2023 Income Tax Withholding

Instrucons, Tables, and Charts

TAX.VERMONT.GOV | 1

EFFECTIVE JANUARY 1, 2023 - EXPIRES DECEMBER 31, 2023

This document is designed to provide you with an overview of the Vermont Withholding Tax. If you

need further claricaon, please contact the Business Secon of the Taxpayer Services Division at

(802) 828-2551 or by email tax.business@vermont.gov.

TAX.VERMONT.GOV | 2 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

Contents

.................................................................3

Payments Subject to Vermont Income Tax Withholding ..........................................3

How Vermont Income Tax Withholding is Calculated ............................................3

Adjustments for Services Not Performed in Vermont ............................................3

Civil Unions or Civil Marriages ..............................................................4

Annuies, Supplemental Payments and Deferred Compensaon Payments .........................4

Payments Under a Non-Qualied Deferred Compensaon Plan ...................................4

Reporng and Reming Vermont Income Tax Withheld .........................................4

Filing Forms W-2 and/or 1099...............................................................5

Combined Fed/State Program ...............................................................5

..................................................................5

Fact Sheets, Guides, and Forms .............................................................5

Other Helpful Resources ...................................................................5

Contact Us ...............................................................................5

.................................................6

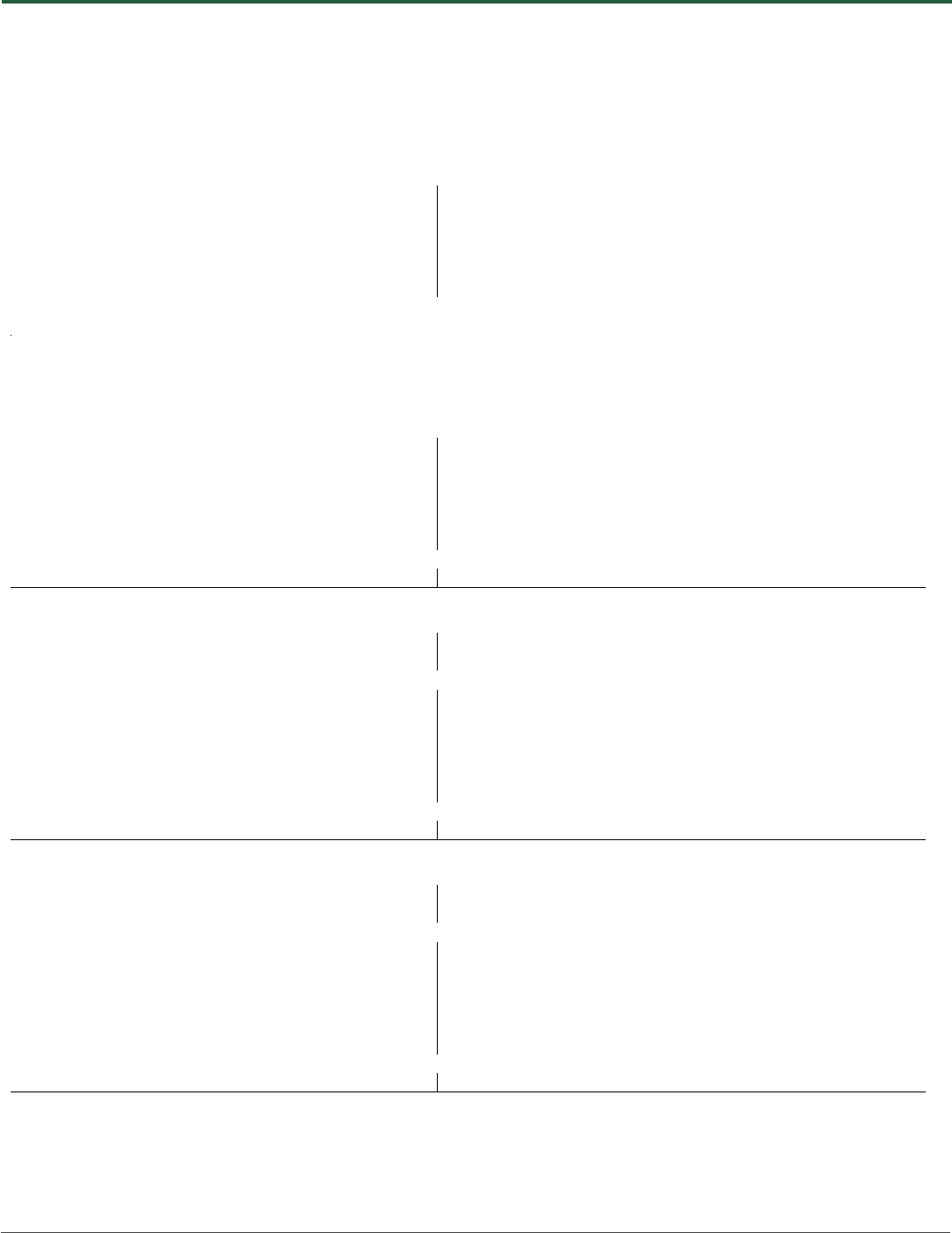

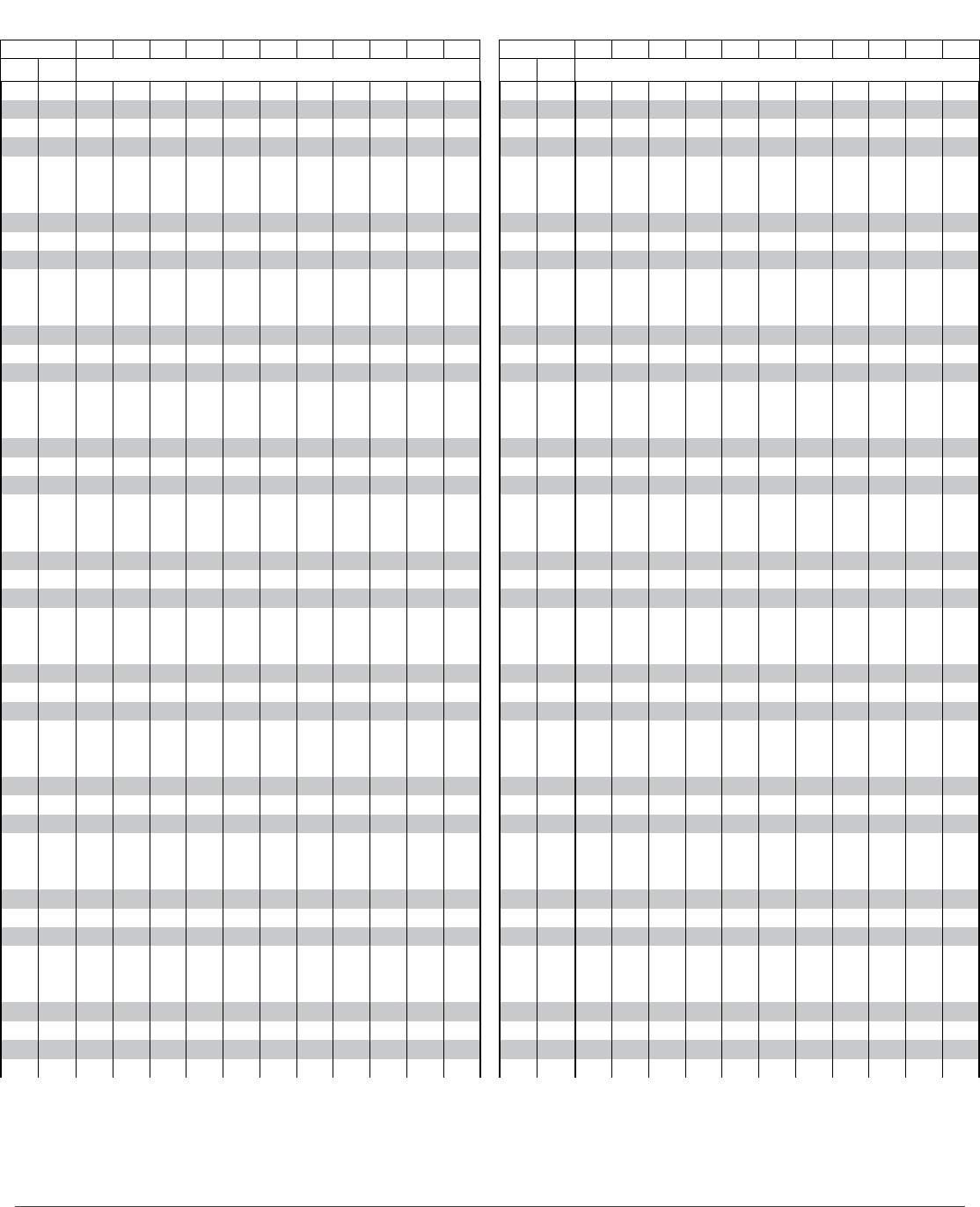

Vermont Percentage Method for Withholding Tables (for wages paid in 2023) ......................6

