STATE OF WISCONSIN

Budget in

Brief

2023 - 25

TONY EVERS, Governor

STATE OF WISCONSIN

BUDGET IN BRIEF

TONY EVERS, GOVERNOR

FEBRUARY 2023

DI

VISION OF

EXECUTIVE BUDGET AND FINANCE

DEPARTMENT OF ADMINISTRATION

i

TABLE OF CONTENTS

I. D

EVELOPMENT OF THE 2023-25 BUDGET ................................................................................. 2

A. OVER

VIEW ............................................................................................................................... 2

B. REVENUE AND EXPENDITURE OUTLOOK ........................................................................... 3

C. GETTING THINGS DONE BY CONNECTING THE DOTS ...................................................... 4

II. SU

MMARY OF GOVERNOR'S MAJOR BUDGET INITIATIVES .................................................... 6

A. I

NVESTING IN WHAT’S BEST FOR KIDS ............................................................................... 6

B. STRENGTHENING OUR ECONOMY & FUTURE WORKFORCE ......................................... 12

C. SUPPORTING HEALTHIER WISCONSINITES ...................................................................... 24

D. BUILDING STRONG, SAFE COMMUNITIES ......................................................................... 36

E. PROTECTING & CONSERVING OUR NATURAL RESOURCES ......................................... 47

F. ADDITIONAL KEY PRIORITIES ............................................................................................. 54

III. ST

ATE BUDGET OVERVIEW ....................................................................................................... 64

A. P

RESENTATION OF THE GOVERNOR'S 2023-25 BUDGET ............................................... 64

B. EXPENDITURES ..................................................................................................................... 64

C. POSITIONS ............................................................................................................................. 67

D. BUDGET BALANCE ................................................................................................................ 69

E. DEBT MANAGEMENT ............................................................................................................ 70

F. CASH MANAGEMENT ............................................................................................................ 71

I

V. BUDGET INITIATIVES BY SUBJECT AREA ................................................................................ 74

A. I

NVESTING IN WHAT’S BEST FOR KIDS ............................................................................. 74

B. STRENGTHENING OUR ECONOMY & FUTURE WORKFORCE ......................................... 82

C. SUPPORTING HEALTHIER WISCONSINITES ...................................................................... 98

D. BUILDING STRONG, SAFE COMMUNITIES ....................................................................... 112

E. PROTECTING & CONSERVING OUR NATURAL RESOURCES ....................................... 127

V. EC

ONOMIC ASSUMPTIONS AND REVENUE ESTIMATES ..................................................... 132

NA

TIONAL ECONOMY................................................................................................................ 132

REVENUE ESTIMATES .............................................................................................................. 134

VI. REFERENCE SECTION .............................................................................................................. 138

APPENDICES ........................................................................................................................................... 142

A

BOUT THE BUDGET DOCUMENTS ..................................................................................................... 150

ii

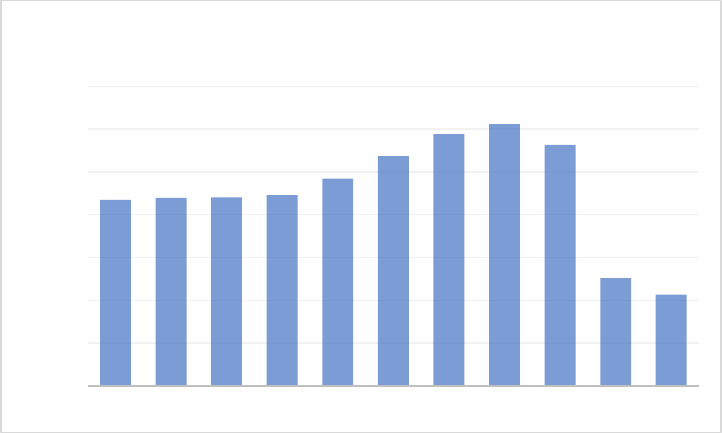

CHARTS

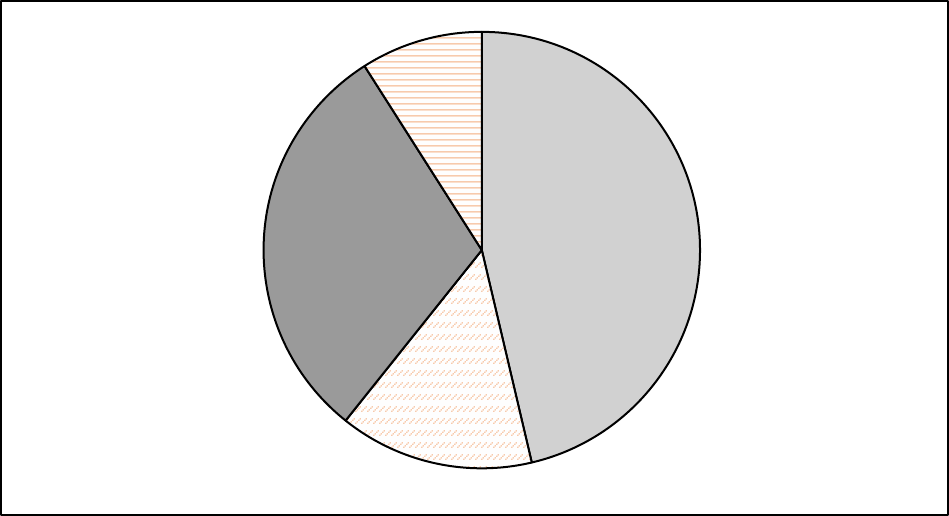

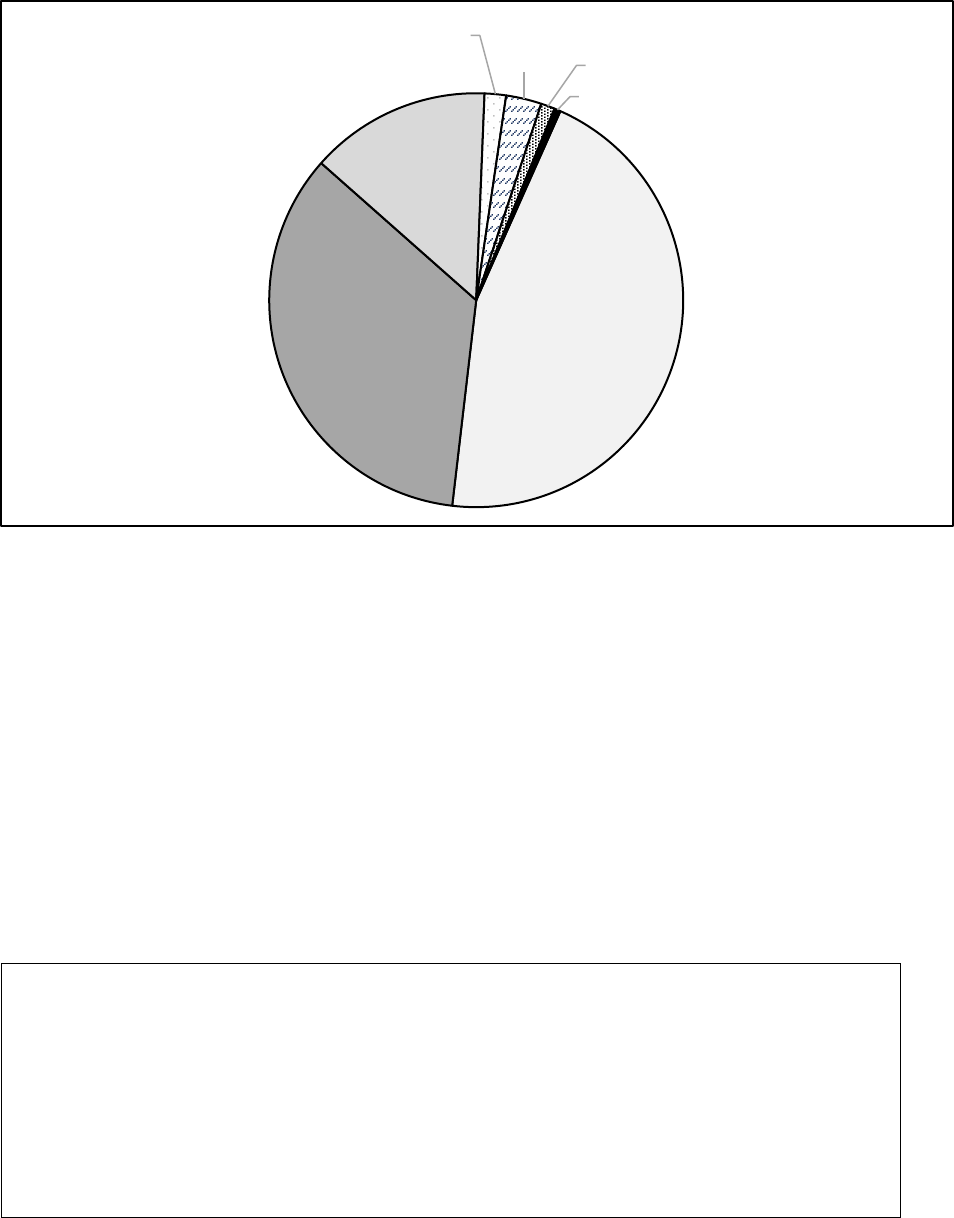

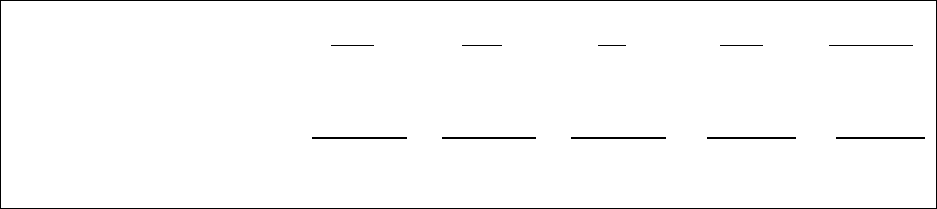

CHART 1: FISCAL YEAR 2024-25 BUDGET BY FUND SOURCE ...................................................... 64

CHART 2: FISCAL YEAR 2024-25 GPR TAX REVENUE BY TYPE .................................................... 65

CHART 3: FISCAL YEAR 2024-25 GPR BUDGET ALLOCATION BY PURPOSE .............................. 66

CHART 4: STATE SUPPORT FOR SCHOOL COSTS TO EDUCATE ENGLISH LEARNERS

DECLINED SIGNIFICANTLY ............................................................................................... 76

CHART 5: GOVERNOR’S BUDGET INCLUDES RECORD PER PUPIL REVENUE LIMIT

ADJUSTMENT INCREASES ............................................................................................... 78

CHART 6: GOVERNOR’S BUDGET WILL PROVIDE RECORD INCREASE IN STATE SPECIAL

EDUCATION REIMBURSEMENT ....................................................................................... 79

CHART 7: UNEMPLOYMENT RATE NEAR LOWEST IN DECADES .................................................. 83

CHART 8: RATIO OF UNEMPLOYED PERSONS PER JOB OPENING ............................................. 83

CHART 9: DEPARTMENT OF SAFETY AND PROFESSIONAL SERVICES AUTHORIZED FTE

POSITION HISTORY ........................................................................................................... 85

