is important to include each entity in the diagram,

showing the actual ownership structure to fully understand

the structure and identify potential issues

18

How Can GTOC Analysis Help? (Cont’d)

Proper labeling is important! (Cont’d)

Determine jurisdiction/country

• It is important to properly diagram and label the entities

so that the reader can determine jurisdiction of income

tax liability and to determine jurisdiction for sourcing of

income

– Country of incorporation

– Country of taxing jurisdiction

– Source country of management and control

Determine proper US entity classification

• In order to determine the proper US income tax results,

it is often helpful to explain the US entity classification

and the associated US income tax treatment of the

transaction on the diagram

19

B. Interpreting GTOCs

Distinguish GTOCs From Other

Types of Org Charts

Taxpayers may use several different organization

charts within their accounting and tax operations:

• Tax Compliance Org Charts

• Corporate Secretary/Legal Entity Charts

• Enterprise General Ledger System Org Charts

• Transactional Flow Charts (Transactional Step Plans)

Beware - these charts are not tax org charts and do

not necessarily indicate all legal entities and their

U.S. tax classification.

21

Distinguish GTOCs From Other

Types of Org Charts (Cont’d)

Corporate Secretary (Legal Entity) Charts

• Most large taxpayer Corporate Secretaries use specific

function legal entity software applications for managing and

recording legal ownership of entities

• Most often the application is used for state/municipality

licensing and franchise reports requirements

• Although, the resulting org charts may indicate “by legal

entity,” they are not reliable for representing US entity

classification for tax compliance purposes. However, these

charts can provide factual information about legal reasons

for entity choice that could, in turn, provide the issue team

with valuable information.

22

Distinguish GTOCs From Other

Types of Org Charts (Cont’d)

Enterprise General Ledger System Org Charts

• Most Accounting Departments use specific function general

ledger software applications for accounting and reporting

purposes.

• These applications have functionality to create

organizational charts based on legal entity, business unit,

branches, etc. to accommodate financial reporting purposes.

• Although, the resulting org charts may be listed somewhat

by legal entity, they are not reliable for representing all

entities’ tax reporting status for US tax reporting purposes.

− Issue teams need to understand the system to be able to

bridge the financial data to the tax return.

23

Distinguish GTOCs From Other

Types of Org Charts (Cont’d)

Global Tax Org Charts

A tax organization chart refers to a legal

organization chart which has been modified to

depict:

• The US tax classification of various legal entities and

persons,

• The direct ownership of each entity, and

• The entity’s country of incorporation

Each type of entity or person is illustrated by a

unique symbol.

• Understanding these symbols and the associated US tax

consequences is critical to the reading of a GTOC

24

Distinguish GTOCs From Other

Types of Org Charts (Cont’d)

Global Tax Org Charts (Cont’d)

Large Taxpayers use Enterprise Tax Compliance

software or other function specific software to create

GTOCs for US classification and reporting purposes.

Other Taxpayers may prepare in-house tax

compliance org charts using some other software

application.

It is important that the issue team is clear about the

source and accuracy of the tax compliance or

transactional org chart received from the taxpayer.

• That is, ensure that all entities are correctly represented

in the chart including DEs and other flow-throughs.

25

Distinguish GTOCs From Other

Types of Org Charts (Cont’d)

Information Document Requests (IDRs) should

request the taxpayer’s GTOC to get the best

representation of the taxpayer’s US reporting

obligations

If no tax compliance (GTOC) or transactional chart

(i.e. step plan) is available:

• Create a chart to document your understanding of the

issue under review.

• Use standard symbols provided in next section and as

depicted on the LB&I Knowledge Based SharePoint site.