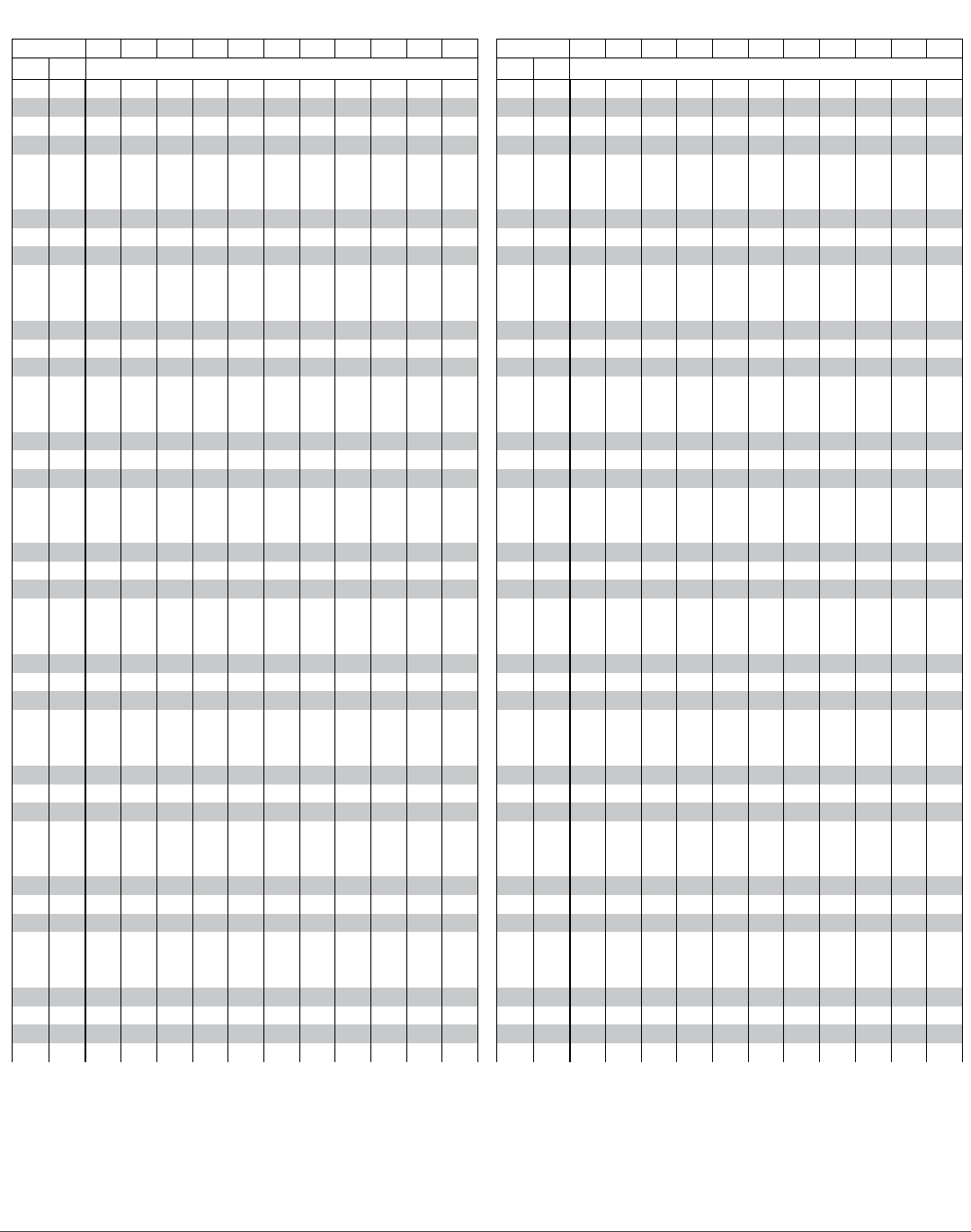

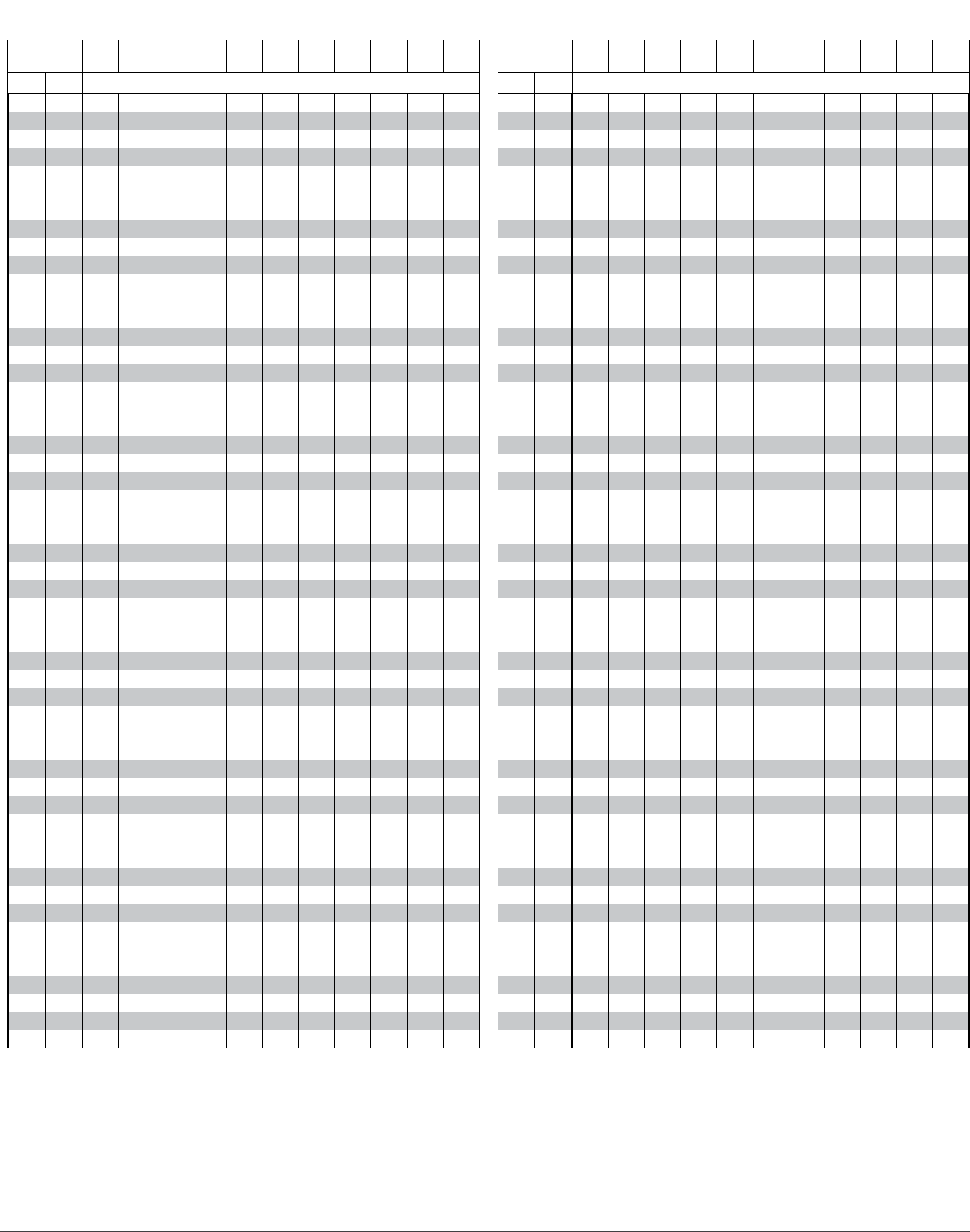

2023 Vermont Wage Bracket Withholding Charts ...............................................8

TAX.VERMONT.GOV | 3 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

Wages, pensions, annuies, and other payments are generally subject to Vermont income tax

withholding if the payments are subject to federal tax withholding and the payments are made to:

1. a Vermont resident

2. a nonresident of Vermont for services performed in Vermont.