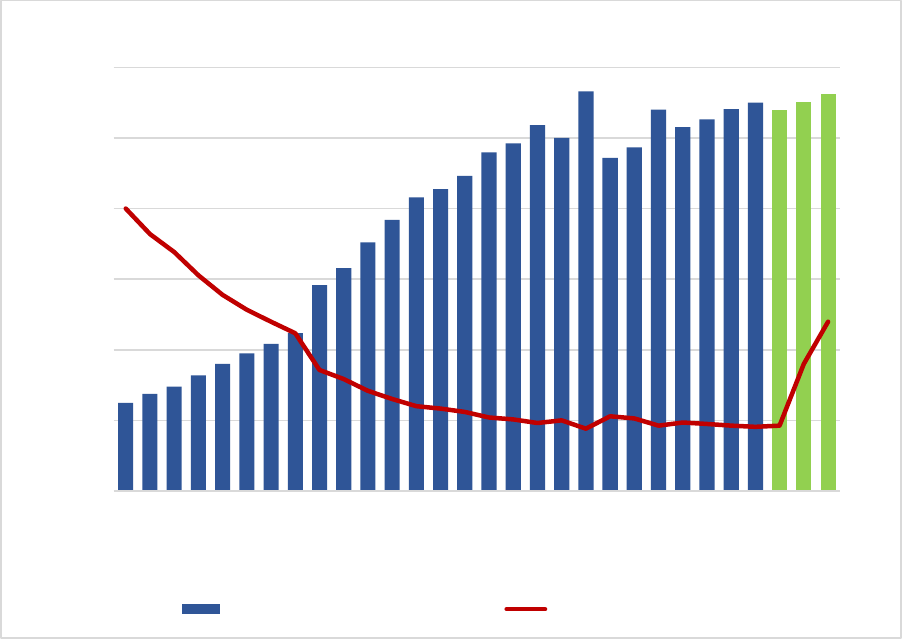

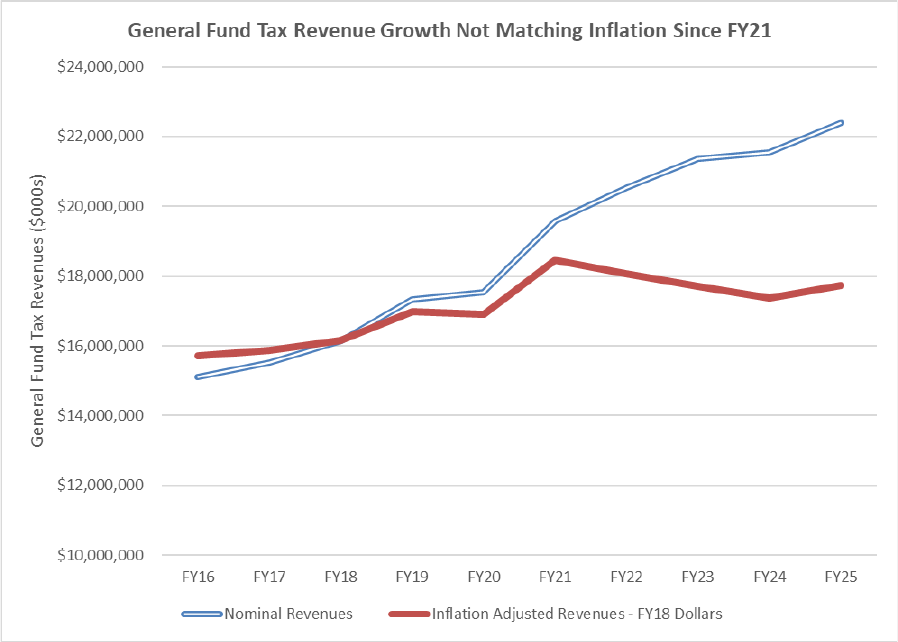

CHART 10: INFLATION ADJUSTED TAX REVENUES FLAT ................................................................ 89

CHART 11: MIDDLE CLASS TAX CUTS SINCE 2019 ........................................................................... 90

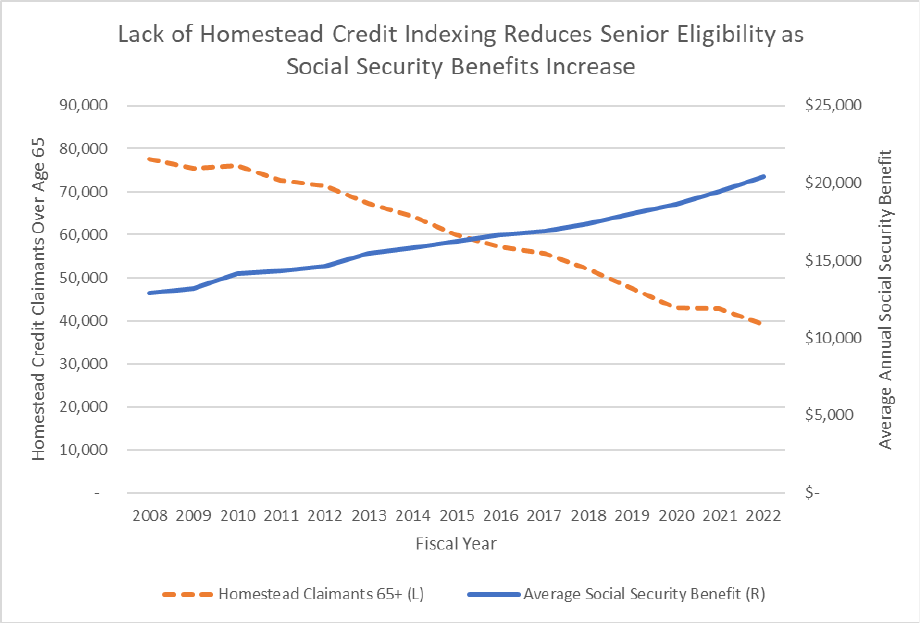

CHART 12: SENIORS HAVE BEEN PUSHED OUT OF THE HOMESTEAD TAX CREDIT BY

INFLATION ........................................................................................................................... 91

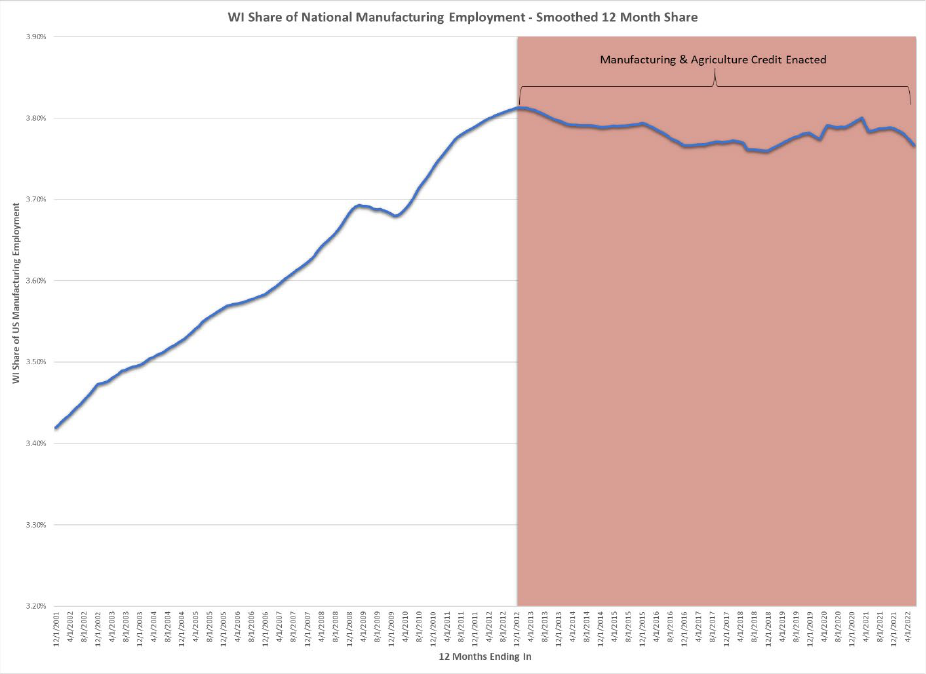

CHART 13: MANUFACTURING AND AGRICULTURE CREDIT INEFFECTIVE AT INCREASING

MANUFACTURING EMPLOYMENT ................................................................................... 93

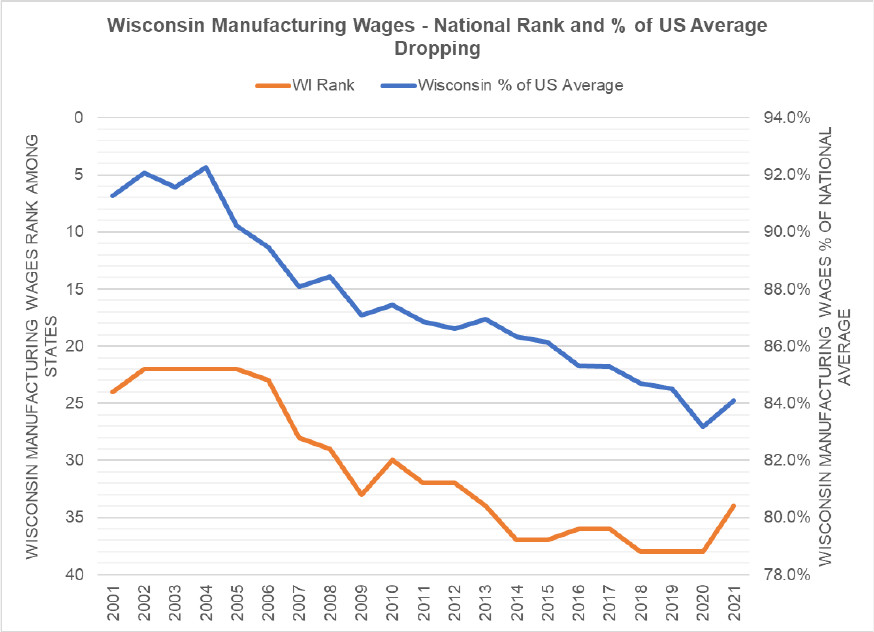

CHART 14: WISCONSIN MANUFACTURING WAGES RANKING ........................................................ 94

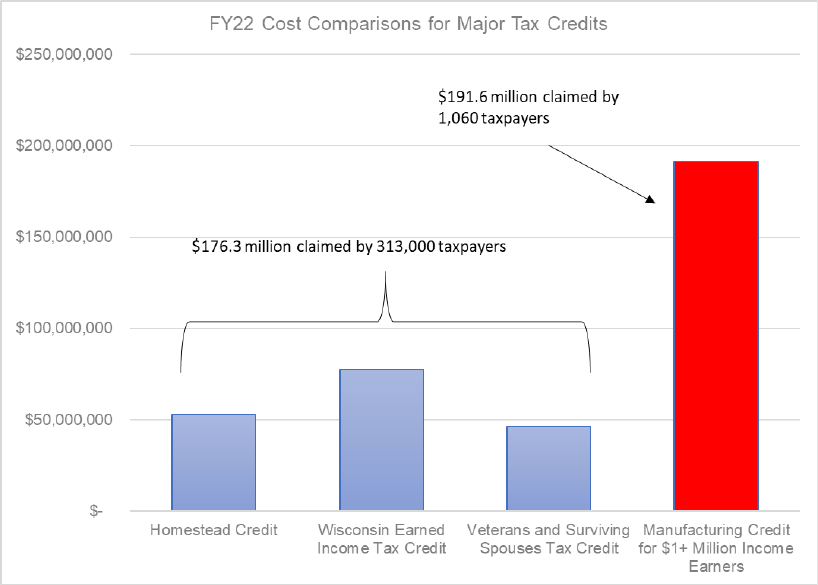

CHART 15: TAX CREDIT CONTEXT ...................................................................................................... 95