• Submit chart to taxpayer to verify

26

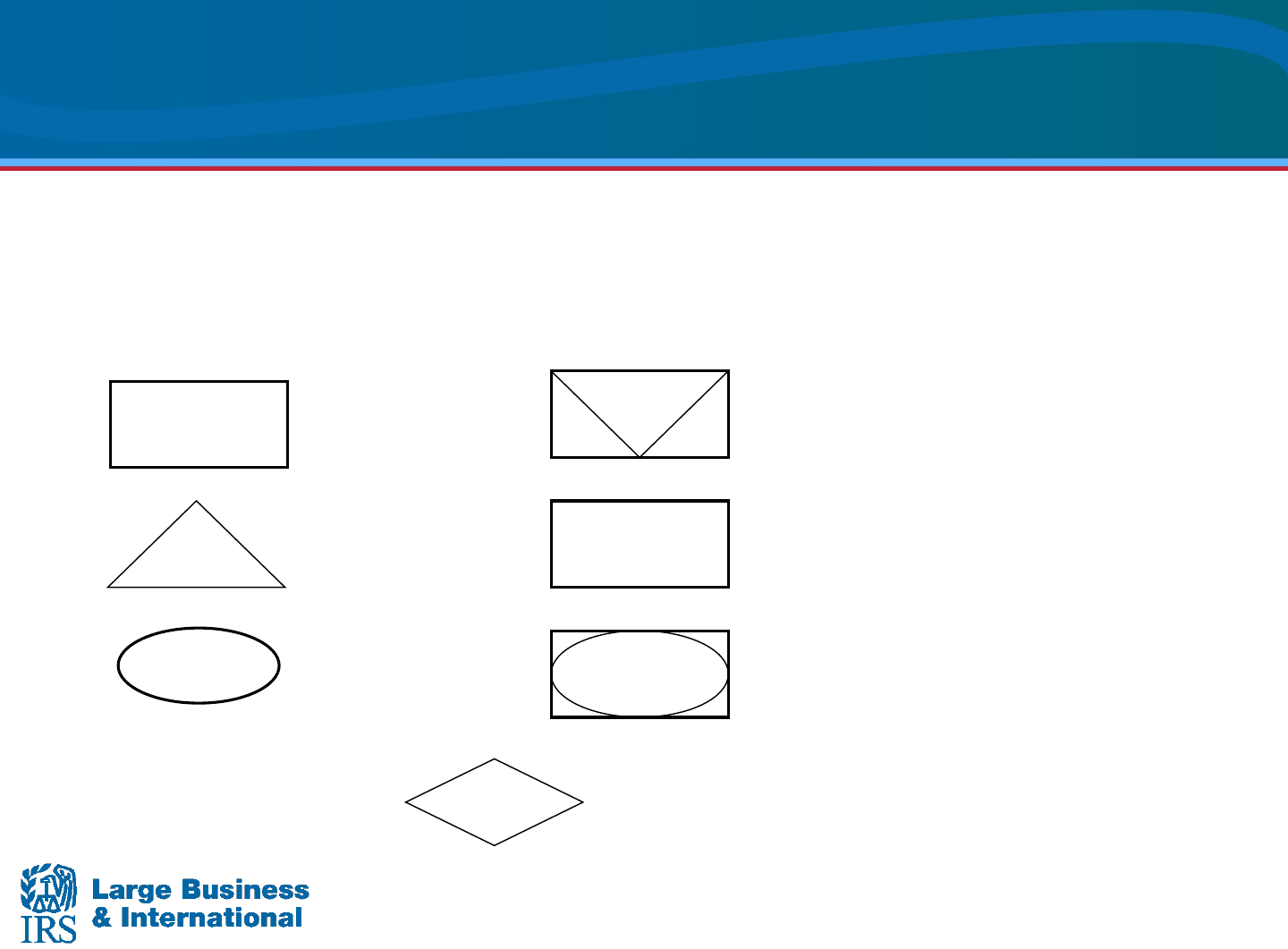

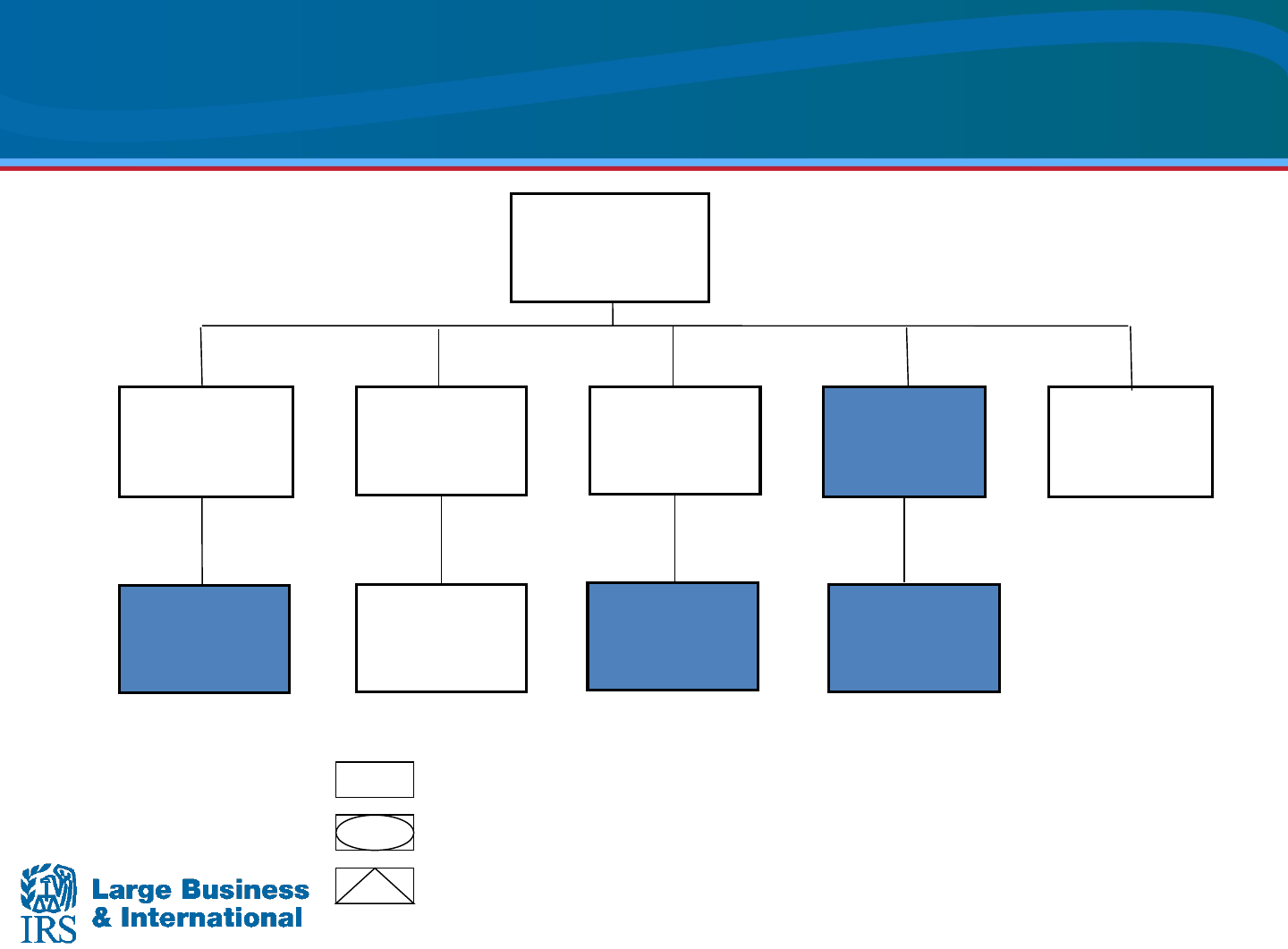

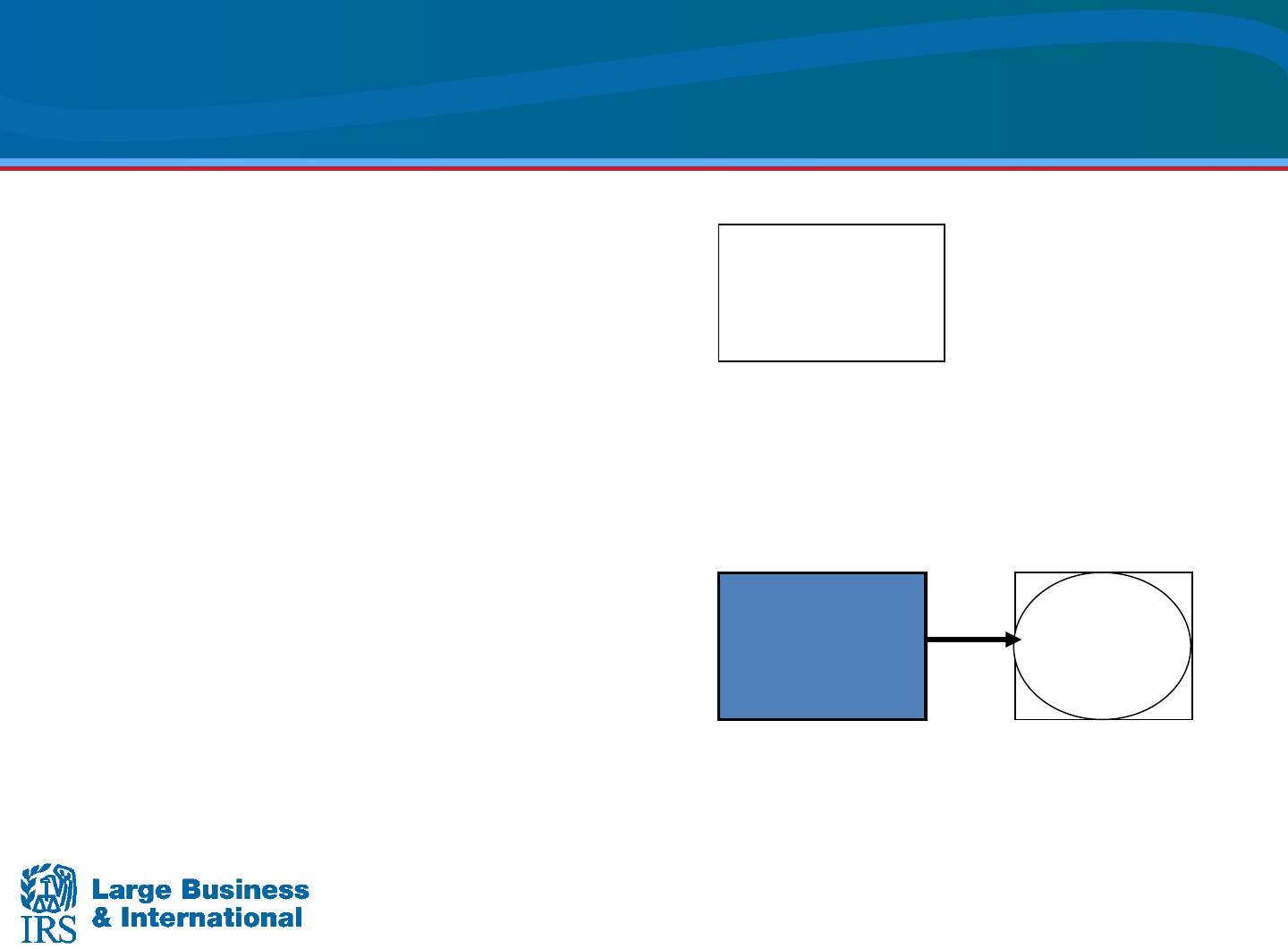

Commonly Understood Symbols

Each type of entity or person is illustrated by a unique

symbol

The ultimate parent is the entity at the top of the

organization chart

• This entity may or may not be the taxpayer

Generally, each level of ownership down from the

ultimate parent is referred to as a tier

• For example, an entity owned by the ultimate parent is a 1st

tier entity

Vertical relationships are typically referred to as Parent-

Subsidiary

Horizontal relationships are typically referred to as

Brother-Sister

27

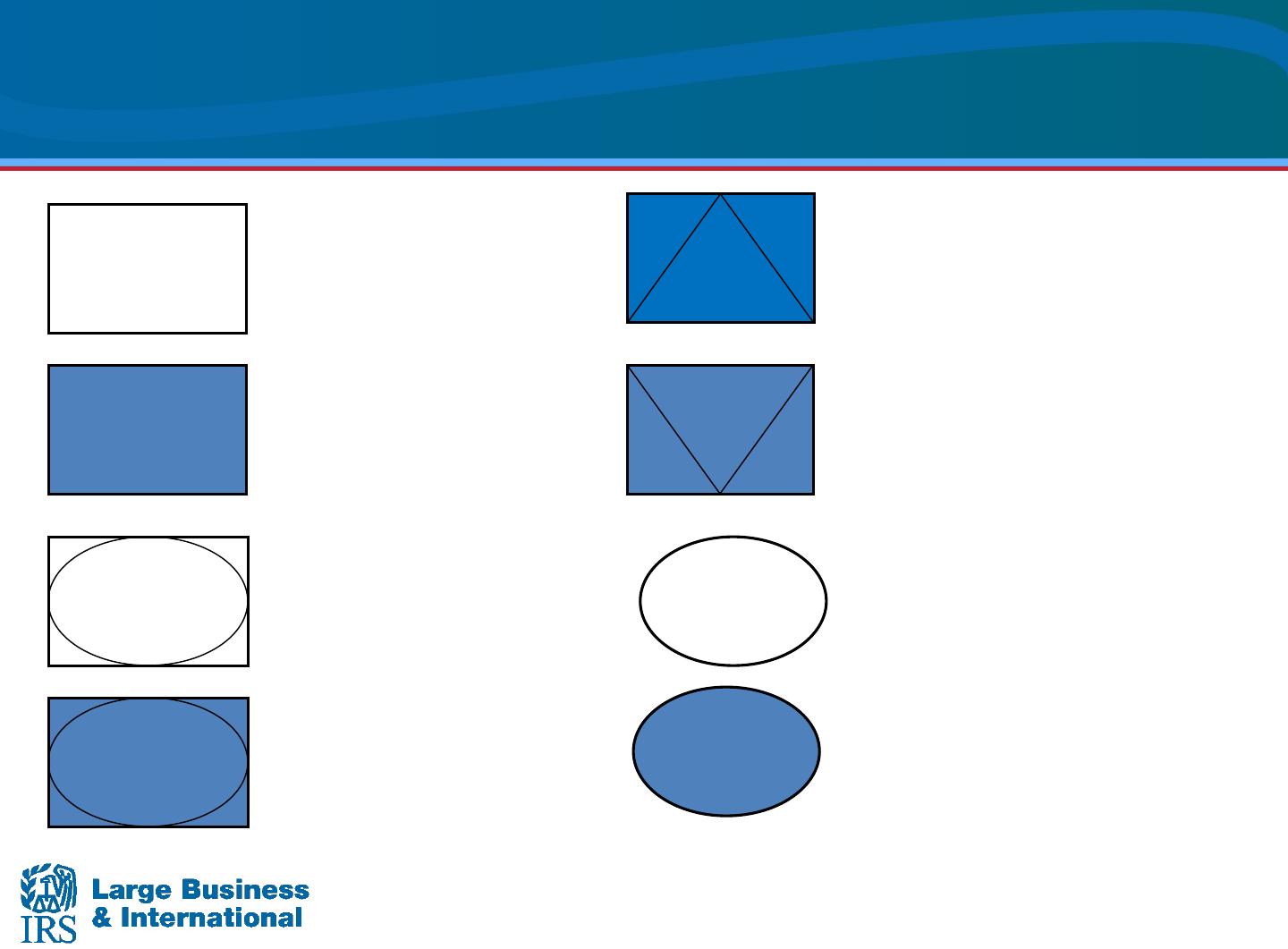

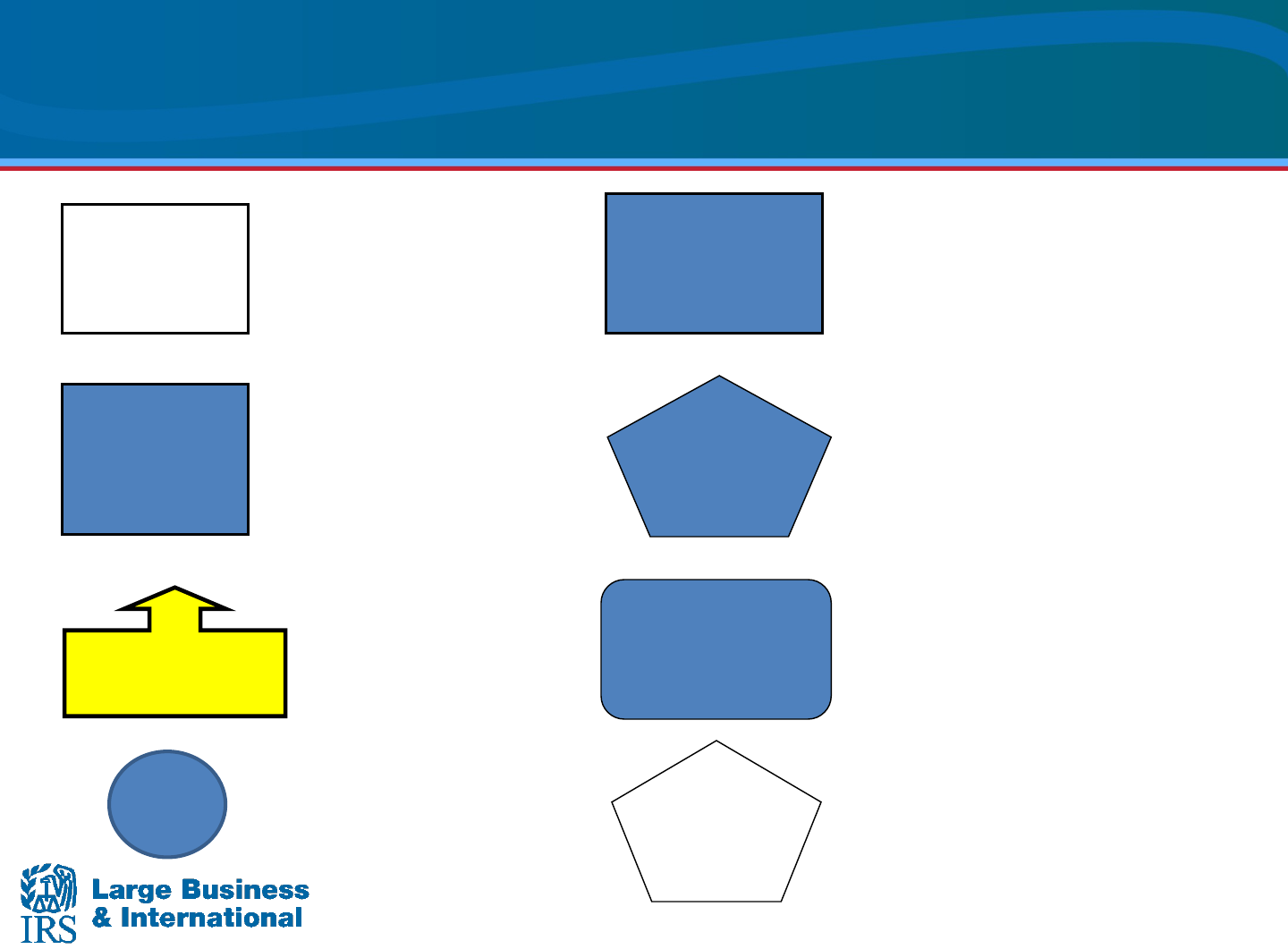

Commonly Understood Symbols

(Cont’d)

The accounting community uses commonly-

accepted symbols for use in creation of GTOCs.

Internally, the IRS has expanded and standardized

these symbols and colors for IRS-generated

GTOCs.

• US entities or disregarded entities included in US tax

reporting entities are “White.”

• Foreign entities not included in US tax reporting entity

consolidated return are “Blue.”

The following slides illustrate these symbols.