For further informaon on wages or payments subject to federal withholding tax, see IRS Publicaon

15 (Circular E) (irs.gov).

The Vermont Income Tax Withholding is calculated in the same manner as federal withholding

tax by using the Vermont withholding tables or wage bracket charts. The ling status, number of

withholding allowances, and any extra withholding for each pay period is determined from the

employee’s Form W-4VT, Vermont Employee’s Withholding Allowance Cercate.

Employees who have adjusted their federal withholding in ancipaon of a credit(s) and employees

who are in civil unions or civil marriages will not have the correct Vermont tax withheld unless they

complete form W-4VT.

An employer may use the informaon from federal form W-4 if a Vermont form is not submied,

but there is a possibility that not enough tax will be withheld. This could result in a tax liability or

tax owed when employees le their taxes. If the federal form W-4 indicates an addional amount of

federal withholding for each pay period on Line 6, the Vermont withholding should be increased by

30% of the extra federal withholding.

When an employee is not a Vermont resident and works in Vermont and another state

during a payroll period, compute the tax on the full payment and then mulply the rao of Vermont

hours to total hours. For example, a nonresident employee worked in Vermont for 16 hours during a

40-hour pay period. If the Vermont withholding on the wages for the enre 40 hours is $48.00, the

Vermont withholding for the 16 hours is:

If a payment to a Vermont resident includes payment for services performed outside this

state, the withholding is computed on the full payment, then reduced by the income tax withheld for

the state where services were performed. An employee who moves into Vermont during a tax year is

considered a resident for withholding purposes.

TAX.VERMONT.GOV | 4 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

Vermont withholding for employees who are partners in civil unions or civil marriages is determined

by the ling status of the employee - either married ling joint or married ling separate. The

Vermont taxable wages may dier from the federal wages due to the treatment of fringe benets

aecng the employee’s partner.

For the purpose of treang a cafeteria plan payment as pretax or impung income from an

employer-paid benet, the federal rules for the payment are applied for state purposes as though

the employee’s partner is a spouse.

This applies only in the case of civil unions and civil marriages and not to domesc partnership

arrangements.

You must withhold Vermont income tax on payments to Vermont residents when federal withholding

is required. Vermont withholding is also required where the recipient elects oponal federal

withholding and does not specically state that the payment is exempt from Vermont withholding.

For periodic payments, the tax is computed using the Vermont wage charts or tables. For non-

periodic payments, the Vermont withholding can be esmated at 30% of the federal withholding.

In all cases, the taxpayer is responsible for ensuring that the correct amount is withheld to avoid

underpayment of the Vermont tax liability.

When a person makes a payment that was previously deferred under a non-qualied deferred

compensaon plan, the correct withholding rate is 6% of the deferred payment. The withholding

is based on both the deferred payment and any income that may be derived from the deferred

compensaon.

If you pay wages or make payments to Vermont income tax withholding, you must register with the

Vermont Department of Taxes for a withholding account. You may register through myVTax (myvtax.

vermont.gov), or using Form BR-400, Applicaon for a Business Tax Account (tax.vermont.gov/

forms).

The department will determine your ling frequency based on your annual withholding totals. You

may le your returns and pay the tax due online through myVTax (myvtax.vermont.gov), or you may

le using paper forms available on our website.

TAX.VERMONT.GOV | 5 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

All employers are required to le Form WHT-434, Annual Withholding Reconciliaon by January 31

each year. This form serves as the transmial for forms W-2 and/or 1099 and reconciles the amount

of Vermont income tax withholding reported during the previous year to the amount of withholding

tax shown on the W-2 and/or 1099 forms. Form WHT-434 and Forms W-2 and 1099 may be led

through myVTax (myvtax.vermont.gov).

The commissioner of taxes has mandated the electronic ling of form WHT-434 and the

accompanying forms for all employers who will submit 25 or more W-2 and/or 1099 forms. Payroll

ling services have been mandated to submit all lings electronically.

The Vermont Department of Taxes is no longer parcipang in the Combined Fed/State program for

subming W-2 and 1099 forms with the IRS. You must le these forms directly with the department.

• Form BR-400, Applicaon for a Business Tax Account (tax.vermont.gov/forms)

• Form W-4VT, Vermont Employee’s Withholding Allowance Cercate (tax.vermont.gov/forms)

• Form WHT-434, Annual Withholding Reconciliaon (tax.vermont.gov/forms)

• IRS Publicaon 15 (Circular E) (irs.gov)

• Internal Revenue Service - Federal Income Tax (irs.gov) Phone:(800) 829-1040

• Social Security Administraon - Social Security/Medicare (ssa.gov) Phone: (800) 772-1213

• Vermont Department of Labor - Unemployment Insurance, Minimum Wage, Overme, Worker

Compensaon (labor.vermont.gov) Phone: (802) 828-4000

If you have quesons, contact the Taxpayer Services Division at (802) 828-2551 or tax.business@

vermont.gov. E-le your withholding tax forms at myVTax (myVTax.vermont.gov).

Vermont Department of Taxes, Taxpayer Services Division, P.O. Box 547, Montpelier, VT 05601-0547