CHART 16: WISCONSIN VENTURE CAPITAL FUNDRAISING UP ...................................................... 97

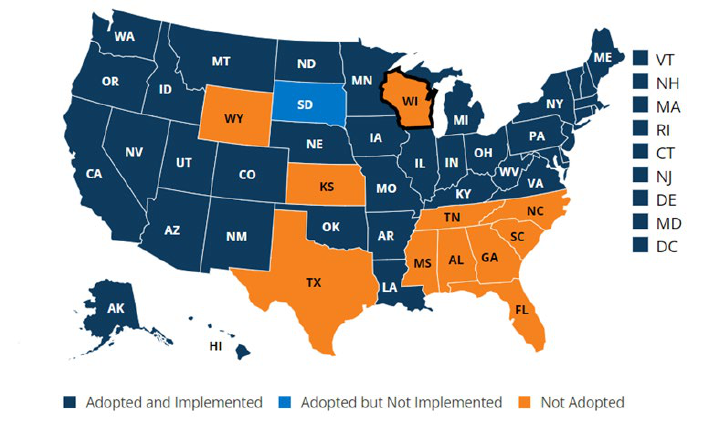

CHART 17: STATUS OF MEDICAID EXPANSION ACROSS THE U.S. ................................................ 99

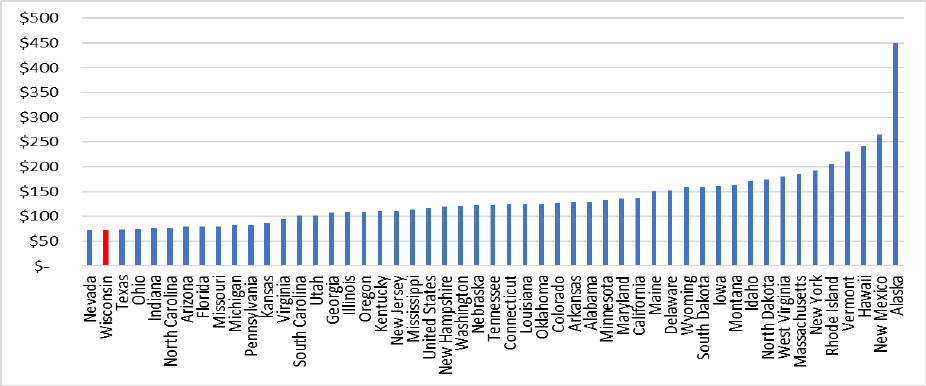

CHART 18: 2019-20 PER CAPITA PUBLIC HEALTH FUNDING BY STATE ...................................... 101

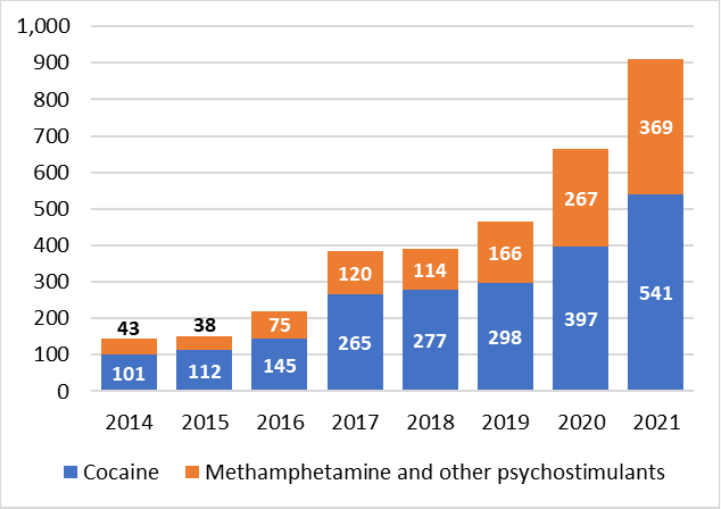

CHART 19: WISCONSIN DEATHS INVOLVING STIMULANTS .......................................................... 106

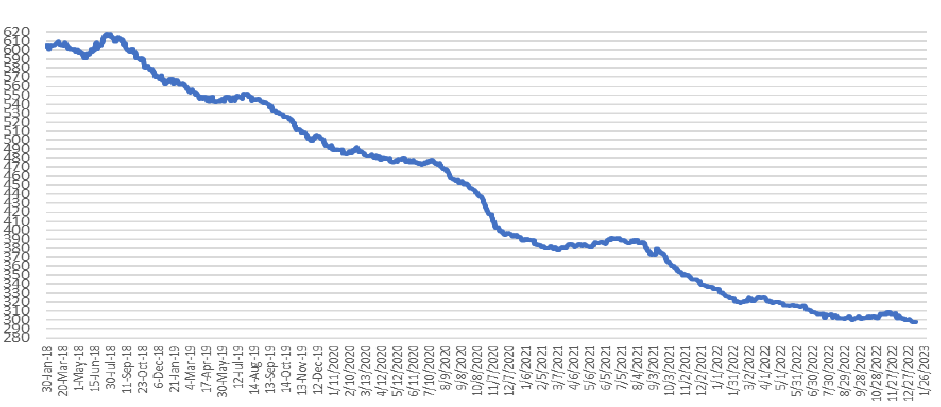

CHART 20: AVERAGE DAILY CENSUS AT THE KING SKILLED NURSING FACILITY .................... 111

CHART 21: DECLINING SHARED REVENUE HAS PUSHED UP COUNTY AND MUNICIPAL

RELIANCE ON PROPERTY TAXES ................................................................................. 113

CHART 22: TIGHT LOCAL GOVERNMENT FINANCIAL CONDITIONS HAVE RESULTED IN SHARP

DECLINES IN LOCAL GOVERNMENT EMPLOYMENT IN WISCONSIN ........................ 114

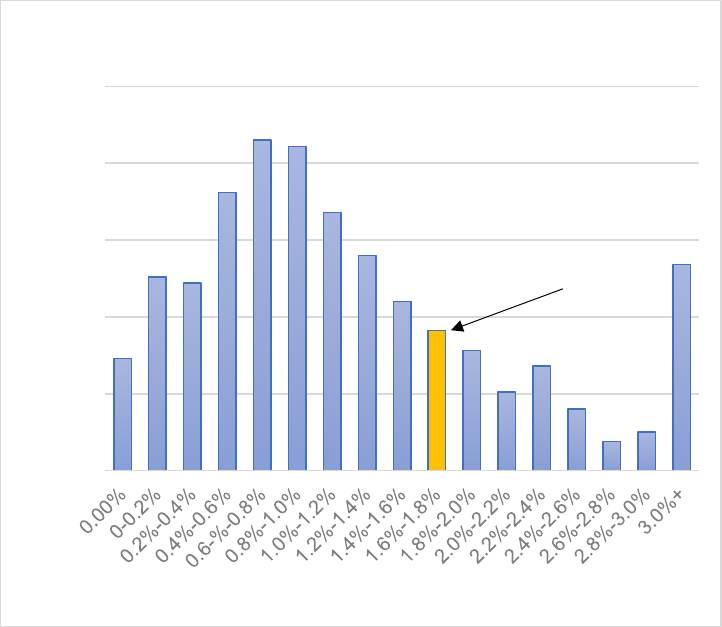

CHART 23: MOST MUNICIPALITIES SEE LITTLE GROWTH FROM NET NEW CONSTRUCTION . 115

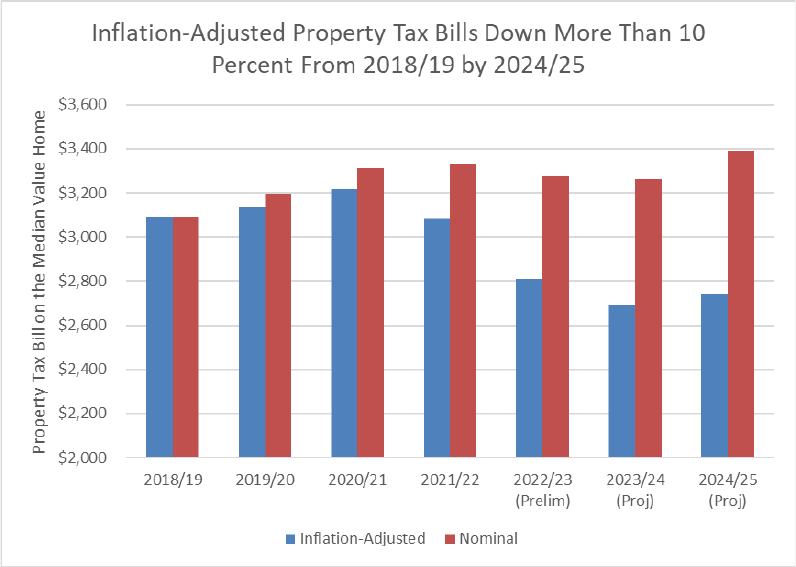

CHART 24: MEDIAN VALUE HOME PROPERTY TAX BILLS DOWN SIGNIFICANTLY VS INFLATION

SINCE 2018/19 .................................................................................................................. 117