Note: taxpayer provided GTOCs may not be color

coded and/or incorporate shading, or even use

these commonly-accepted symbols

28

Commonly Understood Symbols

(Cont’d)

Below are commonly used symbols for GTOCs that you

may encounter outside of IRS:

Corporation

Reverse Hybrid Corporation

(US corporation, foreign pass-through)

Hybrid Partnership

(US pass-through, foreign corporation)

Partnership

Branch, DE or

Individual

Hybrid Branch or Disregarded Entity

“DE”

(US branch or DE, foreign

corporation)

Trust

29

USP

DE

Controlled foreign

corporation

DE

Disregarded entity for US

tax purposes, corporation in

the country of organization

RH

BR

FBR

HP

Commonly Understood Symbols

(Cont’d)

CFC

US parent corporation

Disregarded entity that is

owned directly by a US

company – treated as a

branch for US tax purposes;

corporation in the country of

organization

Hybrid partnership: Treated as a

fl

o

w-t

hr

ough for US tax

purposes; treated as a

corporation in the country of

organization

Reverse hybrid corporation –

Treated as a corporation for US

tax purposes; treated as a flow-

through entity in the country of

organization

A true domestic branch (US and

foreign tax purposes)

A true foreign branch (US and

foreign tax purposes)

30

30

T

Offshore

IBC

Offshore

Bank

Financial

Account

Bank

Commonly Understood Symbols

USC

FC

(Cont’d)

Withholding agent

Treaty Implication

A US corporation or other

domestic entity

characterized as a

corporate entity under the

regulations (301.7701)

Foreign corporation

International business company

formed in an offshore secrecy

jurisdiction to disguise beneficial

ownership of financial accounts,

assets and investments

Bank located in an offshore

secrecy jurisdiction that provides

financial services for individual

international clients

Bank, investment, securities or

other financial account

Bank

31

31

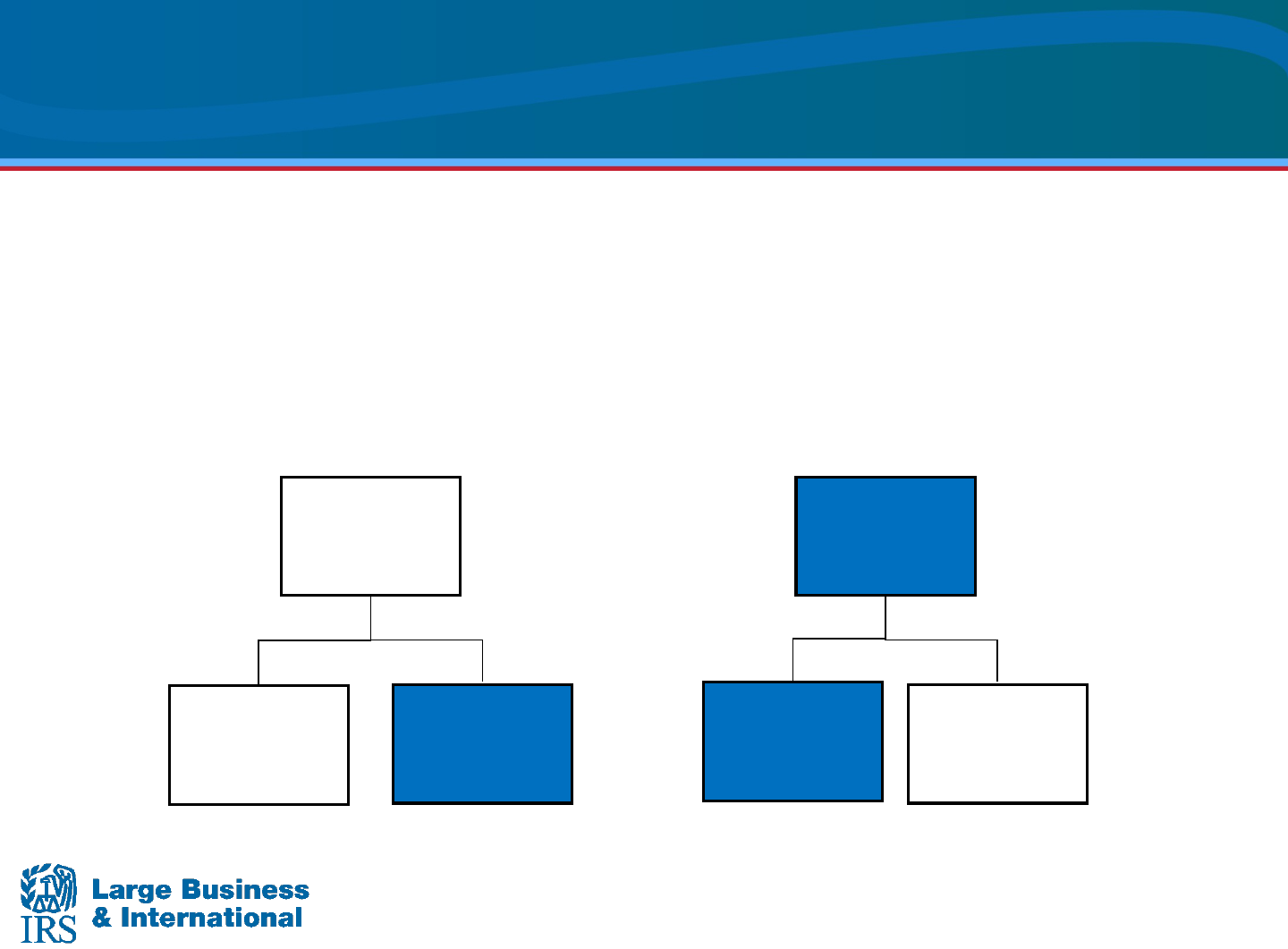

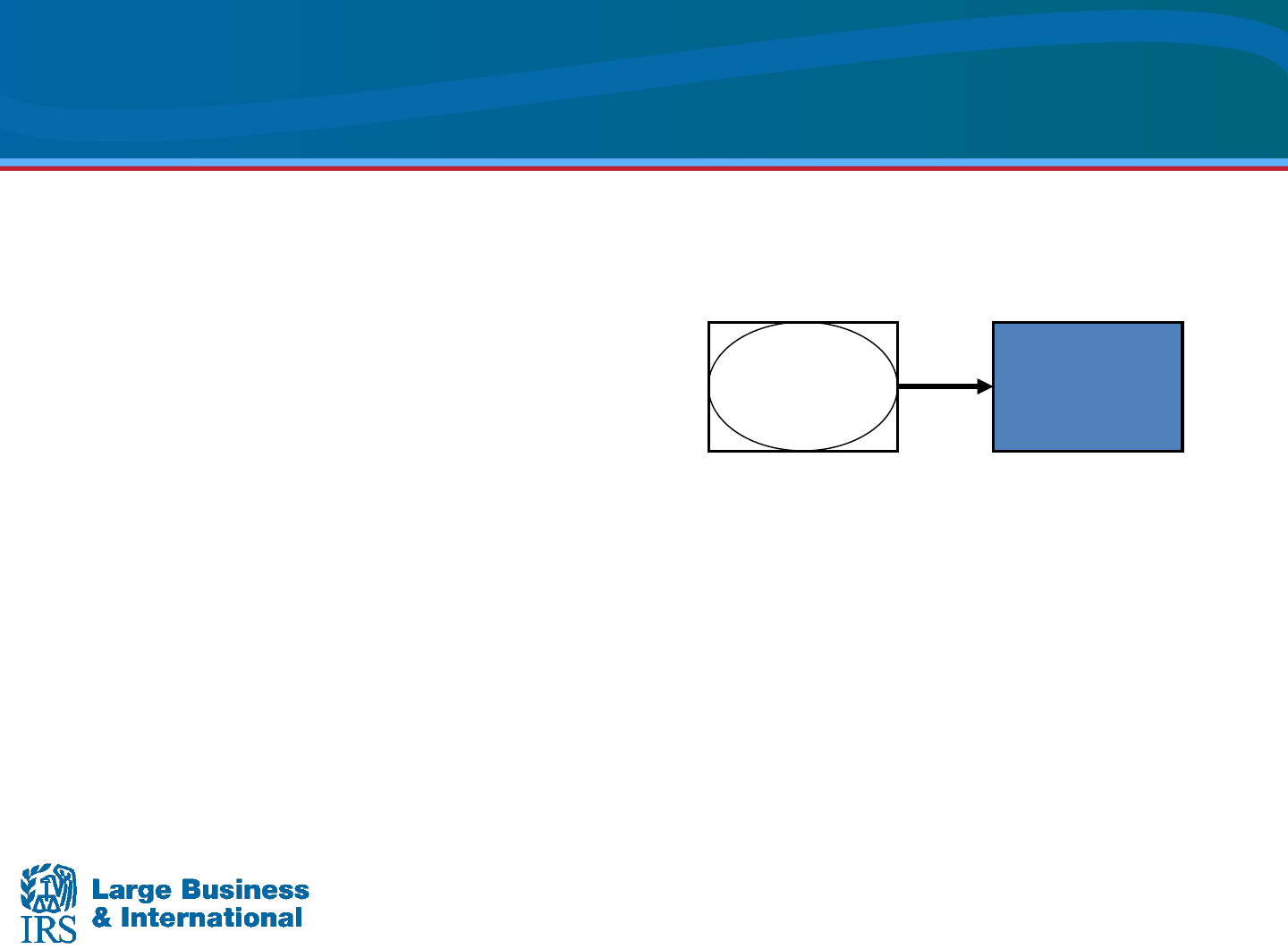

FP

FC

Commonly Understood Symbols

(Cont’d)