Fax: (802) 828-5787

TAX.VERMONT.GOV | 6 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

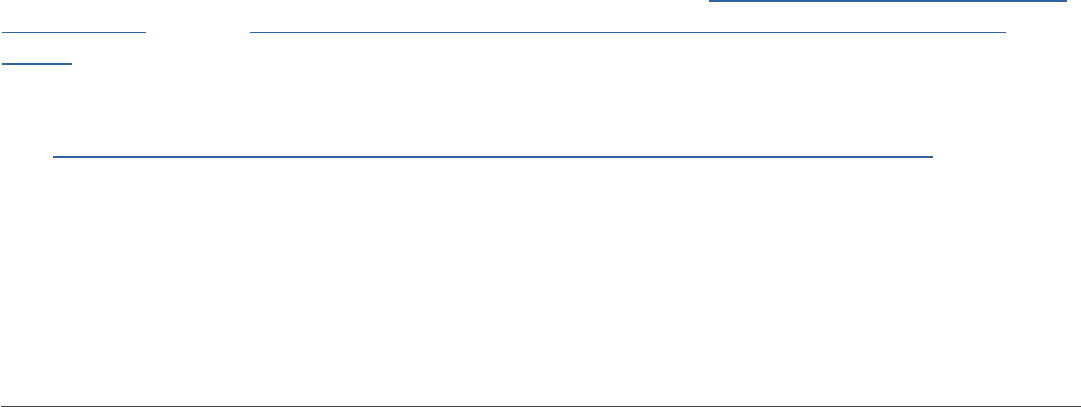

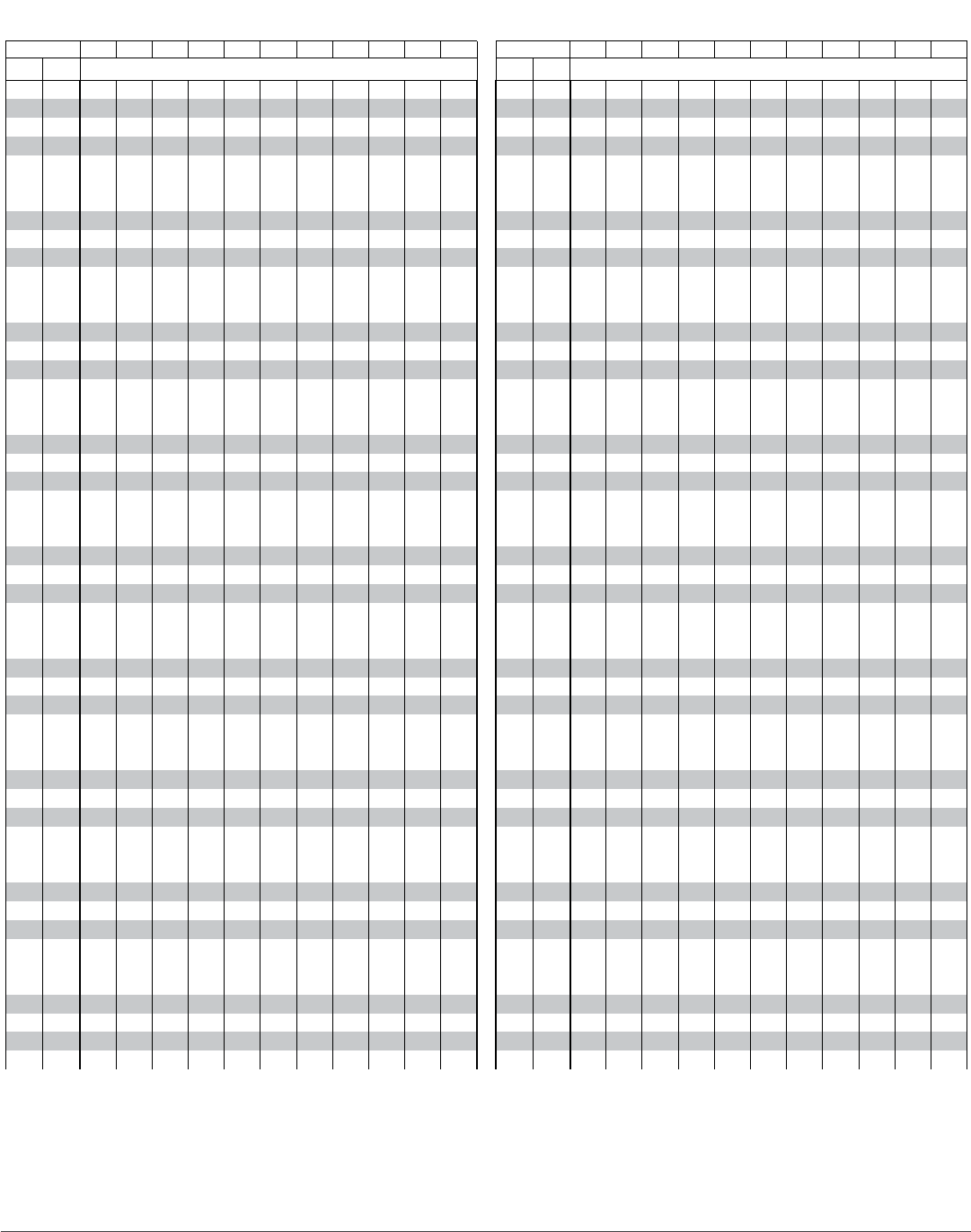

Vermont Percentage Method Withholding Tables

(for wages paid in 2023)

(for wages paid in 2023)

WEEKLY PAYROLLS

Single

If Wages* are:

over but not over Vermont withholding is:

$0 $67 $0

of amount over

67 940 0

+

3.35% $67

940 2,184 29.25

+

6.60% 940

2,184 4,482 111.35

+

7.60% 2,184

4,482 - 286.00

+

8.75% 4,482

Married

If Wages* are:

over but not over Vermont withholding is:

$0 $203 $0

of amount over

203 1,661 0

+

3.35% $203

1,661 3,730 48.84

+

6.60% 1,661

3,730 5,577 185.39

+

7.60% 3,730

5,577 - 325.77

+

8.75% 5,577

*use wages after subtracting withholding allowances (one withholding allowance equals $93.27)

BIWEEKLY PAYROLLS

Single

If Wages* are:

over but not over Vermont withholding is:

$0 $135 $0

of amount over

135 1,881 0

+

3.35% $135

1,881 4,367 58.49

+

6.60% 1,881

4,367 8,963 222.57

+

7.60% 4,367

8,963 - 571.86

+

8.75% 8,963

Married

If Wages* are:

over but not over Vermont withholding is:

$0 $405 $0

of amount over

405 3,323 0

+

3.35% $405

3,323 7,459 97.75

+

6.60% 3,323

7,459 11,153 370.73

+

7.60% 7,459

11,153 - 651.47

+

8.75% 11,153

*use wages after subtracting withholding allowances (one withholding allowance equals $186.54)

SEMIMONTHLY PAYROLLS

Single

If Wages* are:

over but not over Vermont withholding is:

$0 $146 $0

of amount over

146 2,038 0

+

3.35% $146

2,038 4,731 63.38

+

6.60% 2,038

4,731 9,710 241.12

+

7.60% 4,731

9,710 - 619.52

+

8.75% 9,710

Married

If Wages* are:

over but not over Vermont withholding is:

$0 $439 $0

of amount over

439 3,599 0

+

3.35% $439

3,599 8,081 105.86

+

6.60% 3,599

8,081 12,083 401.67

+

7.60% 8,081

12,083 - 705.82

+

8.75% 12,083

*use wages after subtracting withholding allowances (one withholding allowance equals $202.08)

MONTHLY PAYROLLS

Single

If Wages* are:

over but not over

Vermont withholding is:

$0 $292 $0

of amount over

292 4,075 0

+

3.35% $292

4,075 9,463 126.73

+

6.60% 4,075

9,463 19,421 482.34

+

7.60% 9,463

19,421 - 1,239.15

+

8.75% 19,421

Married

If Wages* are:

over but not over Vermont withholding is:

$0 $878 $0

of amount over

878 7,199 0

+

3.35% $878

7,199 16,161 211.75

+

6.60% 7,199

16,161 24,166 803.25

+

7.60% 16,161

24,166 - 1,411.63

+

8.75% 24,166

*use wages after subtracting withholding allowances (one withholding allowance equals $404.17)

Eecve Date: January 1, 2023 Civil union partners use Married Table

TAX.VERMONT.GOV | 7 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

Vermont Percentage Method Withholding Tables

(for wages paid in 2023)

(for wages paid in 2023)

QUARTERLY PAYROLLS

Single

If Wages* are:

over but not over Vermont withholding is:

$0 $875 $0

of amount over

875 12,225 0

+

3.35% $875

12,225 28,388 380.23

+

6.60% 12,225

28,388 58,263 1,446.98

+

7.60% 28,388

58,263 - 3,717.48

+

8.75% 58,263

Married

If Wages* are:

over but not over Vermont withholding is:

$0 $2,634 $0

of amount over

2,634 21,597 0

+

3.35% $2,634

21,597 48,484 635.26

+

6.60% 21,597

48,484 72,497 2,409.80

+

7.60% 48,484

72,497 - 4,234.79

+

8.75% 72,497

*use wages after subtracting withholding allowances (one withholding allowance equals $1212.50)

ANNUAL PAYROLLS

Single

If Wages* are:

over but not over Vermont withholding is:

$0 $3,500 $0

of amount over

3,500 48,900 0

+

3.35% $3,500

48,900 113,550 1,520.90

+

6.60% 48,900

113,550 233,050 5,787.80

+

7.60% 113,550

233,050 - 14,869.80

+

8.75% 233,050

Married

If Wages* are:

over but not over Vermont withholding is:

$0 $10,538 $0

of amount over

10,538 86,388 0

+

3.35% $10,538

86,388 193,938 2,540.98

+

6.60% 86,388

193,938 289,988 9,639.28

+

7.60% 193,938

289,988 - 16,939.08

+

8.75% 289,988

*use wages after subtracting withholding allowances (one withholding allowance equals $4850.00)

DAILY or MISCELLANEOUS PAYROLLS (per day)

Single

If Wages* divided by

the number of days in

the payroll period are:

over but not over

Vermont withholding (per day) is:

$0

$13.50

$0

of amount over

13.50 188.10 0.00 +

3.35% $13.50

188.10 436.70 5.85

+

6.60%

188.10

436.70 896.30 22.26

+

7.60%

436.70

896.30

-

57.19

+

8.75%

896.30

Married

If Wages* divided by

the number of days in

the payroll period are:

over but not over

Vermont withholding (per day) is:

$0 $40.50 $0.00

of amount over

40.50 332.30 0.00

+

3.35% $40.50

332.30 745.90 9.78

+

6.60%

332.30

745.90 1,115.30 37.07

+

7.60%

745.90

1,115.30

-

65.15

+

8.75%

1,115.30

*use wages after subtracting withholding allowances (one withholding allowance equals $18.65)

INSTRUCTIONS FOR USING TABLES

EXAMPLE

1. Locate the correct table for your payroll frequency.

An employee is paid $1800 each week. Her W-4VT form claims two

Note the amount of one payroll allowance listed at the

withholding allowances and married status. Her state withholding is

bottom of the table.

computed from the WEEKLY/Married table on the previous page.

2. Multiply the amount of one allowance by the number

Her total withholding allowance is: 2 x $93.27 = $186.54.

of allowances claimed by the employee on form W-4VT.