CHART 25: HI

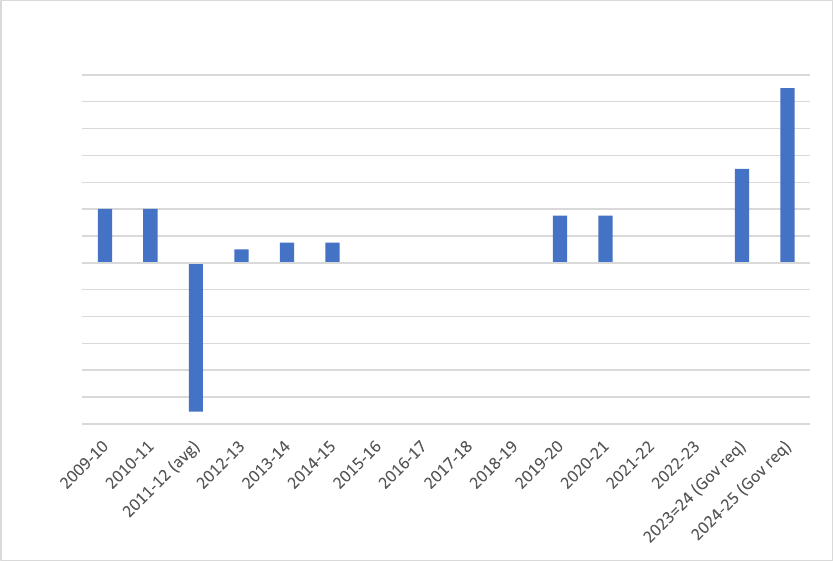

GHWAY BONDING BIENNIAL TOTALS ........................................................................ 120

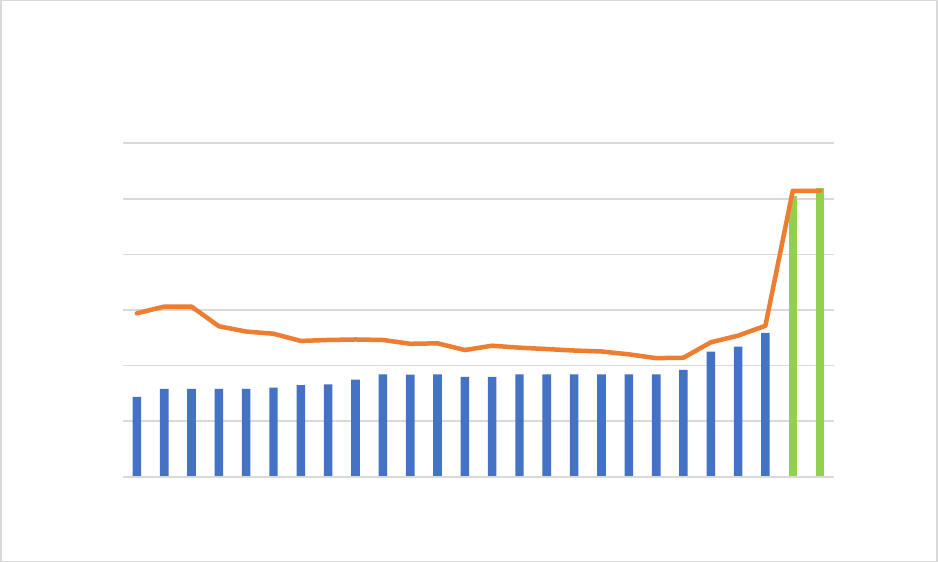

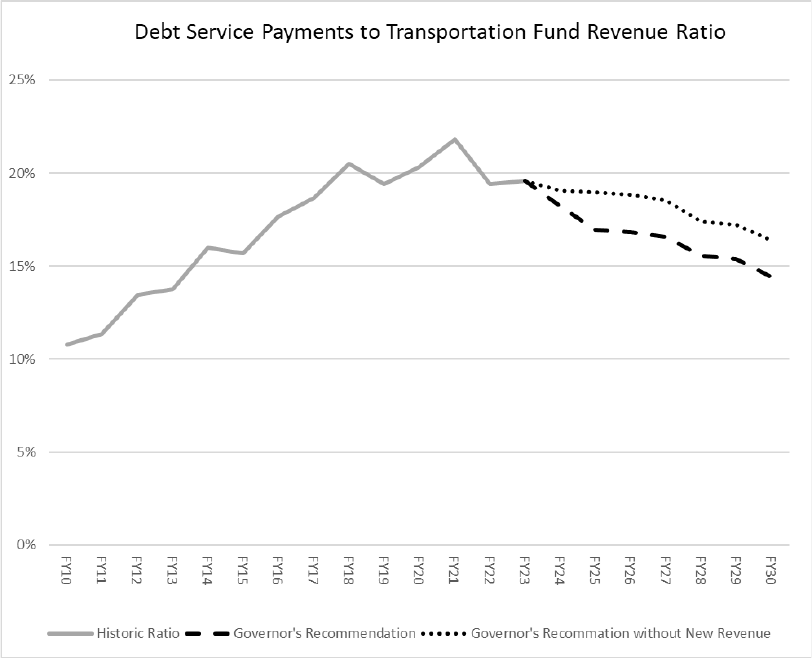

CHART 26: DEBT SERVICE PAYMENTS TO TRANSPORTATION FUND REVENUE RATIO. ......... 121

CHART 27: AVERAGE DAILY ADULT CORRECTIONAL INSTITUTION CENSUS ............................ 124

iii

TABLES

TABLE 1: LARGEST BIENNIAL GPR INCREASES OVER BASE ...................................................... 65

TABLE 2: TEN LARGEST GENERAL PURPOSE REVENUE PROGRAMS ....................................... 66

TABLE 3: FISCAL YEAR 2024-25 FTE POSITION CHANGES OVER BASE ..................................... 67

TABLE 4: GENERAL FUND CONDITION UNDER GOVERNOR'S BUDGET .................................... 69

TABLE 5: ESTIMATED GENERAL FUND CONDITION SUMMARY ACCORDING TO GENERALLY

ACCEPTED ACCOUNTING PRINCIPALS .......................................................................... 70

TABLE 6: TRANSPORTATION FUND REVENUE BENEFITS FROM GOVERNOR’S

RECOMMENDATIONS ...................................................................................................... 122

TABLE 7: SUMMARY OF THE NATIONAL ECONOMIC OUTLOOK ................................................ 133

TABLE 8: GENERAL PURPOSE TAX REVENUE ESTIMATES ....................................................... 134

TABLE 9: GENERAL PURPOSE REVENUE ESTIMATES UNDER GOVERNOR’S

RECOMMENDATION ........................................................................................................ 135

TABLE 10: GENERAL FUND TAX CHANGES .................................................................................... 136

Development of

the 2023-25 Budget

I. DEVELOPMENT OF THE 2023-25 BUDGET

A. OVERVIEW

Governor Tony Evers’ first two biennial budgets have built a strong base for Wisconsin going

forward by both investing in the people of this state and key priorities to maintain our

economy’s momentum while delivering tax relief for most Wisconsinites all at the same time.

A rou

ghly $7 billion opening balance in the general fund gives the state of Wisconsin a

historic opportunity to make strategic investments in Wisconsin’s future, address long-

neglected needs, and simply do the right thing when we, as a state, under different times and

circumstances, took actions to simply get by.

At t

he same time, doing the right thing also includes ensuring the state prudently plans for the

future—a future that prepares the state to both weather economic turbulence and leverage

periods of economic success to best position our state by investing only within our means. By

taking this generational opportunity to not only boldly invest in our priorities but also to shore

up our state’s finances for the long term, we can reduce the likelihood of spending cuts to

critical programs or the need for tax increases during future periods where state revenues

may not keep pace with recent years.

In th

is budget, Governor Evers makes key investments that our historically high general fund

balance fortunately—and in many cases, finally—allows the state to prepare for the future.

These investments will allow us to meet our obligations, reduce our debt, maintain our

economy’s momentum, bolster our workforce for the future, and provide a more fiscally stable

future for the benefit of our kids, our communities, and our state as a whole.

The fi

rst step in securing our state’s financial future is increasing our state’s “rainy-day” fund

for a time when, rather than facing a large surplus of funds as our state does today, the state

could experience an economic downturn and is forced to make difficult budget decisions. To

fulfill this first step, the Governor recommends transferring $500 million to the state’s budget

stabilization fund to raise our “rainy-day” fund balance total to over $2.4 billion by the end of

the biennium. This amount is over 10 percent of fiscal year 2023-24 estimated general fund

tax collections and ensures our state is strongly positioned to weather any future economic

downturns.

The sec

ond step is increasing the general fund’s reserve amount to provide a meaningful

cushion against drops in state tax collections. Today’s general fund reserve amount is equal

to less than one-half of 1 percent of estimated fiscal year 2023-24 general fund tax

collections. The Governor’s proposal lifts the reserve by $500 million to fix the amount at

$600 million beginning in fiscal year 2023-24—enough to uphold our spending commitments

if a 2 percent dip in tax collections occur versus current expectations.

The th

ird step is decreasing our debt. To do so, the Governor’s budget is prepaying, or

buying-down, nearly $380 million of our transportation fund’s debt. This debt accumulated in

past biennia as our spending needs increased while the political will to raise revenue for

transportation diminished. By taking this action, a greater share of the fees that our residents

pay going forward for annual auto registrations will be available to fix our roads today rather

than pay for the debt service for what was done in years past.

As he

has in building each of his biennial budgets, Governor Evers and members of his

administration held budget listening sessions across the state to hear directly from

Wisconsinites about their priorities, needs, and how the state can meet its obligation to

provide the critical services the people of this state expect and deserve. For the third

consecutive budget cycle, thousands of people shared their thoughts and ideas of what the

Governor and the Legislature should do in this budget to address both immediate and long-

term needs.

2

Many of the recommendations in the Governor’s budget came directly from the people he has

heard from over the past few months: increasing resources to support our K-12 public

schools and the mental health needs of our kids; continuing to expand healthcare access and

reduce costs; prudently investing in public safety at both the state and local levels; making

sure child care is both affordable and accessible; further expanding broadband to every

corner of the state; investing in workforce development for critical industries like health and

education; and building on the successes to date in addressing our state’s transportation

infrastructure.

In addi

tion, multiple individuals highlighted the importance of having the budget support

initiatives the Governor implemented with one-time federal pandemic relief funds to keep

investing in priorities such as our workforce, small businesses, and tourism promotion. While

a 2023 report noted that, as a share of federal aid the state received under the American

Rescue Plan Act, Wisconsin ranked first in the country in providing federal resources to

support businesses and economic development, state assistance is necessary to continue

these crucial investments to maintain our economy’s momentum and to prepare and bolster

our economy and our workforce for the future.

The Governor’s budget is about focusing on our shared values as Wisconsinites—to do the

right thing, to make prudent and responsible investments without being reckless, and to do

what we can to make our state an even better place to live, work, play, visit, retire, and raise

a family. It is about making wise and historic investments in our people. It is about continuing

to reduce the tax burden on the middle-class. It is about responsibly setting some of our

historic surplus aside to best ensure our state is prepared even in times of economic

uncertainty to continue to meet the needs of Wisconsinites in the future.

B. REVENUE AND EXPENDITURE OUTLOOK

The revenue estimates released by the Legislative Fiscal Bureau (LFB) on January 25, 2023,

suggest moderating economic growth. The bureau projects revenues will increase by

$804.9 million (3.9 percent) in the current fiscal year, by an additional $188.5 million

(0.9 percent) in fiscal year 2023-24, and by another $849.6 million (3.9 percent) in fiscal year

2024-25.

The LFB estimates individual income tax revenues will increase by 4.3 percent this year,

further increase by 1.7 percent in fiscal year 2023-24, and increase by another 5.4 percent in

fiscal year 2024-25. Sales tax revenues are expected to increase by 7.2 percent this year,

1.6 percent in fiscal year 2023-24 and 2.4 percent in fiscal year 2024-25. Corporate tax

revenues are projected to decrease by 1.7 percent this year, 2.1 percent in fiscal year

2023-24 and then rebound and increase by 4.2 percent in fiscal year 2024-25.

These pr

ojected increases in overall revenues during the upcoming biennium are

extraordinary as they incorporate the nearly $1.5 billion annually in general fund tax

reductions the Governor has signed into law in his two previous biennial budgets.

Furt

her, Wisconsin has made significant strides in its financial position over the past few

years amid a global pandemic and considerable economic volatility. The state is expected to

end this biennium with a $7.1 billion balance in its general fund. In addition, the state has now

had three consecutive years with a positive Generally Accepted Accounting Principles

(GAAP) balance after 30 consecutive years of running a deficit. The state’s GAAP surplus at

the end of fiscal year 2021-22 was $4.6 billion.

During Governor Evers’ time in office, the state has used surplus revenues to eliminate a

delayed school aid payment and make an unprecedented payment to retire previously issued

debt. In addition, prior to this budget, the state has increased its Budget Stabilization Fund

(“rainy day” fund) to its current record high of $1.73 billion, which is more than five times

larger than what it was in 2018.

3

In 2021, the state received multiple upgrades on its debt, including receiving a rating of AAA

for the first time since 1982. It has decreased its reliance on bonding by an average of over

$400 million annually over the past three years alone and reduced the state’s general

purpose revenue debt as a percentage of tax revenues in the current fiscal year by one-third.

State transportation revenue bonds have been reduced by over $200 million since 2018.

C. GETTING THINGS DONE BY CONNECTING THE DOTS

Each of the Governor’s biennial budgets has focused on delivering for all Wisconsinites, not

just some of them, while recognizing that every challenge our state faces is connected to

each of the others—something Governor Evers calls “connecting the dots.” This budget

continues the Governor’s efforts, building upon the advice and needs of the people of our

state, recognizing that there is so much more that unites us than there is that divides us, and

working to address our state’s challenges, collectively, head-on.