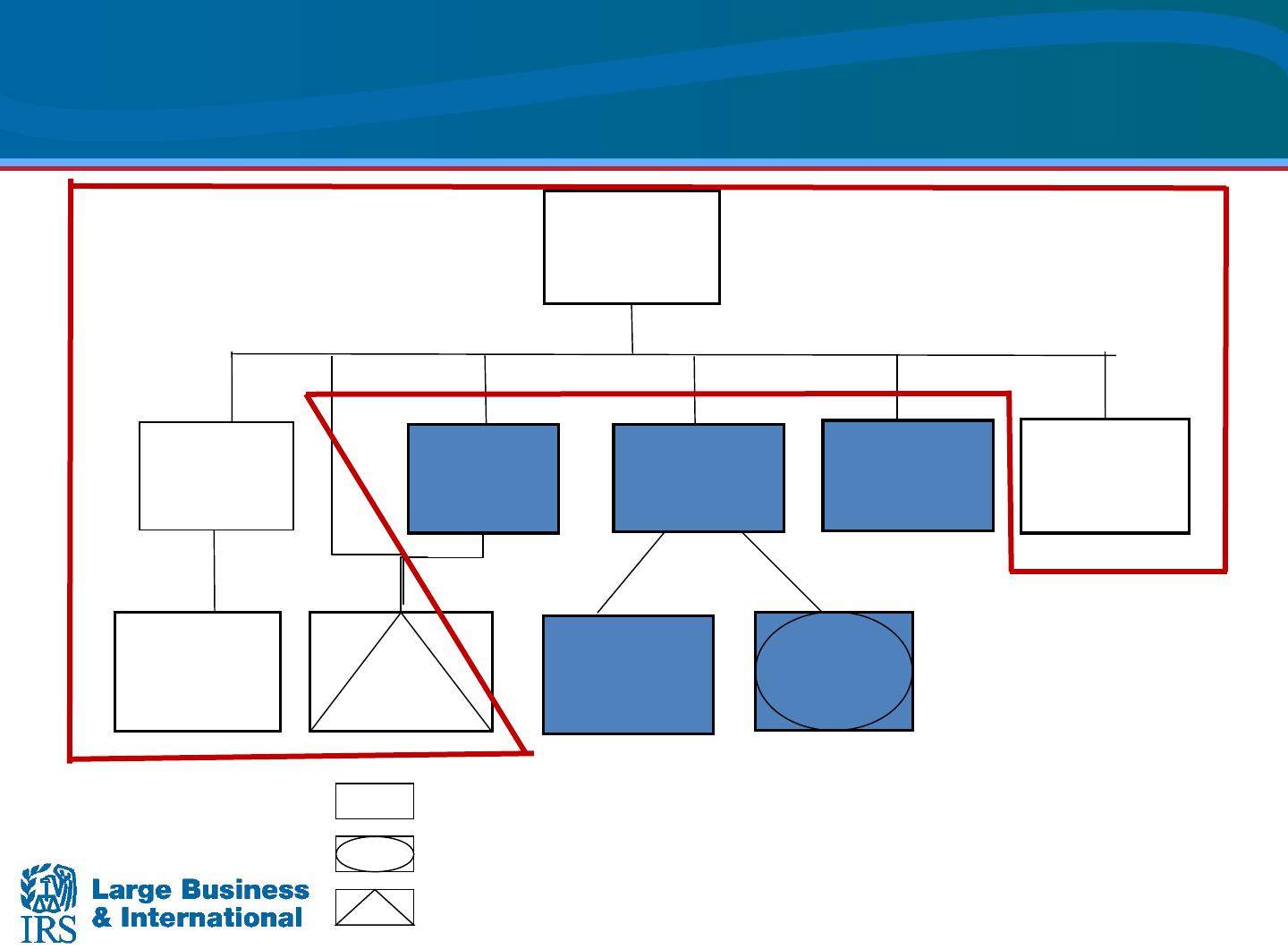

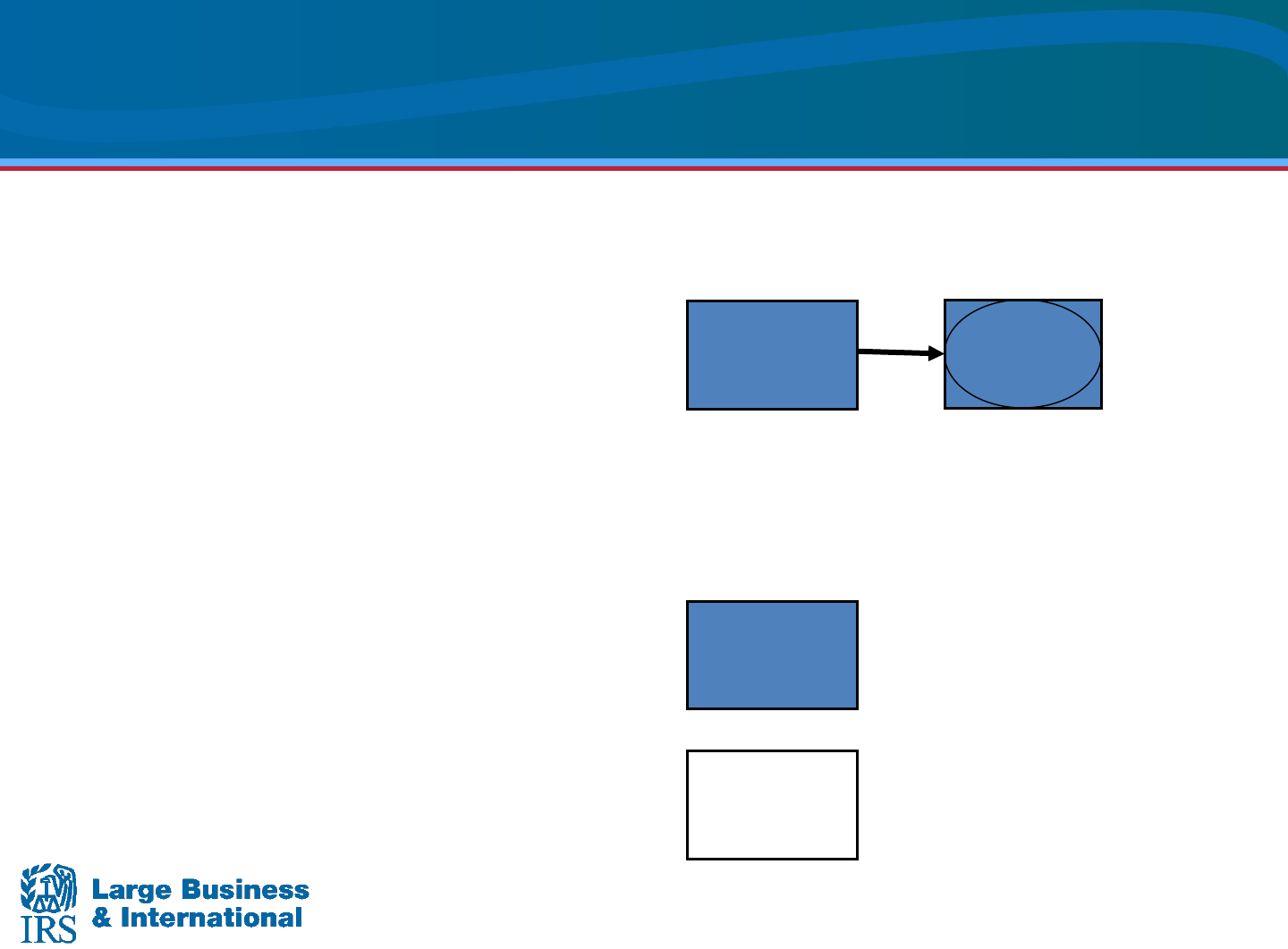

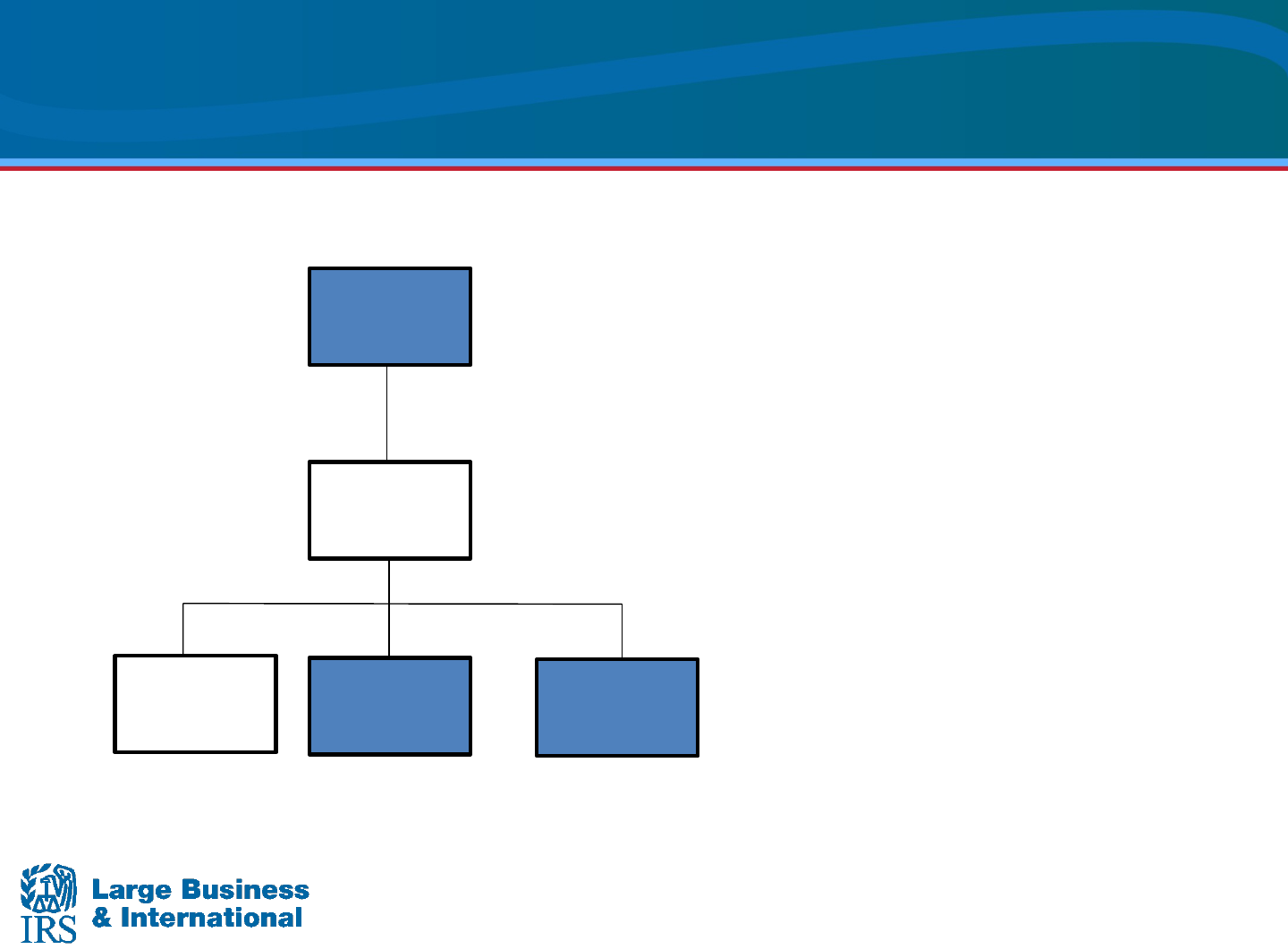

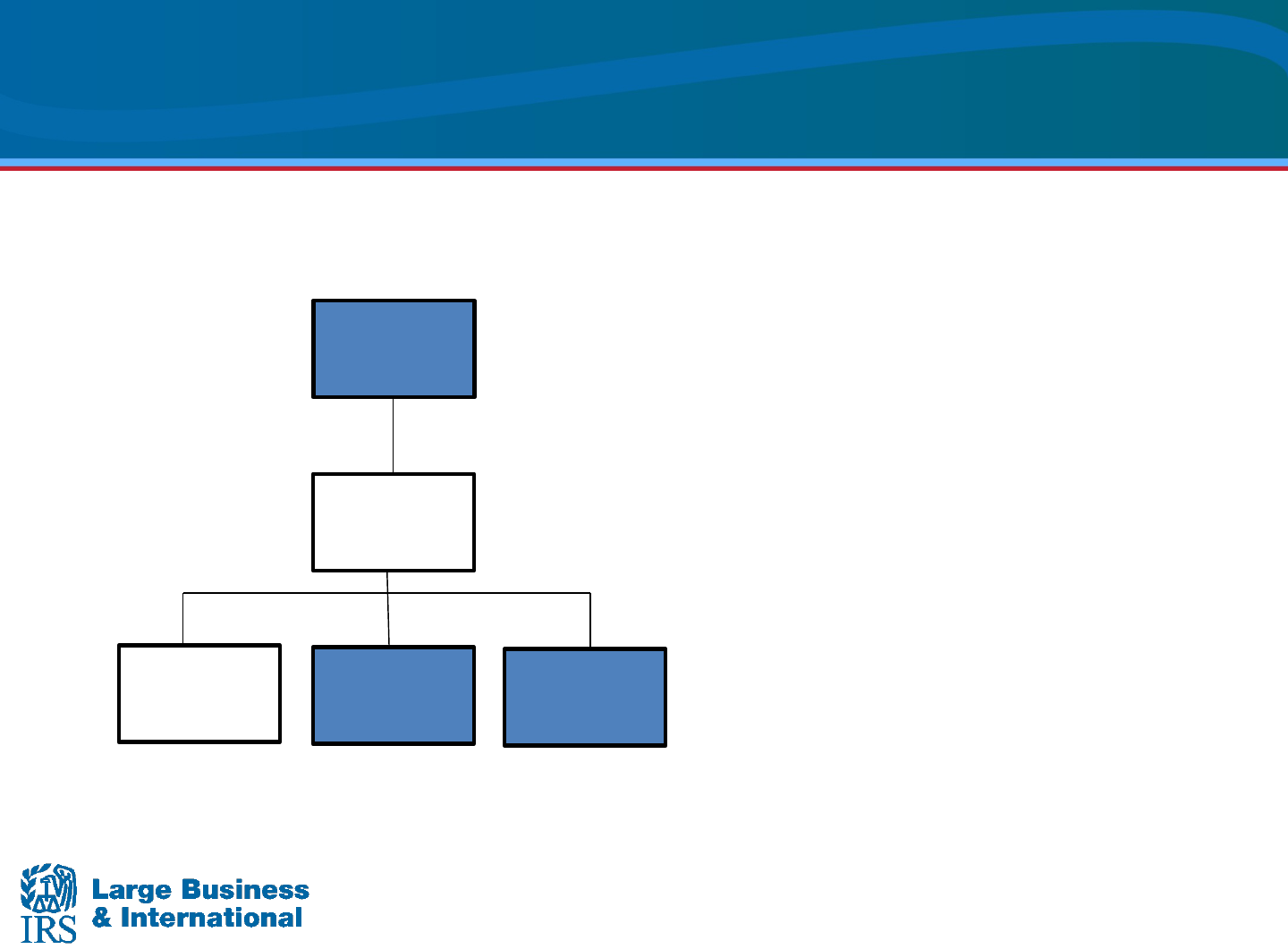

For IRS training purposes, foreign entities are distinguished from US

entities by shading their respective shapes. For example, the

following Outbound and Inbound structures have the foreign entities

shaded blue.