Her wages (after allowances) are: $1800 - $186.54 = $1613.46.

Subtract this amount from the amount of payment.

Because $1613.46 falls between $203 and $1661, the tax is computed as

$0.00 plus 3.35% of the amount over $203.

3. Compute the Vermont tax on the amount from step #2,

$1613.46 - 203.00 = $1410.46

using the table.

Vermont withholding is $141.93.

$1410.46 x 0.0335 = $ 47.25

$47.25 + 0.00 = $47.25

Eecve Date: January 1, 2023 Civil union partners use Married Table

TAX.VERMONT.GOV | 8 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

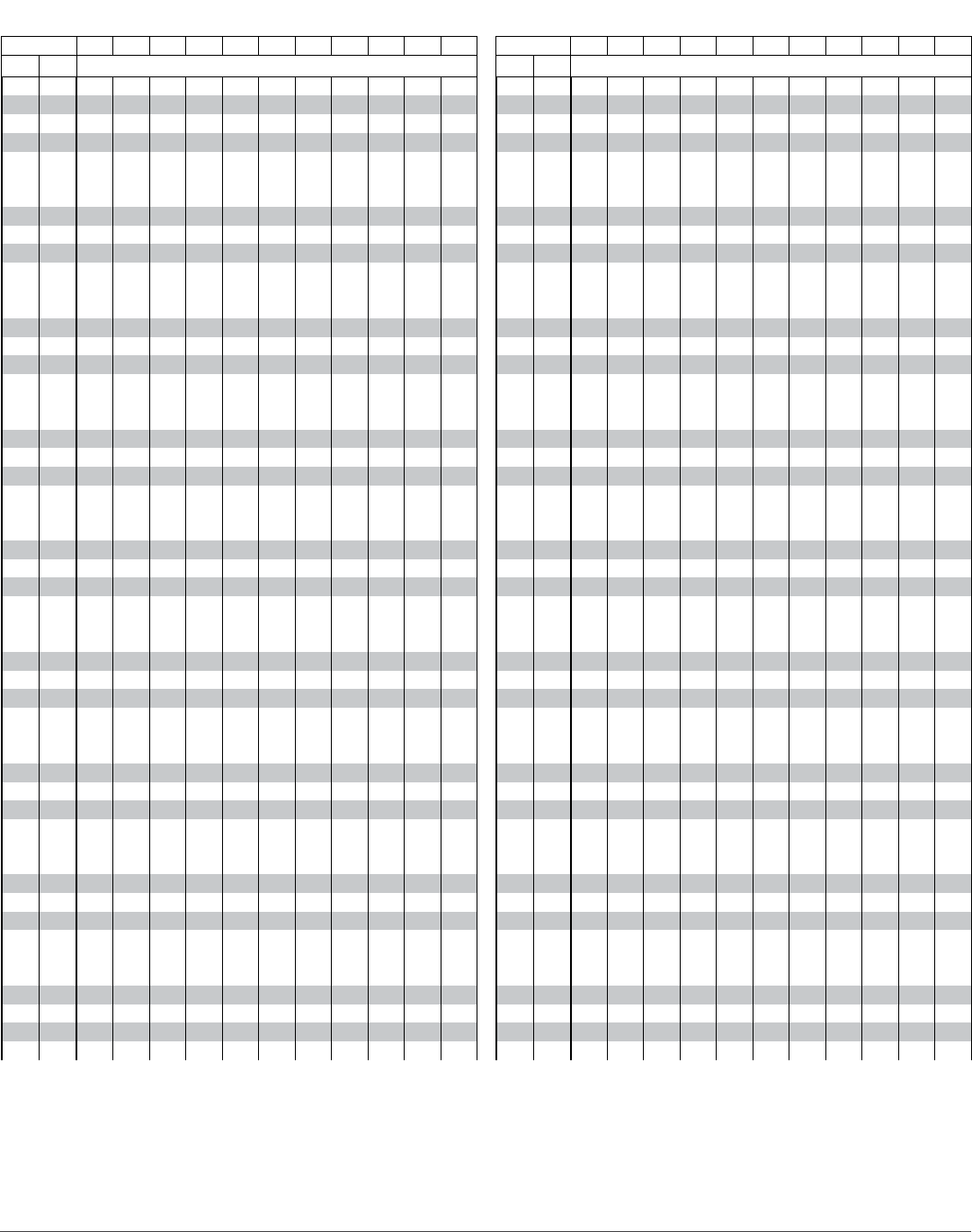

ag g

Single Weekly Married Weekly

Number of Exemptions Claimed Number of Exemptions Claimed

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

0 80 0 0 0 0 0 0 0 0 0 0 0

80 95 1 0 0 0 0 0 0 0 0 0 0

95 110 1 0 0 0 0 0 0 0 0 0 0

110 125 2 0 0 0 0 0 0 0 0 0 0

125

140

140

155

2

3

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

155 170 3 0 0 0 0 0 0 0 0 0 0

170 185 4 1 0 0 0 0 0 0 0 0 0

185 200 4 1 0 0 0 0 0 0 0 0 0

200

215

215

230

5

5

2

2

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

230 245 6 3 0 0 0 0 0 0 0 0 0

245 260 6 3 0 0 0 0 0 0 0 0 0

260 275 7 4 0 0 0 0 0 0 0 0 0

275

290

290

305

7

8

4

5

1

1

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

305 320 8 5 2 0 0 0 0 0 0 0 0

320 335 9 6 2 0 0 0 0 0 0 0 0

335 350 9 6 3 0 0 0 0 0 0 0 0

350

365

365

380

10

10

7

7

3

4

0

1

0

0

0

0

0

0

0

0

0

0

0

0

0

0

380 395 11 8 4 1 0 0 0 0 0 0 0

395 410 11 8 5 2 0 0 0 0 0 0 0

410 425 12 9 5 2 0 0 0 0 0 0 0

425

440

440

455

12

13

9

10

6

6

3

3

0

0

0

0

0

0

0

0

0

0

0

0

0

0

455 470 13 10 7 4 1 0 0 0 0 0 0

470 485 14 11 7 4 1 0 0 0 0 0 0

485 500 14 11 8 5 2 0 0 0 0 0 0

500

515

515

530

15

15

12

12

8

9

5

6

2

3

0

0

0

0

0

0

0

0

0

0

0

0

530 545 16 13 10 6 3 0 0 0 0 0 0

545 560 16 13 10 7 4 1 0 0 0 0 0

560 575 17 14 11 7 4 1 0 0 0 0 0

575

590

590

605

17

18

14

15

11

12

8

8

5

5

2

2

0

0

0

0

0

0

0

0

0

0

605 620 18 15 12 9 6 3 0 0 0 0 0

620 635 19 16 13 9 6 3 0 0 0 0 0

635 650 19 16 13 10 7 4 1 0 0 0 0

650

665

665

680

20

20

17

17

14

14

10

11

7

8

4

5

1

2

0

0

0

0

0

0

0

0

680 695 21 18 15 11 8 5 2 0 0 0 0

695 710 21 18 15 12 9 6 3 0 0 0 0

710 725 22 19 16 12 9 6 3 0 0 0 0

725 740 22 19 16 13 10 7 4 0 0 0 0

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

0 215 0 0 0 0 0 0 0 0 0 0 0

215 230 1 0 0 0 0 0 0 0 0 0 0

230 245 1 0 0 0 0 0 0 0 0 0 0

245 260 2 0 0 0 0 0 0 0 0 0 0

260

275

275

290

2

3

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

290 305 3 0 0 0 0 0 0 0 0 0 0

305 320 4 1 0 0 0 0 0 0 0 0 0

320 335 4 1 0 0 0 0 0 0 0 0 0

335

350

350

365

5

5

2

2

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

365 380 6 3 0 0 0 0 0 0 0 0 0

380 395 6 3 0 0 0 0 0 0 0 0 0

395 410 7 4 0 0 0 0 0 0 0 0 0

410

425

425

440

7

8

4

5

1

1

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

440 455 8 5 2 0 0 0 0 0 0 0 0

455 470 9 6 2 0 0 0 0 0 0 0 0

470 485 9 6 3 0 0 0 0 0 0 0 0

485

500

500

515

10

10

7

7

3

4

0

1

0

0

0

0

0

0

0

0

0

0

0

0

0