The Gov

ernor’s budget reflects these beliefs by investing in our kids, our families, our Main

Streets, our neighbors, and our workers. This budget also reinforces that the issues we face

are often interconnected, whether it’s making child care more affordable to help support our

workforce, addressing the climate crisis so that current and future generations of

Wisconsinites can enjoy our natural resources, building infrastructure for the future so

farmers can get product to market and businesses want to stay and develop here, investing

in affordable housing to ensure workers come to Wisconsin and kids have stability at home to

be their best selves in our classrooms, or addressing our state’s burgeoning mental and

behavioral health crisis that could affect our state, our workforce, and our economy for

generations.

For the third consecutive time, the Governor’s 2023-25 biennial budget continues to connect

the dots and keeps us on course in moving Wisconsin forward.

4

Summary of Governor’s

Major Budget Initiatives

II. SUMMARY OF GOVERNOR’S MAJOR BUDGET INITIATIVES

A. INVESTING IN WHAT’S BEST FOR KIDS

• Ensur

e our kids and educators have the resources they need to succeed by providing an

overall state investment of over $2.64 billion all funds in general and categorical aids for

public schools.

• Of t

his total state investment, provide just over $1 billion GPR over the biennium through the

state’s general equalization aid formula. This is the largest proposed direct investment in

state general school aids since the 1995-97 biennium.

• Prov

ide school districts with the ability to bolster school programming and staffing resources

through a sizable increase in revenue-raising authority. The Governor’s budget provides per

pupil revenue limit increases of $350 in fiscal year 2023-24 and an additional $650 in fiscal

year 2024-25, which are the largest per pupil adjustments since revenue limits were imposed

in fiscal year 1993-94. By coupling this combined increase of $1,000 per pupil over the

biennium with over $1 billion in additional general school aid, the Governor will keep the

estimated gross school levy increase below 1 percent on a statewide basis in both years of

the next biennium.

• Incr

ease the low revenue ceiling by $450 per pupil in fiscal year 2023-24 and an additional

$750 per pupil in fiscal year 2024-25 to increase revenue limit equity among school districts

by providing lower-spending school districts with additional revenue limit authority.

• Prov

ide an increase in per pupil aid of $24 per pupil in fiscal year 2023-24 and an additional

$45 per pupil in fiscal year 2024-25, for a total increase of $46.5 million GPR over the

biennium, which will further assist school districts in addressing many years of highly

restrictive revenue controls.

• Prov

ide $491.4 million GPR in fiscal year 2023-24 and $521.7 million GPR in fiscal year

2024-25 to increase state reimbursement of local special education costs to an historic,

guaranteed 60 percent in both years of the biennium. Prior to the Governor taking office,

special education aid funding was held flat for a decade, while costs increased dramatically

over that same time period.

• Prov

ide $1.6 million GPR in fiscal year 2023-24 and $5.9 million GPR in fiscal year 2024-25

to increase high-cost special education reimbursements. High-cost special education aid

pays a portion of school districts’ eligible special education costs for pupils with specific and

elevated educational needs (defined under current law as 90 percent of costs over $30,000

once other funding sources are considered). These costs currently are reimbursed at only

39.5 percent. The Governor’s budget will increase the reimbursement rate for these costs to

60 percent at the end of the biennium.

• Address the rising number of students experiencing mental health difficulties, and the severity

of their challenges, by providing over $270 million GPR over the biennium to help schools

help kids by making the Governor’s “Get Kids Ahead” initiative a permanent program. This

includes:

o $117.9 m

illion GPR per year for a reformed, comprehensive school-based mental

health services program that ensures predictability of funding through base per pupil

payments rather than the competitive grant process under current law for this

program.

6

o $18 mil

lion GPR per year to reimburse schools for costs around an expanded list of

school mental health professionals, including social workers, school counselors,

psychologists, and nurses.

o $580,000 GPR in each year for training of school staff in mental health, bullying

prevention, restorative practices, and other evidence-based strategies.

o Perm

itting schools to receive reimbursement of costs associated with mental health

services provided to students through telehealth in the expanded aid programs.

• Creat

e the Healthy Meals, Healthy Kids program by providing $120.2 million GPR in fiscal

year 2024-25 to fully fund school breakfast and lunches for all children, to ensure kids are

prepared for the school day and experience less anxiety about where they might get their

next meal.

• Prov

ide $4.3 million GPR in fiscal year 2023-24 and $4.7 million GPR in fiscal year 2024-25

for school breakfast reimbursement at 15 cents per meal under current law. Eligibility for the

reimbursement is also extended to independent charter schools and state residential schools

operated by the Department of Public Instruction.

• Incent

ivize schools to support Wisconsin’s farmers, food producers, and local economies by

providing $2.75 million GPR in fiscal year 2024-25 for an enhanced 10 cents per meal

reimbursement for meals that include locally sourced foods.

• Make a si

gnificant investment in improving reading and literacy rates for kids statewide by

providing $10 million GPR in each fiscal year for early literacy and reading improvement.

These funds will support comprehensive training for 28 new coaches in literacy and 28 new

professionals in early reading instruction practices.

• Support several organizations that serve kids’ literacy needs by providing: (a) $1.4 million

GPR over the biennium to The Literacy Lab; (b) $1 million GPR in fiscal year 2023-24 and

$2 million GPR in fiscal year 2024-25 to the Wisconsin Reading Corps; and

(c) $250,000 GPR in each fiscal year to Reach Out and Read.

• Improve schools’ capacity to support English learners by providing: (a) $8.2 million GPR in

fiscal year 2023-24 and $14.2 million GPR in fiscal year 2024-25 to increase reimbursement

of costs for schools with higher concentrations of English learners from 7.9 percent currently

to 20 percent by the end of the biennium; (b) $25,992,000 GPR in each fiscal year for a new

Aid for English Language Acquisition program to serve the more than 22,000 English learners

currently enrolled in schools that are not eligible for aid under the current state bilingual-

bicultural aid program; and (c) $310,500 GPR over the biennium to formalize the process for

Wisconsin English learners to earn a Seal of Biliteracy and to provide support to school

districts that assist students in achieving this seal.

• In order

to enhance the ability of school districts to recruit and retain teachers, provide:

(a) $5 million GPR in fiscal year 2024-25 for grants to support “grow your own” initiatives to

bolster Wisconsin’s educator pipeline, which may include providing current employees with

money to gain additional higher education credits, licenses or certifications; engaging with

community organizations; and supporting student organizations with “future teacher”

missions; (b) $9.4 million GPR in fiscal year 2024-25 to provide stipends to student teachers

and interns; (c) $2 million GPR in fiscal year 2024-25 to provide stipends to teachers who

agree to train and oversee student teachers or interns; and (d) $50,000 GPR in fiscal year

2024-25 for stipends to school library interns.

• Bolst

er our students’ computer science knowledge, including at lower grade levels, by

providing: (a) funding and 1.0 FTE GPR position at the Department of Public Instruction for a

statewide computer science education coordinator; (b) $20,000 GPR in fiscal year 2024-25

for a computer science education task force to be chaired by the new coordinator; and

(c) $5 million GPR annually for grants to school districts to access computer science

curriculum, especially around programming concepts, as well as professional development.

7

The Governor’s budget also includes a requirement that each high school in the state offer at

least one computer science class.

• Prov

ide $2 million GPR per year to Graduation Alliance, which works to reengage students at

risk of not finishing high school.

• Expan

d afterschool offerings by providing $20 million GPR in fiscal year 2024-25 for out-of-

school time grants. Enhanced afterschool offerings from schools and community

organizations will help kids avoid risky and dangerous behavior in the community, keep kids

engaged in their coursework, and receive assistance with their lessons or homework.

• Prov

ide $6.5 million GPR in fiscal year 2024-25 to subsidize the cost of providing driver’s

education to economically disadvantaged students. This program will ensure students learn

necessary skills to safely and responsibly drive on our roads, while increasing students

access to future job opportunities.

• Prov

ide $10 million GPR in fiscal year 2024-25 to the Milwaukee Mathematics Partnership, a

collaboration among the Milwaukee Public Schools district, University of Wisconsin-

Milwaukee, and Milwaukee Area Technical College focused on consistent implementation of

mathematics curriculum and providing related professional development for current and

aspiring Milwaukee teachers.

• Prov

ide $742,500 GPR in each year for Wisconsin Literacy to conduct adult literacy activities,

including expert trainings, personalized consultations, and workforce connections.

• Provide $2.5 million GPR in each year for a new “Do the Math” personal financial literacy

initiative to help schools start or improve programs around financial literacy curriculum with

an emphasis on innovative instruction.

.

• Provide $630,200 GPR in each year to fully fund sparsity aid payments to continue to

address the specific needs of rural school districts.

• Prov

ide $7.5 million GPR in each year, a total biennial increase of $15 million GPR, to

significantly increase state support for school districts with high per pupil transportation costs.

• Provide $500,000 GPR in fiscal year 2024-25 to pay General Education Development (GED)

testing costs to increase high school equivalency attainment and open doors to employment

or postsecondary opportunities. Over half of GED test inquiries received by the Department

of Public Instruction are from economically disadvantaged individuals; this subsidy will

increase equity in high school diploma achievement.

• Provide $704,000 GPR over the biennium to continue support for contract costs related to

academic and career planning for pupils in grades 6-12.

• Requi

re every school in the state to have opioid antagonists on hand in the event of a

suspected opioid drug overdose.

• Bols

ter Wisconsin’s workforce and pipeline with experienced professionals by authorizing

state agencies and local units of government, including our schools, to rehire a retired

annuitant to address workforce recruitment and retention issues, if: (a) at least 30 days have

passed since the employee left employment; (b) at the time of retirement, the employee does

not have an agreement to return to employment; and (c) upon returning to work, the

employee elects to not become a participating employee and continue receiving their annuity.

In particular, this will make it easier to hire experienced educators and school staff and will

help keep class sizes small and improve student outcomes.

• Create a grant program administered by the Department of Public Instruction to reimburse

expenses incurred by school districts that choose to change race-based mascots and logos,

funded at $200,000 in Tribal gaming revenue per year.

8

• Prov

ide $24,100 in fiscal year 2023-24 and $49,400 in fiscal year 2024-25 in Tribal gami

ng

r

evenues to increase Wisconsin Grants for Tribal college students by 5 percent in the first

year and an additional 5 percent in the second year.

• P

rovide $243,600 GPR in each year of the biennium to the Department of Natural Resources

to provide fee waivers for annual admissions receipts to state parks for the families of fourt

h

gr

aders.

• I

ncrease access to quality, affordable child care for Wisconsin children by continuing th

e

s

uccessful Child Care Counts program, providing $81 million GPR in fiscal year 2023-24 an

d

$221

million GPR in fiscal year 2024-25, and $19 million TANF in each fiscal year t

o

per

manently establish Child Care Counts as the state’s ongoing child care quality

improvement program.

• Provide $53,459,800 TANF in fiscal year 2023-24 and $71,279,700 TANF in fiscal year

2024-25 to migrate to a full-time/part-time model for calculating Wisconsin Shares subsidies

to align with federal child care funding requirements. This includes waiving copayments for

the state’s highest need families under 100 percent of the federal poverty level.

• P

rovide $11,198,000 GPR annually to continue funding the Partner Up! Program to support

partnerships between businesses who purchase child care slots for their employees and child

care providers.

• P

rovide $5 million TANF in each fiscal year for a New Provider grant program, which provides

grants to newly certified or licensed child care providers to help encourage an increase in th

e

s

upply of quality child care providers in the state. Specifically reserve $500,000 of progr

am

f

unding to support newly certified and licensed providers in Tribal areas.