Outbound Inbound

USP

USS

CFC USS

32

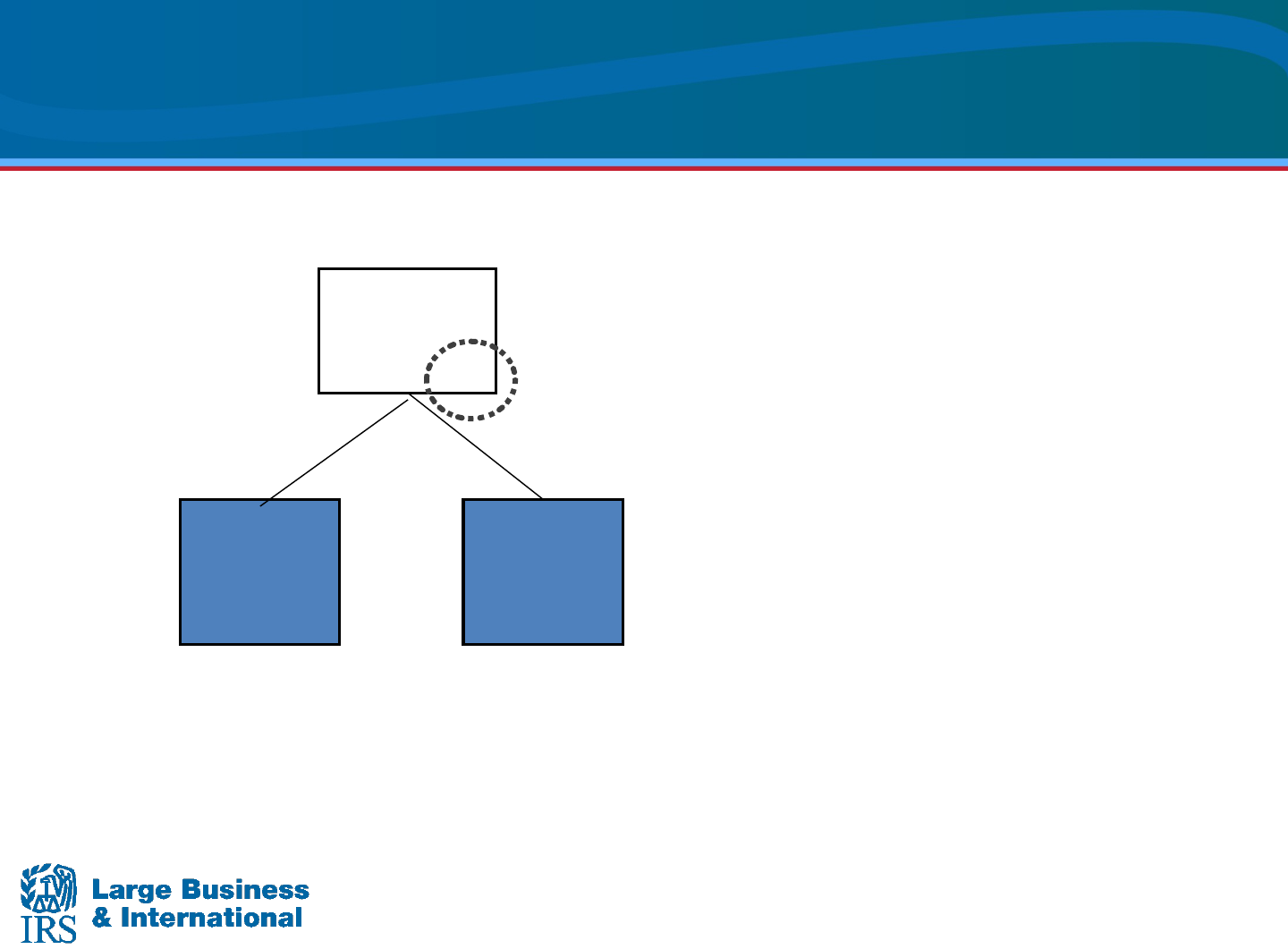

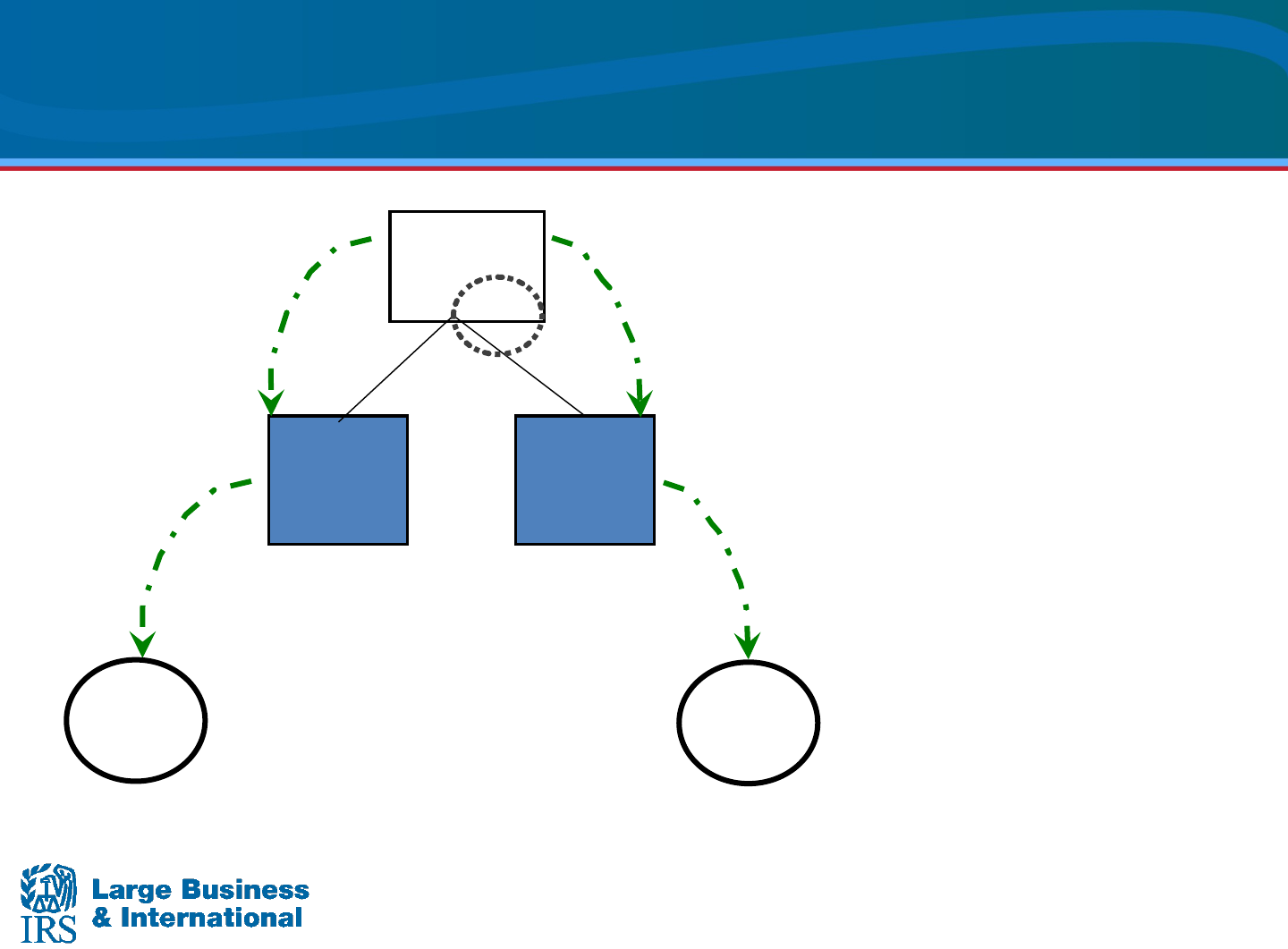

Interpreting a Basic GTOC

Outbound Structure: US person is the ultimate

parent of a foreign entity or conducts foreign activities

through a branch. Some tax planning strategies

available to outbound structures include:

• Shift income or assets offshore

• Manage foreign tax credits, and

• Repatriate cash with little or no residual US tax cost

Inbound Structure: Foreign person is the ultimate

parent of a US entity or conducts US activities through

a branch. Some tax planning strategies available to

inbound structures include:

• Minimize the US tax base

• Shift US income-producing assets to low-tax jurisdictions

33

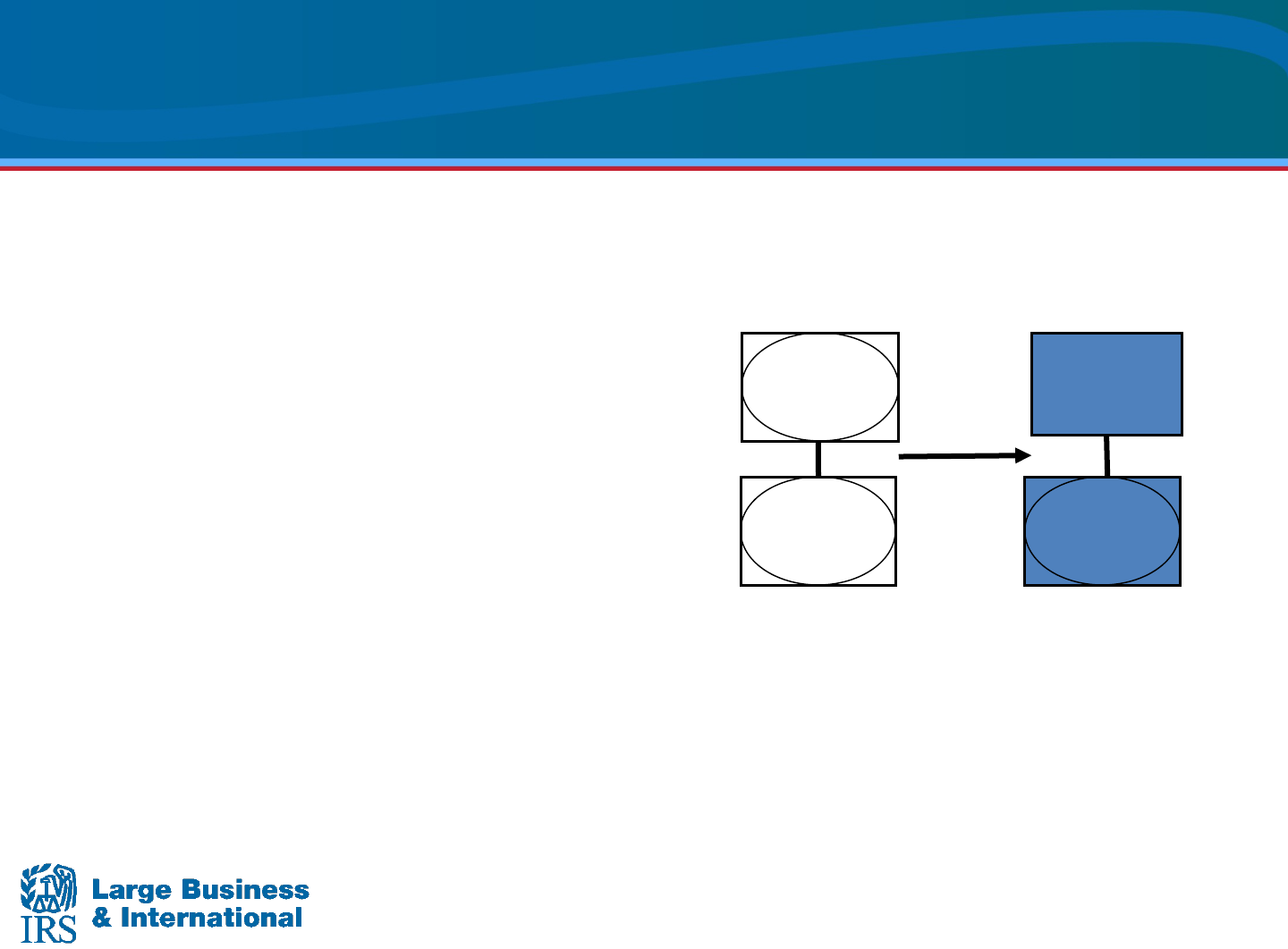

Compare BOY and EOY GTOC

Why compare BOY and EOY GTOCs?

• To identify any entity structure changes that may affect

the tax attributes of the US filer for the current year and

year to year changes

Changes in entity structures may result from:

• Acquisitions

• Dispositions

• Reorganizations

• Change in tax entity structure for US purposes only (e.g.,

CTB election, F-Reorgs, conversion to LLC, etc.)