0

515 530 11 8 4 1 0 0 0 0 0 0 0

530 545 11 8 5 2 0 0 0 0 0 0 0

545 560 12 9 5 2 0 0 0 0 0 0 0

560

575

575

590

12

13

9

10

6

6

3

3

0

0

0

0

0

0

0

0

0

0

0

0

0

0

590 605 13 10 7 4 1 0 0 0 0 0 0

605 620 14 11 7 4 1 0 0 0 0 0 0

620 635 14 11 8 5 2 0 0 0 0 0 0

635

650

650

665

15

15

12

12

8

9

5

6

2

3

0

0

0

0

0

0

0

0

0

0

0

0

665 680 16 13 9 6 3 0 0 0 0 0 0

680 695 16 13 10 7 4 1 0 0 0 0 0

695 710 17 14 10 7 4 1 0 0 0 0 0

710

725

725

740

17

18

14

15

11

12

8

8

5

5

2

2

0

0

0

0

0

0

0

0

0

0

740 755 18 15 12 9 6 3 0 0 0 0 0

755 770 19 16 13 9 6 3 0 0 0 0 0

770 785 19 16 13 10 7 4 1 0 0 0 0

785

800

800

815

20

20

17

17

14

14

10

11

7

8

4

5

1

2

0

0

0

0

0

0

0

0

815 830 21 18 15 11 8 5 2 0 0 0 0

830 845 21 18 15 12 9 6 3 0 0 0 0

845 860 22 19 16 12 9 6 3 0 0 0 0

860 875 22 19 16 13 10 7 4 0 0 0 0

Eecve Date: January 1, 2023 Civil union partners use Married Chart

TAX.VERMONT.GOV | 9 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

5

10

15

20

25

5

10

15

20

25

5

10

15

20

25

5

10

15

20

25

10

15

20

25

30

35

10

15

20

25

30

15

20

25

30

35

15

20

25

30

35

20

25

30

35

40

20

25

30

35

40

25

30

35

40

45

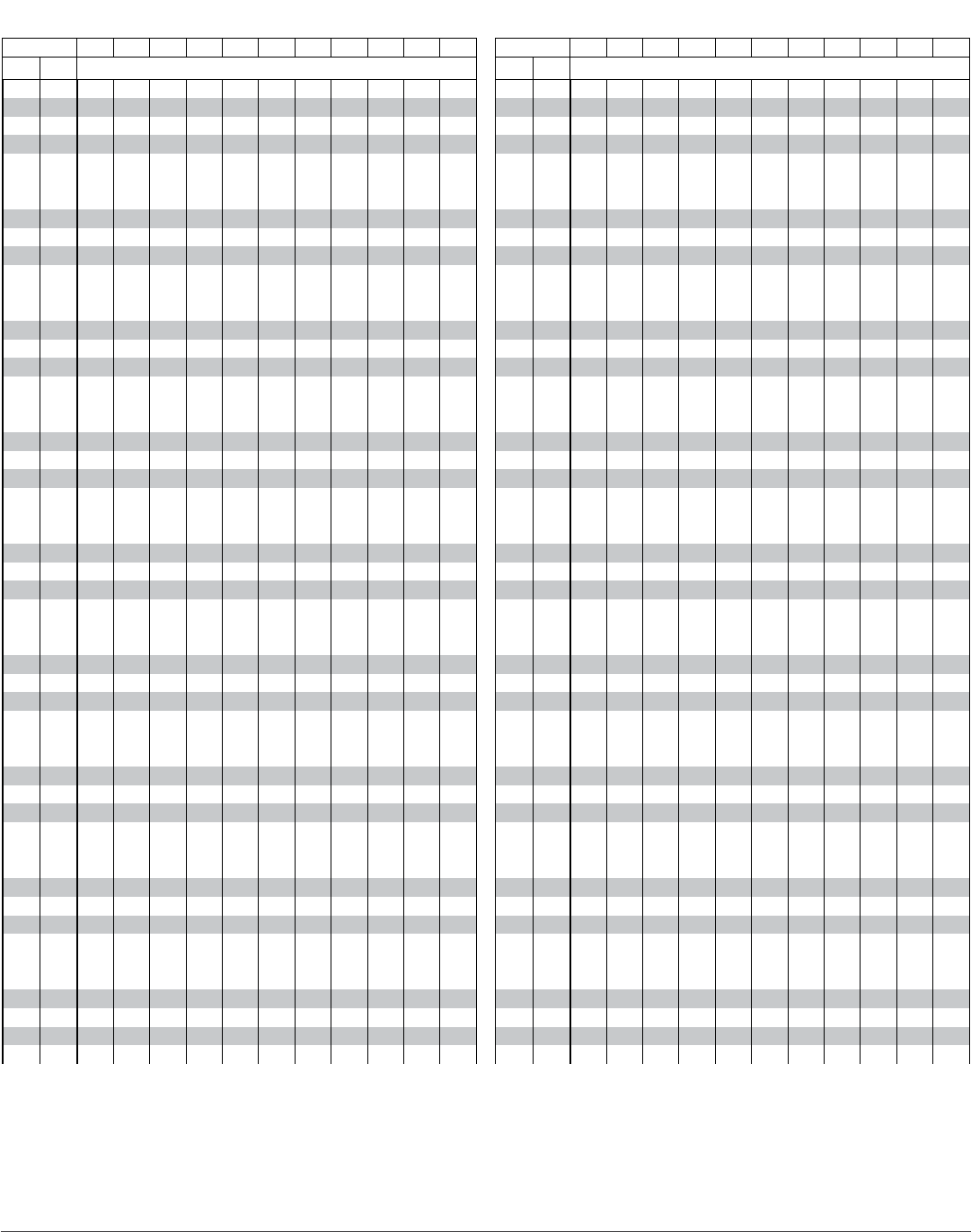

Single Weekly Married Weekly

Number of Exemptions Claimed Number of Exemptions Claimed

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

740 755 23 20 17 13 7 4 1 0 0 0

755 770 23 20 17 14 11 8 1 0 0 0

770 785 24 21 18 14 11 8 2 0 0 0

785 800 24 21 18 15 12 9 6 2 0 0 0

800

815

815

830

25

25

22

22

19

19

15

16

12

13

9

10

6

7

3

3

0

0

0

0

0

0

830 845 26 23 20 16 13 10 7 4 1 0 0

845 860 26 23 20 17 14 11 8 4 1 0 0

860 875 27 24 21 17 14 11 8 5 2 0 0

875

890

890

905

27

28

24

25

21

22

18

18

15

12

12

9

9

5

6

2

3

0

0

0

0

905 920 28 25 22 19 16 13 6 3 0 0

920 935 29 26 23 19 16 13 7 4 1 0

935 950 29 26 23 20 17 14 11 7 4 1 0

950

965

965

980

30

31

27

27

24

24

20

21

17

18

14

15

11

12

8

8

5

5

2

2

0

0

980 995 32 28 25 21 18 15 12 9 6 3 0

995 1010 33 28 25 22 19 16 13 9 6 3 0

1010 1025 34 29 26 22 19 16 13 10 7 4 1

1025

1040

1040

1055

35

36

29

30

26

27

23

23

20

17

17

14

14

10

11

7

8

4

5

1

2

1055 1070 37 31 27 24 21 18 11 8 5 2

1070 1085 38 32 28 24 21 18 12 9 6 3

1085 1100 39 33 28 25 22 19 16 12 9 6 3

1100

1115

1115

1130

40

41

34

35

29

29

25

26

22

23

19

20

16

17

13

13

10

10

7

7

4

4

1130 1145 42 36 30 26 23 20 17 14 11 8 5

1145 1160 43 37 31 27 24 21 18 14 11 8 5

1160 1175 44 38 32 27 24 21 18 15 12 9 6

1175

1190

1190

1205

45

46

39

40

33

34

28

28

25

22

22

19

19

15

16

12

13

9

10

6

7

1205 1220 47 41 35 29 26 23 16 13 10 7

1220 1235 48 42 36 30 26 23 17 14 11 8

1235 1250 49 43 37 31 27 24 21 17 14 11 8

1250

1265

1265

1280

50

51

44

45

38

39

32

33

27

28

24

25

21

22

18

19

15

15

12

12

9

9

1280 1295 52 46 40 34 28 25 22 19 16 13 10

1295 1310 53 47 41 35 29 26 23 20 16 13 10

1310 1325 54 48 42 36 26 23 20 17 14 11

1325

1340

1340

1355

55

56

49

50

43

44

37

38

31

31