• P

rovide $875,000 TANF for Tribal child care contracts to support recruitment, retention, a

nd

ex

pansion of child care providers in Tribal areas.

• Provide $1,680,000 all funds to support the creation of a quality early childhood educatio

n

c

enter in the city of Milwaukee.

• Continue current funding to support quality and affordable child care in economically

disadvantaged areas within the city of Milwaukee.

• Provide $1,421,300 over the biennium to migrate the child care provider licensing application

process to an online process.

• Increase funding to the Boys and Girls Clubs by $500,000 TANF in each year for t

he

W

isconsin After 3 program to improve literacy skills and math proficiency for low-inc

ome

s

tudents. Additionally, provide $1,300,000 GPR annually to support youth mental health

and

substance use prevention.

• Provide $1,327,200 TANF in fiscal year 2023-24 and $1,963,900 in fiscal year 2024-25 for

social-emotional training and technical assistance in child care settings with the goal of

reducing instances of children being removed from daycare for behavioral issues.

• Provide $600,000 TANF in each fiscal year to disregard $10,000 of income for direct car

e

w

orkers when applying for Wisconsin Shares benefits.

• Help offset the high cost of child care and dependent care by increasing the Wisconsin match

percentage of the federal child and dependent care tax credit from 50 percent to 100 percent,

providing nearly $30 million in tax relief in fiscal year 2023-24 and $27.8 million in tax relief i

n

f

iscal year 2024-25 to approximately 107,000 Wisconsin taxpayers.

9

• Incr

ease the Wisconsin percentage of the federal Earned Income Tax Credit from 4 percent

to 16 percent for filers with one qualifying child and from 11 percent to 25 percent for filers

with two qualifying children, providing $60.7 million in tax relief in fiscal year 2023-24 and

$63.8 million in tax relief in 2024-25.

• Provide $392,000 GPR, and $206,200 PR-F in fiscal year 2023-24 and $784,100 GPR and

$412,300 PR-F in fiscal year 2024-25 to increase foster care age-based rates by 5 percent

and allow foster care level one providers to receive the age-based rates. Further, provide

$8,264,700 TANF in fiscal year 2023-24 and $16,482,300 TANF in fiscal year 2024-25 to

allow kinship care providers to receive the age-based rates.

• Provide $6,100 GPR, $3,300 PR-F, and $171,600 TANF in fiscal year 2023-24 and

$6,700 GPR, $3,600 PR-F, and $342,100 TANF in fiscal year 2024-25 to allow foster care

level one and kinship care providers to qualify for the sibling exceptional rate and one-time

clothing payments.

• Increase kinship care funding by $7,826,700 TANF in fiscal year 2023-24 and

$9,661,300 TANF in fiscal year 2024-25 to expand eligibility for kinship caregiving to others

such as like-kin caregivers.

• Provide $8,259,400 GPR in fiscal year 2023-24 and $8,237,100 GPR in fiscal year 2024-25

for additional kinship care program support, including flexible support payments to caregivers

and family search services for child welfare agencies.

• Modify statutes to allow additional payments to kinship care providers if funds are made

available during an emergency.

• Provide $395,800 all funds in fiscal year 2023-24 and $436,000 all funds in fiscal year

2024-25 to reimburse Tribal Nations for subsidized guardianship placements as the state

currently does with counties.

• Enable the Department of Children and Families to conduct congregate care provider training

by providing $200,000 GPR annually, continuing the one-time funding in the 2021-23 biennial

budget.

• Add state support for Tribal family services and to offset the high cost of Tribal out-of-home

care placements by providing $3,825,000 GPR in fiscal year 2023-24 and $4,100,000 GPR in

fiscal year 2024-25.

• Provide $1,505,100 GPR, $268,800 TANF, and $913,800 PR-F in each fiscal year for one-

time improvements to the eWiSACWIS child welfare data system. The Governor further

recommends that a portion of that funding be ongoing into the next biennium, equivalent to a

10 percent increase to base funding, to fund additional projects and support of the system.

• Provide $4,381,000 GPR in fiscal year 2023-24 and $11,082,000 GPR in fiscal year 2024-25

to improve the continuum of care in the Milwaukee child welfare system with stabilization

centers, aftercare services, mental and behavioral health services, and a Qualified

Residential Treatment Program.

• Increase Milwaukee child welfare operations funding by $484,600 GPR and $26,300 PR-F in

fiscal year 2023-24 and $767,900 GPR and $35,000 PR-F in fiscal year 2024-25, including

5.0 FTE all funds positions for case aides, performance monitors, and staff to support on-site

child care for children removed from their homes.

10

• Modif

y Milwaukee child welfare prevention services by replacing current TANF funding with

an equivalent amount of GPR to allow for more flexible use of the funding. In addition,

expand funding to support respite child care services for a total of $4,398,000 GPR

and -$4,031,900 TANF in fiscal year 2023-24 and $4,764,100 GPR and -$4,031,900 TANF in

fiscal year 2024-25.

• Provide $75,000 GPR grants in each fiscal year to provide siblings who have been separated

in adoption with opportunities to be reunited, such as at summer camps.

• Increase funding in the Bureau of Youth Services by $2,020,000 GPR in each year to

increase services in runaway and homeless youth programming.

• Expand independent living services to youth, including Tribal youth with an additional

investment of $3,852,500 GPR in each fiscal year.

• Support family resource centers across the state by providing $4,150,000 GPR in each fiscal

year.

• Expand home visiting services to approximately 24 additional counties and Tribes with

$1,200,000 GPR in fiscal year 2023-24 and $3,896,000 GPR and $104,000 PR-F in fiscal

year 2024-25.

• Provide $1,820,000 GPR in fiscal year 2023-24 and $3,640,000 GPR in fiscal year 2024-25

for behavioral and mental health services for youth as part of a larger initiative to provide a

continuum of care for families in Milwaukee involved with the child welfare system.

• Incr

ease domestic abuse base funding by approximately 50 percent in each fiscal year with

$6,217,300 GPR and continue the domestic abuse Living Independently Through Financial

Empowerment (LIFE) program with $14,000,000 GPR in each fiscal year.

• Increase funding by $14,705,900 all funds in each fiscal year to child support agencies to

improve collection of delinquent child support in the state.

• Create a child support debt reduction program and provide $3,472,000 TANF in fiscal year

2023-24 and $6,944,000 TANF in fiscal year 2024-25 to assist low-income noncustodial

parents participating in a work program with paying child support arrears.

• Provide $7,163,700 all funds in fiscal year 2023-24 and $20,517,200 all funds in fiscal year

2024-25 to support the continuation of the Child Support Modernization IT project to

implement an improved system for Wisconsin to continue meeting federal performance

standards and more quickly and easily accommodate changes in the child support

landscape.

• Support critical cybersecurity activities with $1,185,800 GPR in each fiscal year to ensure the

continued integrity and protection of child welfare and child care data.

• Increase funding for the Department of Children and Families’ Office of Legal Counsel, by

$246,100 all funds in fiscal year 2023-24 and $328,100 all funds in fiscal year 2024-25 to

support 2.0 FTE positions to meet increasing demands.

• Provide $250,000 TANF in each fiscal year, coupled with a match requirement, to expand the

Families and Schools Together (FAST) program.

• Provide $187,200 TANF in each fiscal year to fund a contractor position to conduct a pilot

program, known as the Housing, Opportunity, Planning and Empowerment (HOPE) program,

to provide financial literacy and empowerment services to families receiving W-2 benefits.

11

B. STRENGTHENING OUR ECONOMY & FUTURE WORKFORCE

• Support Wisconsin families by modifying and expanding the Wisconsin Family Medical Leave

Act (FMLA) as follows: (a) permit leave to be taken to care for a grandparent, grandchild, or

sibling with a serious health condition; (b) expand the definition of “qualifying exigency” to

include deployment of a spouse or child, and an unforeseen or unexpected closure of a

school or child care facility; (c) expand the definition of “serious health condition” to include

medical quarantine to allow workers to take FMLA leave when under a medical quarantine or

caring for someone under quarantine, regardless of whether the person is exhibiting

symptoms; (d) reduce the number of hours an employee is required to work before qualifying

to 680, instead of 1,000; and (e) extend the statute of limitations for filing a FMLA complaint

to 300 days, instead of 30 days.

• Furt

her support Wisconsin families by implementing paid family and medical leave for both

public and private sector workers. Workers who qualify for FMLA would be entitled to

12 weeks of benefits for any of the reasons described in the preceding bullet point. On a

long-term basis, private sector benefits will be supported by employer and employee payroll

contributions; however, to effectuate this groundbreaking benefit as quickly as possible, the

state will transfer $158.9 million from the general fund to a new, related trust fund to support

initial benefit payments as the new fund builds a balance. Additionally, the state will support

the 2023-25 administrative costs of the program by transferring an additional $84.5 million

from the general fund into the new fund and provide 198.0 FTE SEG positions over the

biennium.

• Expan

d the Transitional Jobs and Transform Milwaukee Jobs programs by providing an

additional $1.7 million TANF in each fiscal year, removing the requirement that individuals are

unemployed for at least four weeks before being eligible, and allowing individuals who are

eligible for unemployment insurance (UI), but not receiving UI benefits, to participate in the

program.

• Provide $500,000 TANF in each fiscal year to expand the Jobs for America’s Graduates-

Wisconsin program to provide educational support and job or postsecondary readiness for

TANF-eligible youth.

• Prov

ide $10 million GPR annually beginning in fiscal year 2023-24 to increase the Wisconsin

Economic Development Corporation’s block grant on an ongoing basis to $51,550,700,

supporting economic development opportunities across Wisconsin.

• Prov

ide $40 million GPR on a one-time basis to the Wisconsin Economic Development

Corporation as temporary additional assistance to support continued economic recovery

efforts throughout Wisconsin.

• Prov

ide $5 million GPR annually to support the Wisconsin Economic Development

Corporation in its talent attraction and retention efforts, including coordination with industry

partners, to help address the state’s long-term workforce needs.

• Provide a major $200 million GPR investment to continue the Workforce Innovation Grant

Program at the Department of Workforce Development, with $100 million allocated

specifically for enhancing the state’s health care workforce. The program will support the

development of long-term, locally based solutions for businesses to locate and train workers,

resulting in individuals gaining new skills and higher wages and helping employers address

labor shortages. The grant program was previously funded with federal funding received by

the state under the American Rescue Plan Act of 2021.

12

• In ad

dition, provide $4.5 million GPR in one-time dollars to fund the Reengaging Out-of-Work

Barriered and Underserved Individuals through System Transformation (ROBUST) Pilot

Program to help find methods to more effectively reach and serve population groups that are

underserved and disconnected from the labor force.

• Provide $12 million GPR for the continuation of the Worker Advancement Initiative, which

provided assistance to individuals whose employment was eradicated due to the pandemic.

This initiative was previously funded with $20 million of federal funding received by the state

under the American Rescue Plan Act of 2021.

• Addi

tionally, provide $5 million GPR in additional funding for the Worker Advancement

Initiative to support efforts by technical colleges and nursing schools to reduce barriers to

graduation and assist students in becoming career ready.

• Prov

ide state funding to workforce development boards to support services for youth, which

generally are not supported by federal workforce grants. Over the biennium, $8.8 million GPR

will enhance greater in-school and out-of-school services including employment counseling

and work experiences for kids.

• Help

prepare individuals who are currently incarcerated for post-prison employment by

providing almost $900,000 GPR and 6.0 FTE GPR positions over the biennium for staffing at

correctional institutional job centers.