− A CTB deemed liquidation of a CFC or other CTB

actions can result in deemed restructurings without any

foreign legal consequences.

34

Compare BOY and EOY GTOC (Cont’d)

Once the entity structure changes are identified,

analyze the changes to the US tax attributes of the

reporting entity

Examples of how the tax attributes may be affected:

• Non-taxable income inclusions

• Increase in FTC taken

• Increase in Foreign Sourced Income (FSI), decrease in

US sourced income

• Increase in US sourced expenses

• Income producing assets moved onshore or offshore

• Character of income as eligible for deferral vs. subpart F

or GILTI

35

Corporation

Hybrid Entity - Disregarded Entity (DE) for US and Corporation for Foreign purposes

Hybrid Entity - Partnership for US and Corporation for Foreign purposes

US Sub1

DE2

DE10

US Sub6

US Sub4

CFC3

CFC5

CFC9

CFC7

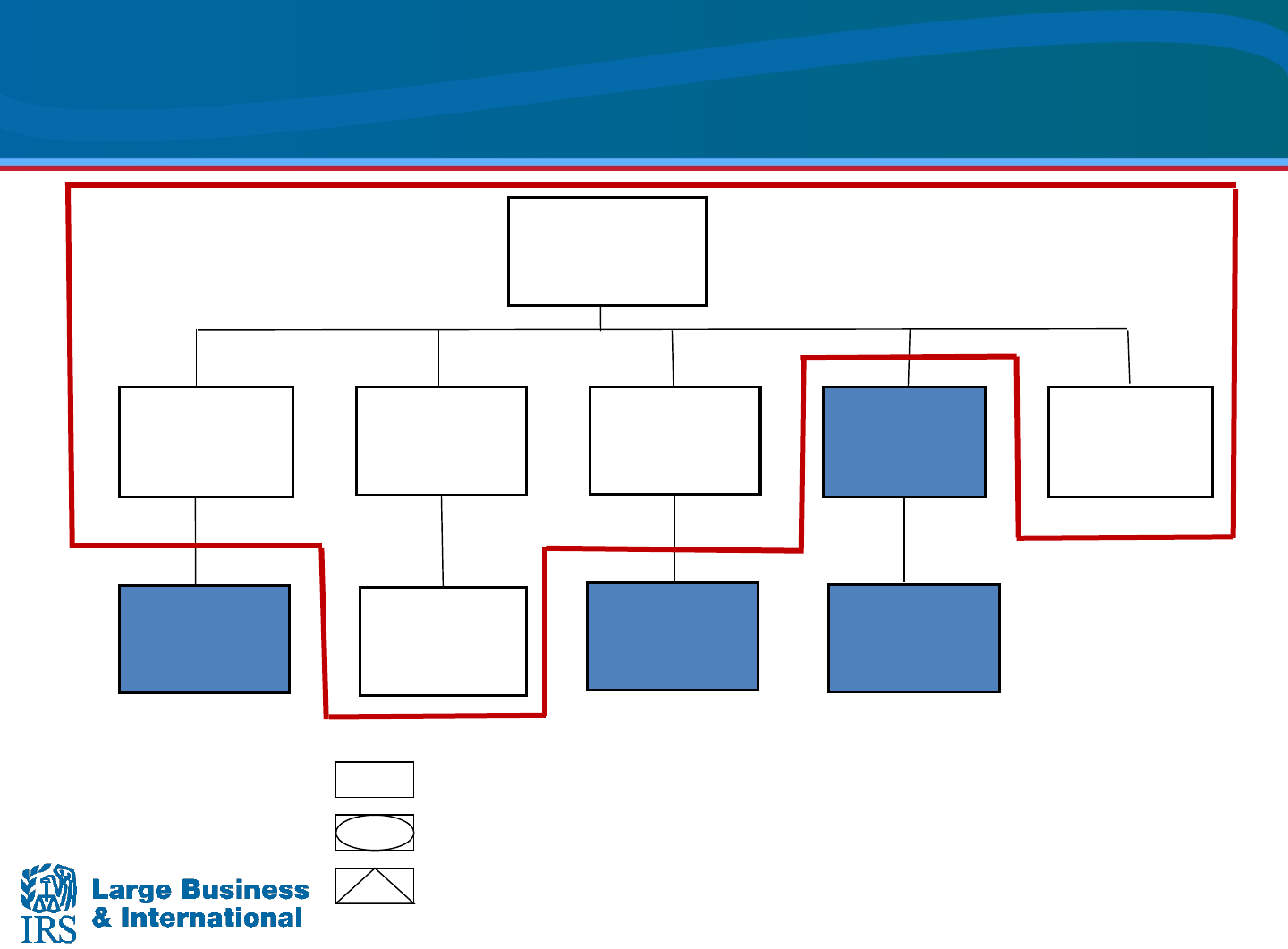

GTOC Exercise (BOY)

USP

36

GTOC Exercise (BOY) (Cont’d)

USP

US Sub1

DE2

DE10

US Sub6

US Sub4

CFC3

CFC5

CFC9

CFC7

Corporation

Hybrid Entity - Disregarded Entity (DE) for US and Corporation for Foreign purposes

Hybrid Entity - Partnership for US and Corporation for Foreign purposes

37

Summary (BOY)

US Tax Group Offshore

• USP • CFC7

• US Sub1 • CFC3

• US Sub4 • CFC5

• US Sub6 • CFC9

• DE2

• DE10

38

20%

80%

US

Sub1

DE5

CFC2

CFC9

CFC4

(with US4’s

assets)

US Sub6

CFC3

DE7

CFP10

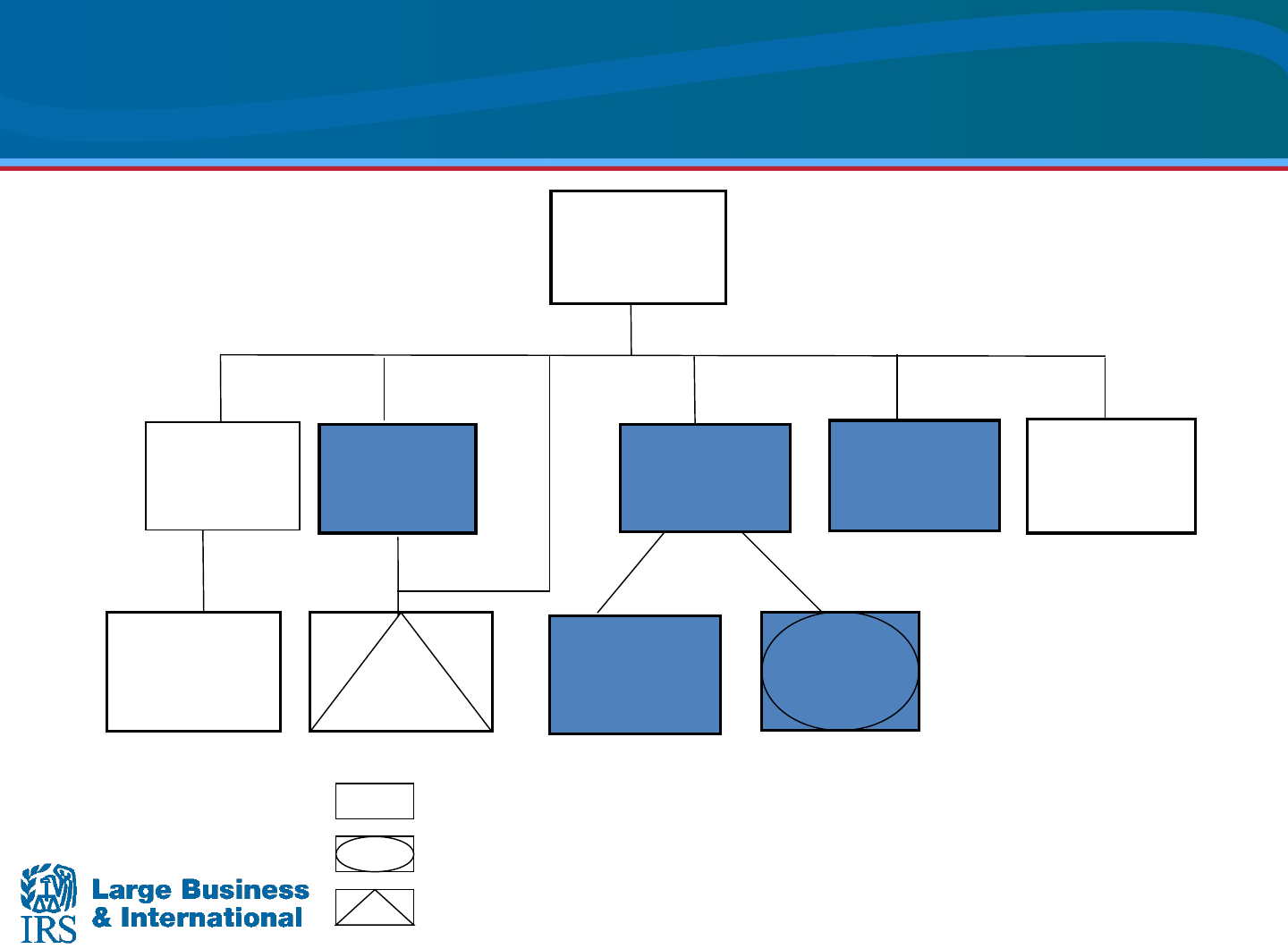

GTOC Exercise (EOY)

USP

Corporation

Hybrid Entity - Disregarded Entity (DE) for US and Corporation for Foreign purposes

Hybrid Entity - Partnership for US and Corporation for Foreign purposes

39

GTOC Exercise (EOY) (Cont’d)

Corporation

Hybrid Entity - Disregarded Entity (DE) for US and Corporation for Foreign purposes

Hybrid Entity - Partnership for US and Corporation for Foreign purposes

USP

20%

80%

US

Sub1

DE5

CFC2

CFC9

CFC4

(with US4’s

assets)

US Sub6

CFC3

DE7

CFP10

40

Summary (EOY)