27

27

24

24

21

21

17

18

14

15

11

12

1355 1370 57 51 45 39 32 28 22 18 15 12

1370 1385 58 52 46 40 33 28 22 19 16 13

1385 1400 59 53 47 41 34 29 26 23 19 16 13

1400 1415 60 54 48 42 29 26 23 20 17 14

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

875 890 23 17 13 7 4 1 0 0 0

890 905 23 17 14 11 8 1 0 0 0

905 920 24 21 18 14 11 8 2 0 0 0

920 935 24 21 18 12 9 6 2 0 0 0

935

950

950

965

25

22

22

19

19

16

12

13

9

10

6

7

3

3

0

0

0

0

0

0

965 980 26 23 20 16 13 10 7 4 1 0 0

980 995 26 23 20 17 14 11 8 4 1 0 0

995 1010 27 24 21 17 14 11 8 5 2 0 0

1010

1025

1025

1040

27

28

24 21

22

18

18

15

12

12

9

9

5

6

2

3

0

0

0

0

1040 1055 28 22 19 16 13 6 3 0 0

1055 1070 29 26 23 19 16 13 7 4 1 0

1070 1085 29 26 23 17 14 11 7 4 1 0

1085

1100

1100

1115

30

27

27

24

24

21

17

18

14

15

11

12

8

8

5

5

2

2

0

0

1115 1130 31 28 25 21 18 15 12 9 6 3 0

1130 1145 31 28 25 22 19 16 13 9 6 3 0

1145 1160 32 29 26 22 19 16 13 10 7 4 1

1160

1175

1175

1190

32

33

29 26

27

23

23

20

17

17

14

14

10

11

7

8

4

5

1

2

1190 1205 33 27 24 21 18 11 8 5 2

1205 1220 34 31 28 24 21 18 12 9 6 3

1220 1235 34 31 28 22 19 16 12 9 6 3

1235

1250

1250

1265

35

32

32

29

29

26

22

23

19

20

16

17

13

13

10

10

7

7

4

4

1265 1280 36 33 30 26 23 20 17 14 11 8 5

1280 1295 36 33 30 27 24 21 18 14 11 8 5

1295 1310 37 34 31 27 24 21 18 15 12 9 6

1310

1325

1325

1340

37

38

34 31

32

28

28

25

22

22

19

19

15

16

12

13

9

10

6

7

1340 1355 38 32 29 26 23 16 13 10 7

1355 1370 39 36 33 29 26 23 17 14 11 8

1370 1385 39 36 33 27 24 21 17 14 11 8

1385

1400

1400

1415

40

37

37

34

34

31

27

28

24

25

21

22

18

18

15

15

12

12

9

9

1415 1430 41 38 35 31 28 25 22 19 16 13 10

1430 1445 41 38 35 32 29 26 23 19 16 13 10

1445 1460 42 39 36 32 29 26 23 20 17 14 11

1460

1475

1475

1490

42

43

39 36

37

33

34

30

27

27

24

24

21

21

17

18

14

15

11

12

1490 1505 43 37 34 31 28 22 18 15 12

1505 1520 44 41 38 31 28 22 19 16 13

1520 1535 44 41 38 32 29 26 23 19 16 13

1535 1550 42 39 36 32 29 26 23 20 17 14

Eecve Date: January 1, 2023 Civil union partners use Married Chart

TAX.VERMONT.GOV | 10 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

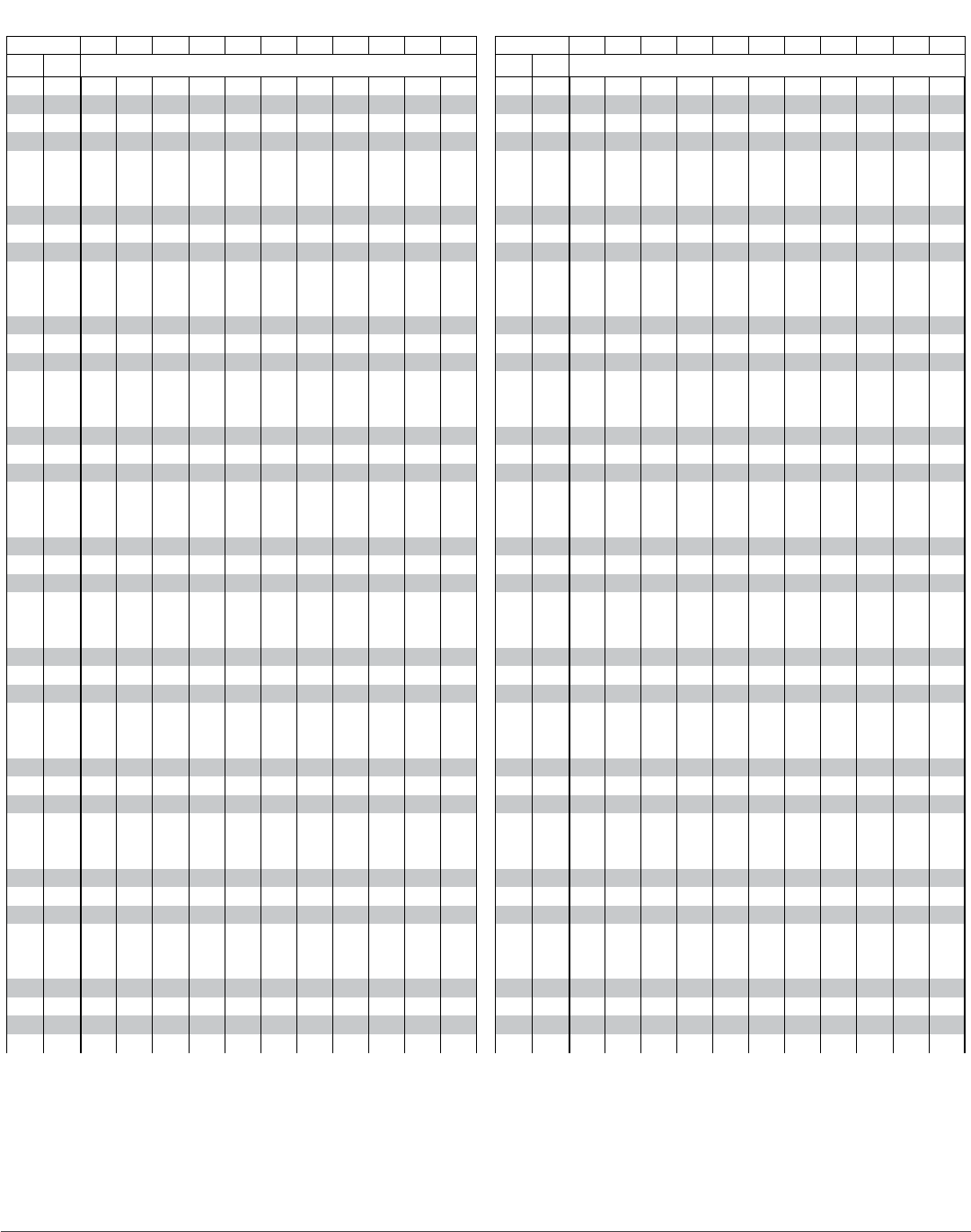

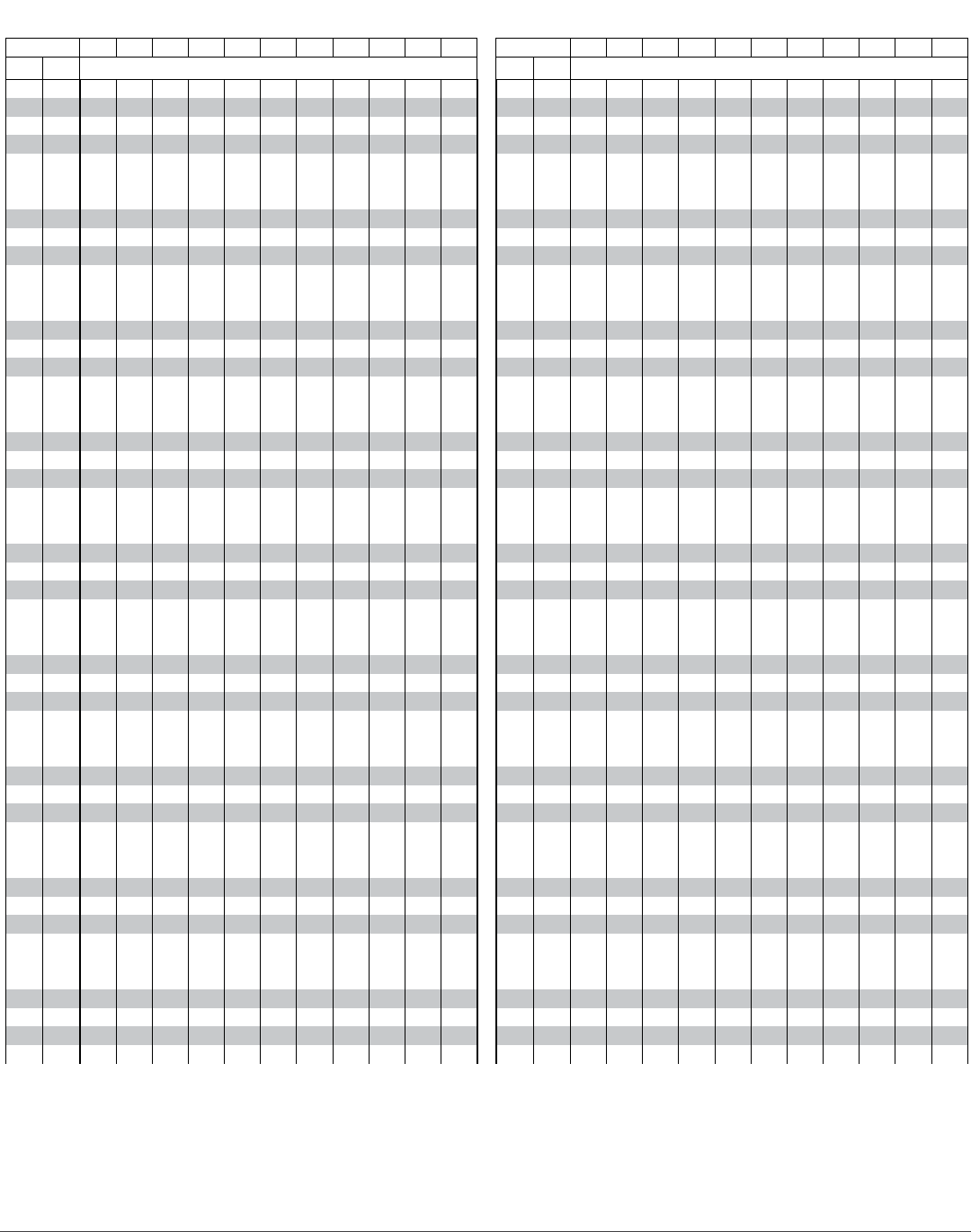

Single Biweekly Married Biweekly

Number of Exemptions Claimed Number of Exemptions Claimed

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

0 160 0 0 0 0 0 0 0 0 0 0 0

160 190 1 0 0 0 0 0 0 0 0 0 0

190 220 2 0 0 0 0 0 0 0 0 0 0

220 250 3 0 0 0 0 0 0 0 0 0 0

250

280

280

310

4

5

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

310 340 6 0 0 0 0 0 0 0 0 0 0

340 370 7 1 0 0 0 0 0 0 0 0 0

370 400 8 2 0 0 0 0 0 0 0 0 0

400

430

430

460

9

10

3

4

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

460 490 11 5 0 0 0 0 0 0 0 0 0

490 520 12 6 0 0 0 0 0 0 0 0 0

520 550 13 7 1 0 0 0 0 0 0 0 0

550

580

580

610

14

15

8

9

2

3

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

610 640 16 10 4 0 0 0 0 0 0 0 0

640 670 17 11 5 0 0 0 0 0 0 0 0

670 700 18 12 6 0 0 0 0 0 0 0 0