• Prov

ide 3.0 FTE GPR positions and $709,800 GPR to increase Job Centers of Wisconsin

staffing and expand the number of individuals who receive services and ultimately obtain

family-supporting employment.

• As recommended by the Blue Ribbon Commission on Veteran Opportunity, provide

$450,000 GPR annually to assist employers that hire veterans who are transitioning to civilian

life. The funding will help employers provide training and wraparound services to veterans.

• Incr

ease the state’s healthcare workforce by providing to the Department of Workforce

Development: (a) $500,000 GPR on a one-time basis to support healthcare profession

apprenticeship curriculum development; (b) $200,000 GPR on a one-time basis to implement

licensed practical nurse apprenticeships at state-run care facilities; and (c) $236,600 GPR

and 1.0 FTE GPR position over the biennium for outreach to potential stakeholders and

partners and to develop new collaborations related to healthcare workforce.

• Provide 2.0 FTE GPR positions at the Department of Workforce Development to serve as

dedicated staff for vocational rehabilitation self-employment customers.

• Prot

ect migrant laborers by providing 3.0 FTE GPR positions to perform housing inspections

at migrant labor camps, provide greater outreach to migrant workers and develop outreach

plans, conduct prevailing wage and practice surveys, and investigate complaints and

potential violations to state migrant worker protections.

• Ensur

e safety at public works job sites by providing 3.0 FTE GPR positions to conduct

outreach and inspections related to enforcement of state standards regarding substance use

disorders.

• Dramat

ically enhance pathways to information technology careers by providing

$9 million GPR in one-time funding to expand registered apprenticeship within the information

technology sector in southeast Wisconsin.

• Prov

ide an additional $200,600 GPR annually to supplement federal employment

demonstration projects to fund community action agencies and organizations.

• Encour

age individuals to follow conservation and environmental career paths by providing

$1 million GPR annually under the Wisconsin Fast Forward framework for training in green

jobs.

13

• E

stablish a clean energy and reemployment program with $5 million annually GPR to connect

workers with employers that will utilize apprenticeship and technical college programs t

o

del

iver training for clean energy jobs.

• P

rovide $2 million GPR in fiscal year 2023-24 to establish a Southeast Wisconsin Green Jobs

Corps Pilot Program to encourage young adults facing barriers to employment to enter

energy efficiency, conservation, and environmental job sectors.

• Provide the largest increase in general aid ever to the Wisconsin Technical College System

by investing $32.9 million GPR in each year of the biennium. This increase means general

aid will exceed inflation-adjusted pre-2011 appropriation levels and will provide the necessary

resources to allow the system to expand the state’s talent pipeline and grow Wisconsin’

s

s

killed workforce.

• Bolster Workforce Advancement Training grants awarded by the Wisconsin Technical

College System by providing an additional $3.5 million GPR over the biennium for skilled

w

orker training. These grants are in high demand and additional resources will help provid

e a

r

elief valve for the employer demand for skilled talent.

• Provide $3 million GPR over the biennium to provide grants to technical colleges to create

open educational resources and course materials, which will help to address the rising cost of

educational materials such as textbooks for students.

• P

rovide $2 million GPR annually to technical colleges in order to offset the costs associated

with providing transcripted credit to high school students in health sciences and to encoura

ge

the expansion of health sciences-related offerings.

• P

rovide $250,000 GPR annually for capital equipment and supplies, information technology

equipment, and equipment for student learning infrastructure and to support staffing at a new

Advanced Manufacturing, Engineering Technology, and Apprenticeship (AMETA) Center at

Mid-State Technical College.

• I

n addition, provide $250,000 GPR annually for the Wisconsin Institute for Sustainabl

e

T

echnology (WIST) at the University of Wisconsin-Stevens Point to broaden its technical

contributions and support to reinforce the well-being of the Wisconsin forest and paper

industries.

• P

rovide $700,000 GPR over the biennium to jumpstart the Farm and Industry Short

Course (FISC) 2.0 program based at the University of Wisconsin-River Falls, in partnershi

p

w

ith multiple other University of Wisconsin System schools and stakeholder groups.

• P

rovide $2.5 million GPR on a one-time basis for equipment and supplies to support t

he

c

reation of a regional emergency medical services training facility in Baraboo thro

ugh

Mad

ison College.

• Provide $2 million all funds annually of additional funding to Wisconsin’s navigator program to

regularly engage industry partners and help assisted living, nursing homes, home health

agenc

ies, and other providers inform new workers about HealthCare.gov and help workers

understand eligibility for tax credits and subsidies available in the healthcare marketplace.

• Strengthen workers’ voices in their workplaces by repealing the prohibition on contracts

between labor unions and employers that specify employers may only hire unionized workers

and repeal the prohibitions on the following as a condition of obtaining or continuin

g

emp

loyment: (a) refraining or resigning from membership or affiliation with a labor

organization; (b) becoming or remaining a member of a labor organization; (c) paying dues or

other amounts to a labor organization; or (d) paying a third party amounts in place of dues t

o

a l

abor organization.

14

• Inc

rease the state minimum wage for general workers to $8.25 on or after the effective date

of the budget bill and prior to January 1, 2025; to $9.25 on or prior January 1, 2026; to $10.25

on or after January 1, 2026; and finally, by the change in the consumer price index for each

year thereafter. In addition, create a task force to study options for achieving a statewide

minimum wage of $15 per hour.

• Require employers conducting projects of public works, both state and local, to pay workers

the hourly wage and benefits paid to most workers in the project’s area, commonly known as

prevailing wage.

• Expan

d the concept of employment discrimination to specify that employers cannot

discriminate based upon gender identity and expression.

• Str

engthen the enforcement of employment discrimination law prohibitions by allowing the

Department of Workforce Development, or an individual who is alleged or was found to have

been discriminated against, including on the basis of equal pay for equal work, or subjected

to unfair honesty or genetic testing, to bring an action in circuit court to recover compensatory

and punitive damages caused by an act of discrimination, unfair honesty testing, or unfair

genetic testing in addition to or in lieu of filing an administrative complaint.

• Proh

ibit employers from requiring compensation history of current and prospective

employees and prohibit discrimination against employees who choose not to disclose

information on compensation.

• Establish collective bargaining rights for state and local government frontline workers and

their bargaining units. Frontline workers are defined as employees with a substantial portion

of job duties interacting with members of the public or large populations. The Wisconsin

Employment Relations Commission would settle definitional disputes.

• Eliminate the annual recertification requirement for state and local government bargaining

units, as well as the provision that approval by a majority of bargaining unit members, instead

of majority of the vote, is required to certify.

• Require employers to meet at least quarterly, or upon change in policies affecting wages,

hours, and working conditions of general employees, with certified representatives of

collective bargaining units if applicable or with other representatives in order to receive

employee input.

• Provide two additional positions at the Wisconsin Employment Relations Commission to

assist employees, bargaining units and units of government with the expansion of collective

bargaining rights.

• Require local government employers to include a just cause standard of review of termination

in their grievance procedures. Additionally, require existing local government grievance

procedures to address employee discipline and workplace safety issues.

• Requi

re an additional impartial hearing officer from the Wisconsin Employment Relations

Commission to oversee employee grievance hearings.

• The Governor’s budget includes funding in the compensation reserve, and any statutory

language changes needed for the following items to make investments in the state

government’s workforce, address recruitment and retention challenges in key state positions,

and ensure the state can be a competitive employer. The state’s compensation plan will also

have to be approved by the Joint Committee on Employment Relations:

o Prov

ide $415.7 million GPR over the biennium for a general wage adjustment for

most state employees of 5 percent on July 1, 2023, and an additional 3 percent on

July 1, 2024.

15

o Provide $39.7 million GPR over the biennium for targeted market and parity wage

adjustments for employees within certain classifications in state agencies to better

align their wages to those paid by private and other public sector employers.

o Prov

ide $4.3 million GPR over the biennium to support development of a

semiautomatic pay progression for many classifications that will allow employees to

increase pay based on performance and experience.

o Prov

ide $2.1 million GPR over the biennium to support market and parity wage

adjustments for employees within information technology classifications to better

align their wages to those paid by private and other public sector employers.

o Provide $269,000 GPR over the biennium to support a pay progression for wardens

at the Department of Natural Resources and Capitol Police within the Department of

Administration.

o Prov

ide $18.9 million GPR over the biennium to support a pay progression for

probation and parole agents within the Department of Corrections.

o Enhanc

e the pay structure for correctional officers, sergeants, psychiatric care

technicians, and youth counselors at the Department of Corrections and the

Department of Health Services to address critical recruitment and retention needs. In

total, this budget provides $327.6 million GPR over the biennium to address

compensation issues within these critical areas, including:

$261.2 million GPR over the biennium to: (a) continue and roll into the

employee’s base hourly wage the $4/hour add-on for all security staff,

including supervisors, within these classifications and (b) support an

enhanced pay progression for these classifications. As a result, starting

hourly pay would increase from $20.29 to $33, increasing to $39 per hour for

correctional officers with 25 or more years of experience.

$30.5 mi

llion GPR over the biennium to continue the $5/hour add-on for

security staff working at correctional institutions with vacancy rates greater

than 40 percent.

$24.6 million GPR over the biennium to increase the existing add-on for

correctional staff at the Department of Corrections working in maximum

security institutions from $2/hour to $4/hour. This provision also provides

staff working at maximum security facilities within the Department of Health

Services with the $4/hour add-on.

$8.1 mi

llion GPR over the biennium to support a $1/hour add-on for

correctional staff working in medium security institutions.

Prov

ide $3.2 million GPR over the biennium to support add-ons for

supervisors of employees in maximum and medium security institutions.

o Prov

ide funding to support the continuation of pilot add-ons implemented by the

Division of Personnel Management within the Department of Administration to

address critical recruitment and retention needs within specific classifications at

several state agencies, including:

$3.7 mi

llion GPR over the biennium to the Department of Health Services to

support add-ons for respiratory therapists, income maintenance specialists,

disability program associates, disability determination supervisors, and

several nursing classifications.

$3.6 mi

llion GPR over the biennium to the Department of Corrections to

support add-ons for several nursing classifications.

16

$6.7 mi

llion in non-GPR funding to the Department of Veterans Affairs to

support add-ons for several nursing classifications.

$2.3 mi

llion in non-GPR funding collectively to the Department of

Administration, Department of Safety and Professional Services, and

Department of Military Affairs to support add-ons for Capitol Police, licensing

staff and office operations associates, and military security officers.

o Prov

ide $34.1 million GPR over the biennium to support a new paid family and

medical leave program for state and University of Wisconsin System employees for

12 weeks annually.

o Decr

ease the waiting period for all new state employees to receive the employer

share of their health insurance premiums from three months to one month.

o Fund pai

d sick leave for limited term employees that work for state agencies.

o Modif

y the vacation allowance during the first five years of state employment to

improve retention of employees for state agencies.

o Est

ablish Juneteenth and Veterans Day as holidays for all of state government.

• Provide $93.9 million GPR in fiscal year 2023-24 to adjust agency compensation budgets to

reflect an additional biweekly payroll.

• Provide funding and position authority to the Division of Personnel Management within the

Department of Administration to support human resources and payroll functions associated

with the development of the Wisconsin Paid Family and Medical Leave Program within the

Department of Workforce Development and the paid family and medical leave program that

will be developed for state and University of Wisconsin System employees.

• Creat

e a small business retirement savings program for privately employed individuals who

are not currently eligible for an employer-sponsored retirement plan to help fill the retirement

savings gap that is most acute for the employees of small businesses. Allocate $2 million

GPR in one-time funding for program start-up costs. The Small Business Retirement Savings

Board, attached to the Department of Financial Institutions, will have oversight of this new

program and will be empowered to contract with a vendor to administer the retirement

program. The program will target businesses with 50 or fewer employees and enhance the

long-term finances of Wisconsin workers.