US Tax Group

• USP

• US Sub1

• DE7

• US Sub6

• 80% of CFP10

Offshore

• CFC2

• 20% of CFP10

• CFC4

• CFC3

• DE5

• CFC9

41

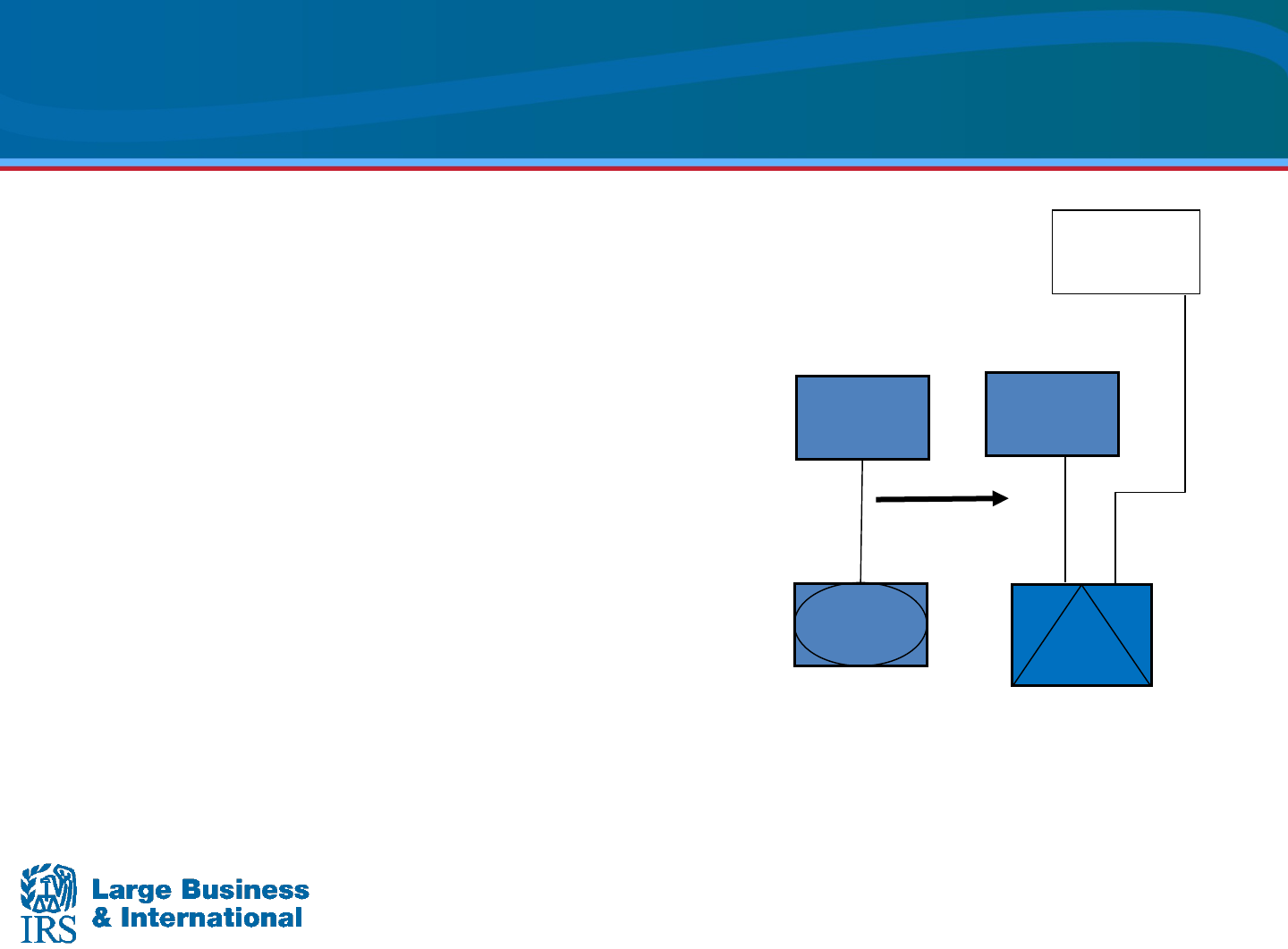

DE7

CFC7

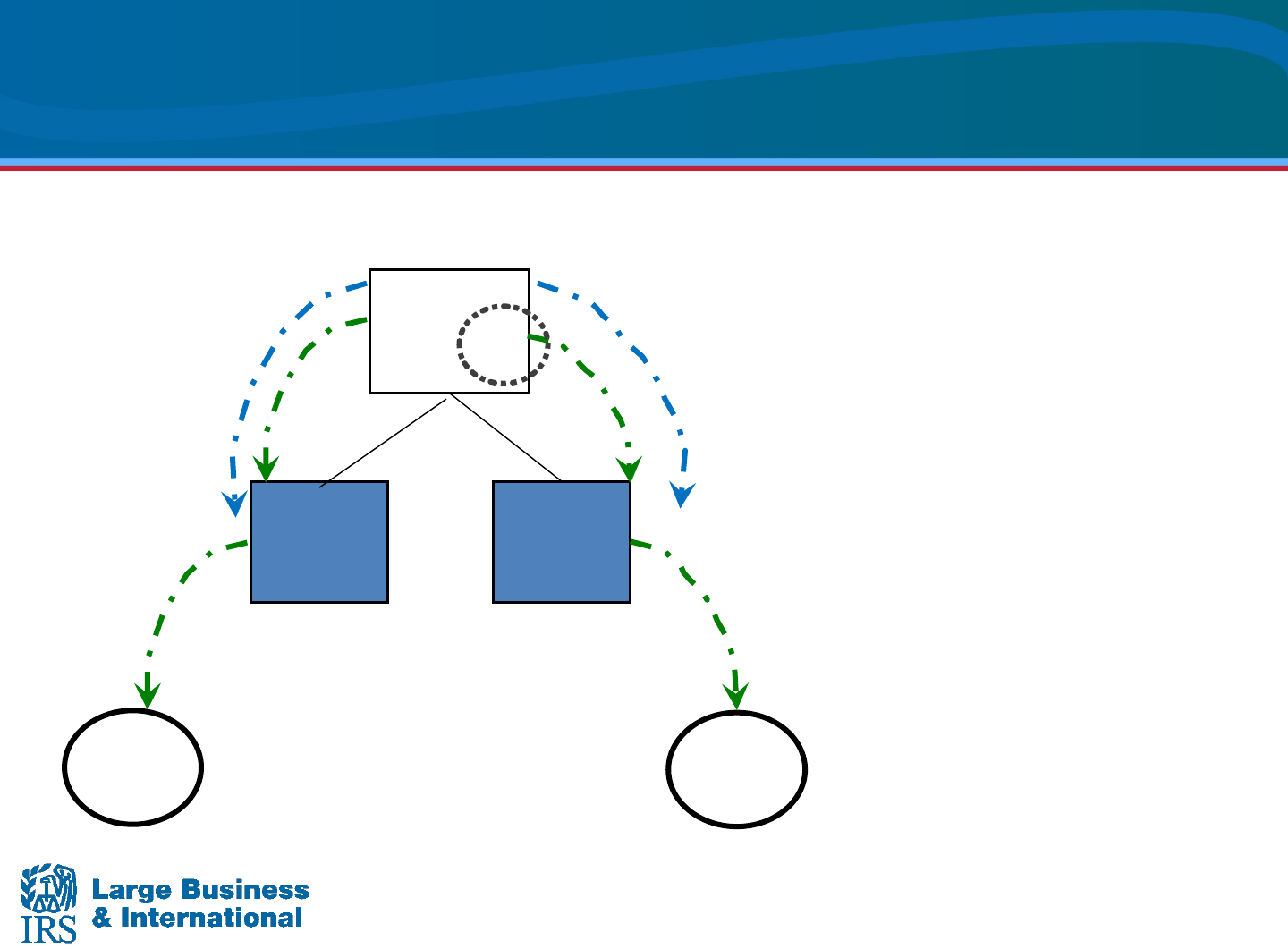

Possible Transactions

US Sub 1

• No change in form

CFC7

• Made an election to

be disregarded

− Filed Form 8832

− Filed final Form 5471

− Files initial Form

8858

US Sub1

42

Possible Transactions (Cont’d)

DE2

• Made election to

be regarded

• Outbound transfer

of property (USP

filed Form 926)

DE2 CFC2

• Filed Form 8832

• Final Form 8858

• Files initial Form

5471

43

Possible Transactions (Cont’d)

DE10

• When DE2 elected

to be regarded, that

also caused the

outbound transfer of

DE10…

DE10

DE2

CFC2

DE10

44

DE10

CFC2

CFP10

20%

CFC2

Possible Transactions (Cont’d)

DE10

• …DE10 remained a DE until USP

contributed additional assets

amounting to 80% of the value of

DE10 in exchange for an 80%

interest of the entity

• Now having more than one owner,

it can no longer be disregarded. It

undergoes a per se classification

change to a partnership (retaining

the passthrough nature of a DE)

• A Form 8832 entity change form is

not necessary

• It must now file a final Form 8858

and initial Form 8865

USP

80%

45

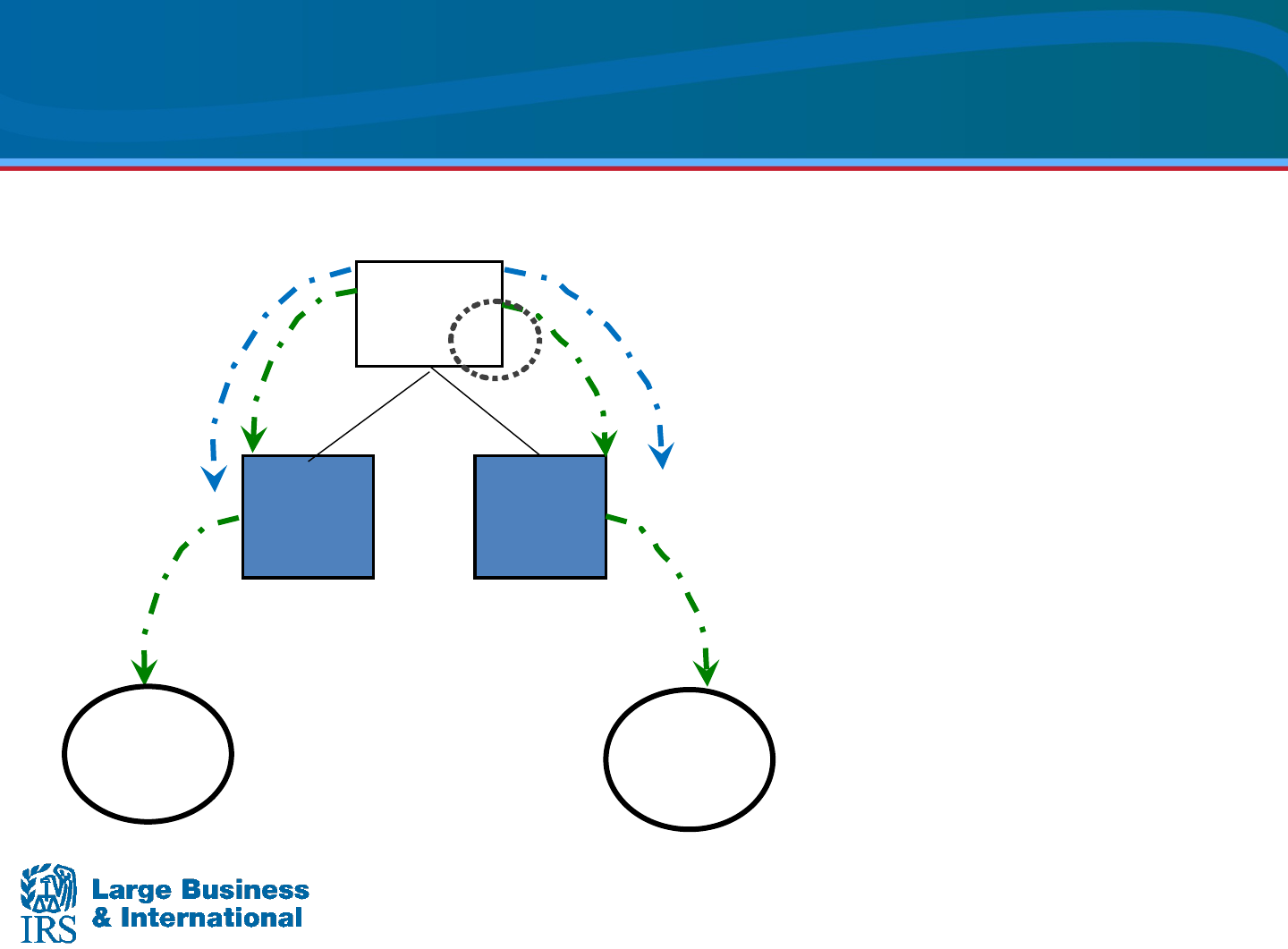

CFC4

Possible Transactions (Cont’d)

US Sub4

• Outbound transfer of property

• USP files Form 926 for assets

of US Sub4

• Likely files a Gain Recognition

Agreement (GRA)

• Files initial Form 5471

CFC3

US Sub4

• Parent would file Form 926 for

its stock owned by US Sub4

CFC3

• GRA likely filed for CFC3

stock

• Continues to file its Form 5471

46

CFC5

DE2

US Sub6

Possible Transactions (Cont’d)

CFC5

• Foreign to foreign

transfer, so no GRA

needed

• Final Form 5471

• Files Form 8832

• Files initial Form 8858

CFC9

CFC9

• No change

CFC6

• No change

47

C. Common Global Tax Structures

in International Tax Planning

Outbound Transactions and ETR

Some of these activities may affect ETR

• Income shifting

• FDII maximization

• BEAT minimization

• Expense allocation and apportionment

• Affirmative subpart F use

• FTC maximization

• GILTI reduction management

• Participation exemption/Dividend Received Deduction

(DRD) maximization

• Manage interest expense allocation

• Loss importation

49

CFC1

(High Tax)

USP

CFC2

(Low Tax)

IP

Outbound Transaction Example

and ETR (Pre-TCJA)

Possible tax strategies

• Transfer pricing

• Transfer IP offshore

followed by license of IP

• E&P segregation

• FTC “hyping”

• Avoiding subpart F

50

Outbound Transaction Example and

GILTI (Post-TCJA)

GILTI Effect

CFC1

(High Tax)

USP

CFC2

(Low Tax)

Customers

Customers

Goods

Goods Goods

Goods

IP

US parent corporation wholly

owns two foreign corporations

(“High Tax Co”) and (“Low Tax

Co”)

• USP performs

manufacturing

• USP owns the global IP

• USP transfers IP to

offshore foreign affiliates

• USP sells widgets to

High Tax Co and Low

Tax Co based on a

resale minus

• The overall foreign tax

rate is 27%

51

Outbound Transaction Example and

GILTI (Post-TCJA) (Cont’d)

License of IP

License of IP

Goods

CFC1

(High Tax)

USP

CFC2

(Low Tax)

Customers

Customers

Goods

Goods

Goods

IP

Possible tax issues

• USP could be in

situation where

excess FTCs are

permanently lost.

What can it do?

• Separate price of

intangibles from the

sale of goods

− May create

significant low-

tax, foreign-

source, general

basket income.

52

Outbound Transaction to Minimize ETR

and GILTI (Post-TCJA) (Cont’d)

License of IP

License of IP

Goods

CFC1

(High Tax)

USP

CFC2

(Low Tax)

Customers

Customers

Goods

Goods

Goods

IP

Possible tax issues

Could potentially blend this with

high-tax income currently in

GILTI basket through

affirmative Subpart F planning?

• By engaging in this

planning (separating

royalty and then

affirmative Subpart F

planning), USP has

optimized its tax position

and maximized FTC

utilization?

• IP royalties may also

produce FDII

53

Inbound Transactions and ETR

Taxpayers may use one or more of the

following typical transactions to minimize ETR

• Efficient use of entity classification rules

• Expense allocations to US branch/PE

• Income shifting

• Loans through low-tax affiliates

• Section 163(j) optimization

• Foreign guarantees

• BEAT minimization

• FDII maximization

54

Inbound Transaction Example and

ETR (Pre-TCJA)

FP

US Sub 1

US Sub 2

FC

FC

Possible tax issues

• US Sub 1 enters into

loan with FP

• US Sub 1 pays

management and

oversight fees

• Transfer pricing

55

FP

US Sub 2

FC

FC

US Sub 1

Inbound Transaction Example and

ETR (Post-TCJA)

• Related party loans are

subject to new rules: BEAT,

IRC 163(j) (modified old

section 163(j), and new

hybrid rules

• Following US tax strategies

may still be employed:

− Allocation and

apportionment of overhead

expenses

− Transfer pricing

− Optimizing BEAT and IRC

163(

j) calculations

56

What did we learn?

Summary

You should now be able to:

A. Identify taxpayer's objectives in global tax

planning

B. Describe how to interpret a taxpayer’s GTOC

C. Identify typical global tax structures for

international tax planning strategies

58

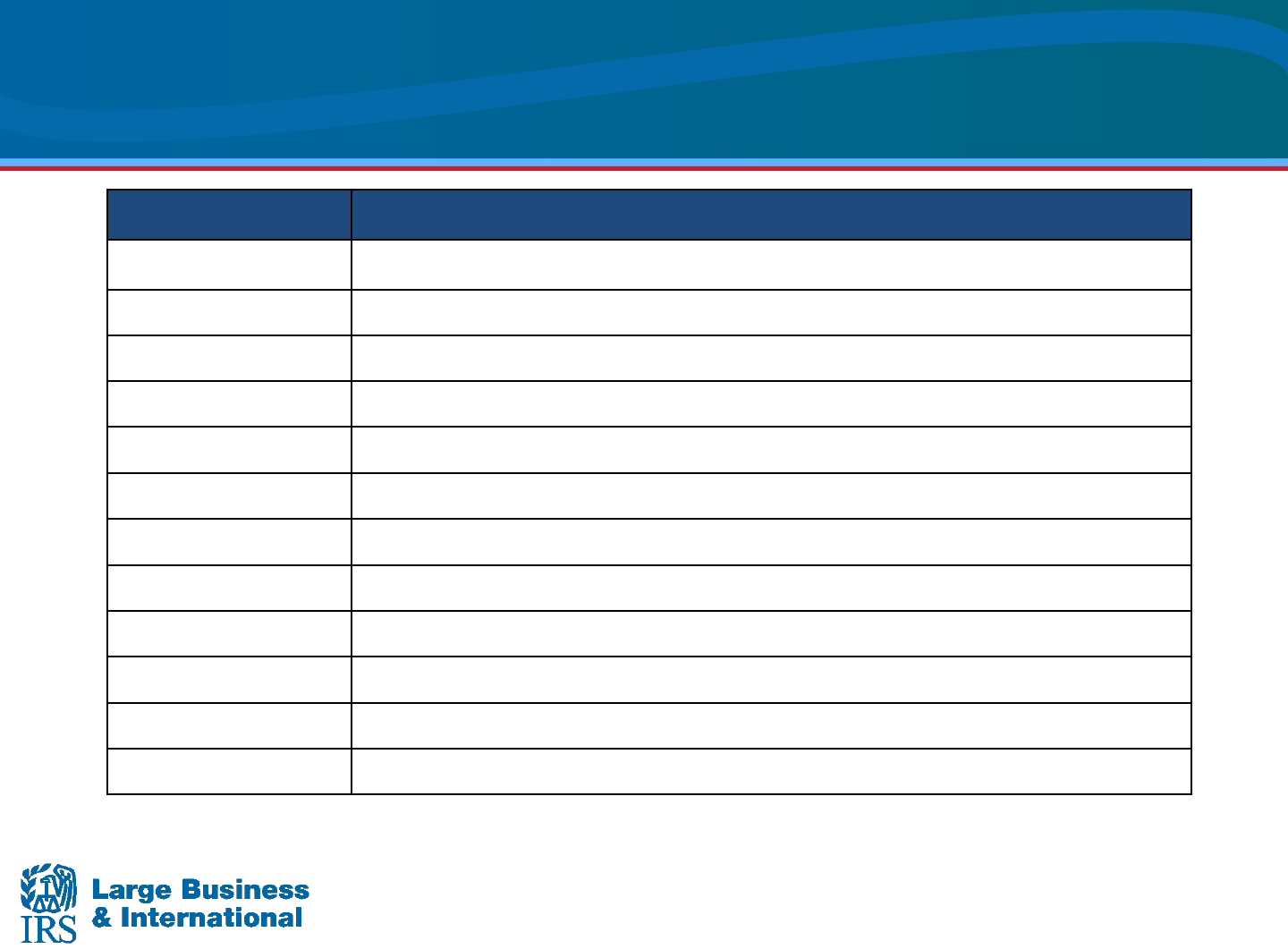

Appendix

Glossary of Terms

Acronym/Terms Definition

BOY Beginning of Year

BEAT Base Erosion and Anti-abuse Tax

BR True Domestic Branch for US and foreign tax purposes

CFC Controlled Foreign Corporation

CSA Cost Sharing Arrangement

CTB Check-the-Box

DE Disregarded legal entity for US Tax purposes

DRD Dividends Received Deduction

E&P Earnings and Profits

EOY End of Year

ECI Effectively Connected Income

EPS Earnings Per Share

60

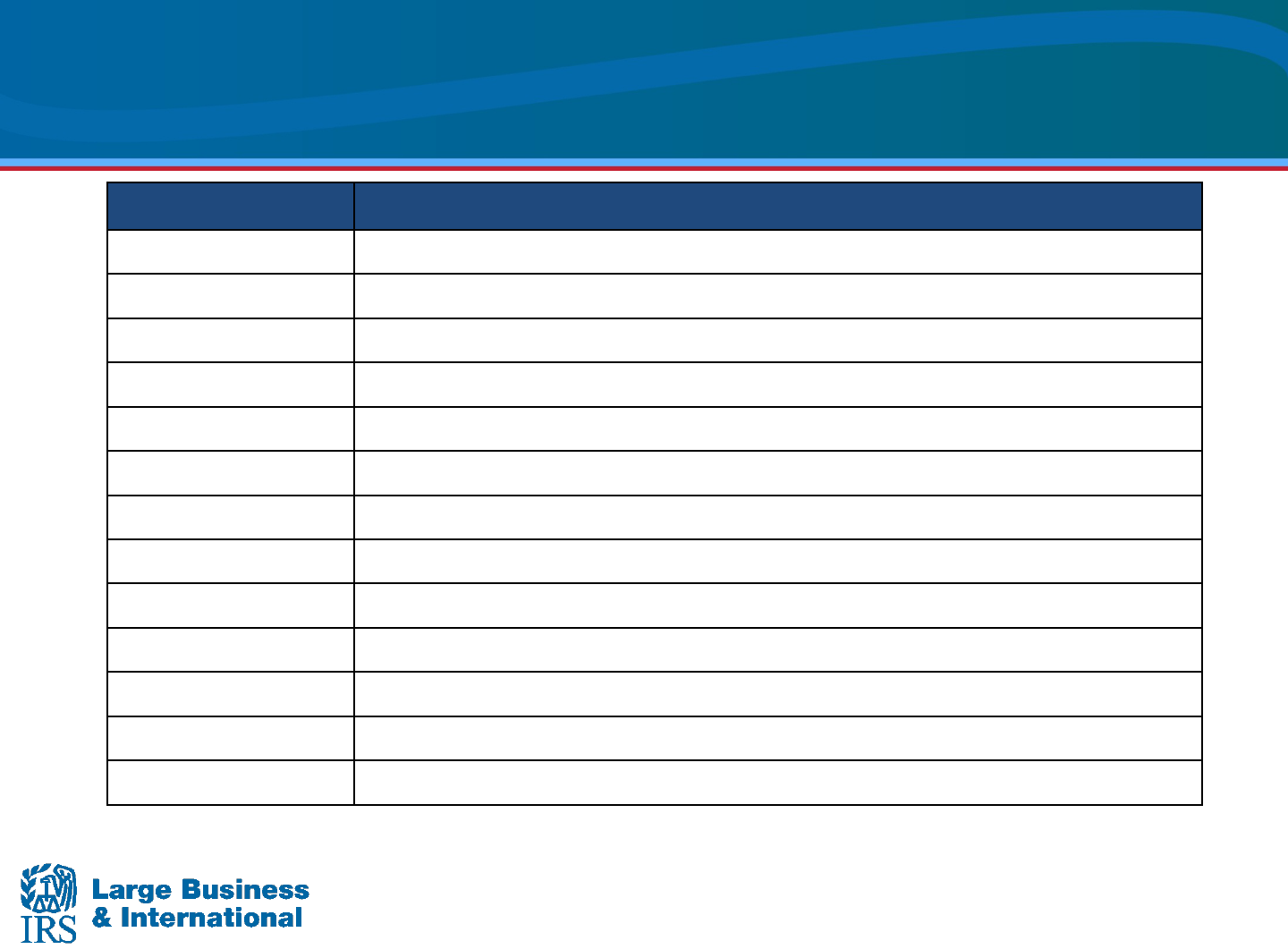

Glossary of Terms (Cont’d)

Acronym/Terms Definition

ETR Effective Tax Rate

FBR True Foreign Branch

FC Foreign Corporation

FDE Foreign Disregarded Entity

FDII Foreign Derived Intangible Income

Financial/”Book” US GAAP Financial Book income

FP Foreign Parent Company

FSI Foreign Source Income

FTC Foreign Tax Credit

FTR Foreign Tax Rate

GTOC Global Tax Organizational Chart

GILTI Global Intangible Low-Taxed Income

GRA Gain Recognition Agreement

61

Glossary of Terms (Cont’d)

Acronym/Terms Definition

Holdco Holding Company

Hubco Foreign holding company organized in a low-tax jurisdiction, often

vested with centralized functions and centralized control of IP

Hybrid Hybrid: Flow through for US tax/Corporation for country of incorporation

HP Hybrid Partnership

IBC International Business Company

IP Intangible Property

IDR Information Document Request

LLC Limited Liability Company

MNE Multinational Entity

PRI Permanently Reinvested Income (Foreign)

QBU Qualified Business Unit

RH Reverse Hybrid: Corporation for US tax and flow through for foreign

country of incorporation

62

Glossary of Terms (Cont’d)

Acronym/Terms Definition

QBU Qualified Business Unit

PTI Previously Taxed Income

PTR Partner

RH Reverse Hybrid: Corporation for US tax and flow through for foreign

country of incorporation

SEC Securities Exchange Commission

USC United States

USP United States Parent

USS United States Subsidiary

TCJA Tax Cuts and Job Act of 2017

63