• Conti

nue the Rural Wisconsin Entrepreneurship Initiative which aims to develop

entrepreneurial activity throughout rural areas of Wisconsin through education, training,

research, and technical assistance to small businesses and entrepreneurs, economic

development practitioners, and communities by providing the University of Wisconsin-

Madison Division of Extension with $254,100 GPR and 2.0 FTE GPR positions in fiscal year

2024-25.

• Bols

ter local communities with $25 million GPR annually beginning in fiscal year 2023-24 to

continue state support of the Main Street Bounceback Grant program. The Wisconsin

Economic Development Corporation will use these funds to continue the Governor’s

successful efforts aimed at restoring business occupancy in vacant commercial spaces.

Program funding for the Main Street Bounceback Grant program had previously been

provided through federal assistance received by the state under the American Rescue Plan

Act of 2021.

• Spur

economic growth through entrepreneurship by creating a venture capital program

located at Wisconsin Economic Development Corporation with $75 million in one-time GPR

funding in a continuing appropriation in fiscal year 2023-24. The program will be required to

17

be a fund of funds investment program aimed at enhancing the vibrancy of Wisconsin’s

venture capital ecosystem.

• F

urther encourage investments in entrepreneurship by removing the requirement that t

he

B

adger Fund of Funds program repay its initial investment from the state and inste

ad

continue to reinvest those funds as they are returned from current investments.

• Encourage investment in research and development by Wisconsin businesses through

increasing the refundable share of the research credit from 15 percent to 50 percent

beginning with tax year 2024. This will reduce taxes on businesses engaging in research an

d

dev

elopment by $16.1 million in fiscal year 2023-24 and $64.4 million annually beginning i

n

fiscal year 2024-25.

• P

romote the development of cooperative networks in Wisconsin by requiring the Wisconsi

n

E

conomic Development Corporation to allocate $500,000 over the biennium from its availabl

e

f

unds to support feasibility studies and other technical support and implementation efforts.

• E

ncourage growth in wages by raising the wage thresholds under the Enterprise Zone Jobs

Tax Credit and the Business Development Tax Credit to account for inflationary pressures

on

w

ages.

• P

romote Wisconsin as a premier business, cultural, and recreational destination by providi

ng

a r

ecord investment of $33.6 million GPR over the biennium to the Department of Tourism for

marketing activities.

• Expand the state’s growing outdoor recreation market by providing $1.1 million GPR and

3.0 FTE GPR positions over the biennium to make the Department of Tourism’s Office of

O

utdoor Recreation a permanent hub for outdoor partners, brands, and industry.

• R

ecruit large-scale events to Wisconsin by creating and funding an opportunity and attracti

on

f

und with $30 million GPR over the biennium. This substantial investment to help showcas

e

everything Wisconsin has to offer will reap significant benefits for local and regional

businesses and workers, Main Streets and the statewide economy.

• C

reate a new Meetings, Conventions, and Sports Bureau within the Department of Tourism,

supported by $2.7 million GPR and 2.0 FTE GPR positions over the biennium, to focus

on

pr

omoting the state as a destination for large company meetings, conventions, and sporti

ng

events.

• P

rovide $1,883,200 GPR in fiscal year 2023-24 and $1,000,000 GPR in fiscal year 2024-

25

f

or the Wisconsin Initiative for Agricultural Exports to help build Wisconsin’s agricultural br

and

i

n international markets and increase agricultural exports.

• Provide $100,000 GPR in each year for grants to help farms hire business consultants t

o

ex

amine their farm business plans.

• Provide an additional $800,000 GPR in each year to increase the available funding for the

Dairy Processor Grant program.

• Create the Value-Added Agriculture Grant program with $400,000 GPR in each year. The

program will help farmers expand agricultural practices that produce value-added products.

• C

reate the Farm to Fork Grant Program with $200,000 GPR in each year. The program will

connect nonschool entities that operate cafeterias with local farmers to purchase locally

grown food.

• Provide a one-time infusion of $200,000 GPR in each year into the Something Special from

Wisconsin® program.

18

• Pr

ovide an additional $800,000 GPR in each year to increase the available funding for the

Meat Processor Grant program.

• Make the Meat Talent Development Grant program permanent with $1,237,500 GPR in fiscal

year 2024-25 to support meat industry workforce development needs by providing funds for

curriculum development and tuition assistance to individuals pursuing meat processing

programming at Wisconsin universities, colleges, and technical schools.

• Convert 4.0 FTE GPR project positions that were approved in the 2021-23 biennial budget to

permanent positions for the meat inspection program at the Department of Agriculture, Trade

and Consumer Protection. Also provide $476,900 GPR in each year for supplies and services

related to meat inspections.

• Provide $74,300 GPR in fiscal year 2023-24, $93,200 GPR in fiscal year 2024-25, and

1.0 FTE GPR agricultural economist position at the Department of Agriculture, Trade and

Consumer Protection.

• Create a biennial agricultural assistance appropriation to fund various farmer and producer-

focused grant programs. This single appropriation will allow the Department of Agriculture,

Trade and Consumer Protection to direct resources in an efficient and effective manner to

help grow Wisconsin’s agricultural economy.

• Provide $15 million GPR in each year for grants to nonprofit food assistance agencies to

combat food insecurity and purchase Wisconsin made or grown agricultural products.

• Provide $2 million Tribal gaming revenues each year for a Tribal Food Box program to

support producers and those requiring sustainable food in Tribal Nations.

• Increase Tribal gaming funding for Native American economic development technical

assistance administered by Department of Administration by $40,500.

• Replace $8,967,100 Tribal gaming revenues for tourism marketing with an equal amount of

GPR and replace $1,309,500 Tribal gaming revenues for snowmobile enforcement with an

equal amount of conservation SEG funds.

• Prov

ide to the Department of Safety and Professional Services $2,966,100 PR in fiscal

year 2023-24 and $3,212,300 PR in fiscal year 2024-25 to support technology infrastructure

upgrades and automation which will bring efficiencies to the department.

• Ensure that the Department of Safety and Professional Services can provide efficient and

effective processing of license applications that helps bolster our state’s workforce and our

economy by increasing the agency’s expenditure authority by $968,700 PR in fiscal year

2023-24 and $1,246,900 PR in fiscal year 2024-25. The increased authority will support

16.0 FTE PR positions in each year, who will ensure quick and efficient review at all stages of

the credential application process and allow qualified applicants to gain employment quickly,

in turn providing skilled workers and necessary services in the state’s economy.

• Meet substantially increased public demand for licensed occupation assistance in the

Department of Safety and Professional Services’ professional credential processing customer

service center by providing increased spending authority of $793,000 PR in fiscal year

2023-24, $1,018,300 PR in fiscal year 2024-25, and 14.0 FTE PR permanent positions. This

increase will provide the staffing needed to best serve applicants and bolster the safety and

economic wellbeing of the state.

• All

ow the Department of Safety and Professional Services to provide scheduled plan review

services to better serve the design-build industry. Scheduled plan reviews place construction

projects on the agency’s review calendar early in the project time line so that review is

accomplished in a timely and efficient manner. To effectuate scheduled plan review, provide

7.0 FTE PR permanent positions and increased expenditure authority of $470,300 PR in

fiscal year 2023-24, $610,200 PR in fiscal year 2024-25.

19

• Reduce

building plan review and approval time lines to improve customer satisfaction at the

Department of Safety and Professional Services by providing plan review within four weeks

by providing 14.0 FTE PR permanent positions and increased expenditure authority of

$972,500 PR in fiscal year 2023-24, $1,263,000 PR in fiscal year 2024-25.

• Incr

ease the Department of Safety and Professional Services’ capability to provide one-week

plan review of certain small and common building plans by providing 4.0 FTE PR permanent

positions and increased expenditure authority of $270,000 PR in fiscal year 2023-24 and

$350,200 PR in fiscal year 2024-25.

• Str

eamline the Department of Safety and Professional Services’ credentialing process and

make it more efficient by helping individuals, employers, and higher education institutions

better understand the application and approval process, including standard application

requirements and requirements for those applicants with unique circumstances. Provide

2.0 FTE PR permanent positions and increased expenditure authority of $113,200 PR in

fiscal year 2023-24 and $143,000 PR in fiscal year 2024-25, to support these efforts. Similar

efforts to simplify application processes undertaken by the Evers Administration at the

Department of Workforce Development have yielded positive results in both customer

satisfaction and efficient application review.

• Prov

ide resources at the Department of Safety and Professional Services for training and

oversight to increase the number of delegated municipalities for commercial plan review and

inspection functions. This will ensure consistent application of building code standards across

the state. Increase expenditure authority by $70,800 PR in in fiscal year 2023-24 and

$90,400 PR in fiscal year 2024-25, and provide 1.0 FTE PR permanent position.

• Enhanc

e the Department of Safety and Professional Services’ presence for building plan and

related inspections through increased outreach and training related to code compliance and

inspection standards. Provide increased spending authority of $315,300 PR in fiscal year

2023-24, $408,300 PR in fiscal year 2024-25, and 5.0 FTE PR permanent positions to

support such outreach and training.

• Prov

ide the Department of Safety and Professional Services with increased spending

authority of $100,000 PR in fiscal year 2023-24 to develop an assured provider pilot program

to modernize the continuing education certification process for realtors.

• Acc

elerate the license review process by providing the Department of Safety and

Professional Services and affiliated credentialing boards with the authority to investigate

whether the circumstances of an arrest, conviction, or other offense are substantially related

to the circumstances of the license activity without specifically reviewing certain types of

violations.

• Enhanc

e licensure opportunity and portability in Wisconsin through increased participation in

multistate compacts, reciprocity agreements, including for Deferred Action for Childhood

Arrivals (DACA) recipients and undocumented individuals who wish to obtain professional

licenses, and integration of internationally trained professionals. Provide the Department of

Safety and Professional Services with increased expenditure authority of $341,200 PR in

fiscal year 2023-24, $434,900 PR in fiscal year 2024-25, and 5.0 FTE PR permanent

positions to support licensure portability.

• Provide $500,000 PR in each year of the biennium to make the trade exam process at the

Department of Safety and Professional Services more efficient by moving from a manual

process to an online, electronic platform.

• Ensure continued modernization of Department of Safety and Professional Services

information technology by providing increased expenditure authority of $580,000 PR in fiscal

year 2023-24 and $520,000 PR in fiscal year 2024-25 to work with the Department of

Administration Division of Enterprise Technology. Also, provide $2,966,100 PR in fiscal year

2023-24 and $3,212,300 PR in fiscal year 2024-25 to maintain system platform subscriptions

20

and customer-facing services including electronic permit services, license application review,

and call center flexibility.

• Conti

nue to fund the successful youth firefighter training grant program and increase the

number of volunteer firefighters in the state by providing $100,000 PR in each year of the

biennium to the Department of Safety and Professional Services.

• Prov

ide $20,000 PR annually to the Department of Safety and Professional Services to

support the awarding of funds for environmentally sound disposal of abandoned

manufactured homes, and critical repairs to low income, elderly or disabled homeowner

occupied manufactured homes.

• All

ow the Department of Safety and Professional Services to keep all fees paid for credentials

and other department approvals to be used for licensing, rule-making, and regulatory

functions of the department.

• All

ow the Department of Safety and Professional Services to adjust credential renewal