700

730

730

760

19

20

13

14

7

8

1

2

0

0

0

0

0

0

0

0

0

0

0

0

0

0

760 790 21 15 9 3 0 0 0 0 0 0 0

790 820 22 16 10 4 0 0 0 0 0 0 0

820 850 23 17 11 5 0 0 0 0 0 0 0

850

880

880

910

24

25

18

19

12

13

6

7

0

0

0

0

0

0

0

0

0

0

0

0

0

0

910 940 26 20 14 8 1 0 0 0 0 0 0

940 970 27 21 15 9 2 0 0 0 0 0 0

970 1000 28 22 16 10 3 0 0 0 0 0 0

1000

1030

1030

1060

29

30

23

24

17

18

11

12

4

6

0

0

0

0

0

0

0

0

0

0

0

0

1060 1090 32 25 19 13 7 0 0 0 0 0 0

1090 1120 33 26 20 14 8 1 0 0 0 0 0

1120 1150 34 27 21 15 9 2 0 0 0 0 0

1150

1180

1180

1210

35

36

28

29

22

23

16

17

10

11

3

4

0

0

0

0

0

0

0

0

0

0

1210 1240 37 30 24 18 12 5 0 0 0 0 0

1240 1270 38 31 25 19 13 6 0 0 0 0 0

1270 1300 39 32 26 20 14 7 1 0 0 0 0

1300

1330

1330

1360

40

41

33

34

27

28

21

22

15

16

8

9

2

3

0

0

0

0

0

0

0

0

1360 1390 42 35 29 23 17 10 4 0 0 0 0

1390 1420 43 36 30 24 18 11 5 0 0 0 0

1420 1450 44 37 31 25 19 12 6 0 0 0 0

1450 1480 45 38 32 26 20 13 7 1 0 0 0

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

0 430 0 0 0 0 0 0 0 0 0 0 0

430 460 1 0 0 0 0 0 0 0 0 0 0

460 490 2 0 0 0 0 0 0 0 0 0 0

490 520 3 0 0 0 0 0 0 0 0 0 0

520

550

550

580

4

5

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

580 610 6 0 0 0 0 0 0 0 0 0 0

610 640 7 1 0 0 0 0 0 0 0 0 0

640 670 8 2 0 0 0 0 0 0 0 0 0

670

700

700

730

9

10

3

4

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

730 760 11 5 0 0 0 0 0 0 0 0 0

760 790 12 6 0 0 0 0 0 0 0 0 0

790 820 13 7 1 0 0 0 0 0 0 0 0

820

850

850

880

14

15

8

9

2

3

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

880 910 16 10 4 0 0 0 0 0 0 0 0

910 940 17 11 5 0 0 0 0 0 0 0 0

940 970 18 12 6 0 0 0 0 0 0 0 0

970

1000

1000

1030

19

20

13

14

7

8

1

2

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1030 1060 21 15 9 3 0 0 0 0 0 0 0

1060 1090 22 16 10 4 0 0 0 0 0 0 0

1090 1120 23 17 11 5 0 0 0 0 0 0 0

1120

1150

1150

1180

24

25

18

19

12

13

6

7

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1180 1210 26 20 14 8 1 0 0 0 0 0 0

1210 1240 27 21 15 9 2 0 0 0 0 0 0

1240 1270 28 22 16 10 3 0 0 0 0 0 0

1270

1300

1300

1330

29

30

23

24

17

18

11

12

4

5

0

0

0

0

0

0

0

0

0

0

0

0

1330 1360 31 25 19 13 6 0 0 0 0 0 0

1360 1390 32 26 20 14 7 1 0 0 0 0 0

1390 1420 33 27 21 15 8 2 0 0 0 0 0

1420

1450

1450

1480

34

36

28

29

22

23

16

17

9

11

3

4

0

0

0

0

0

0

0

0

0

0

1480 1510 37 30 24 18 12 5 0 0 0 0 0

1510 1540 38 31 25 19 13 6 0 0 0 0 0

1540 1570 39 32 26 20 14 7 1 0 0 0 0

1570

1600

1600

1630

40

41

33

34

27

28

21

22

15

16

8

9

2

3

0

0

0

0

0

0

0

0

1630 1660 42 35 29 23 17 10 4 0 0 0 0

1660 1690 43 36 30 24 18 11 5 0 0 0 0

1690 1720 44 37 31 25 19 12 6 0 0 0 0

1720 1750 45 38 32 26 20 13 7 1 0 0 0

Eecve Date: January 1, 2023 Civil union partners use Married Chart

TAX.VERMONT.GOV | 11 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

5

10

15

20

25

30

35

40

45

5

10

15

20

25

30

35

40

45

10

15

20

25

30

35

40

45

50

10

15

20

25

30

35

40

45

50

25

30

35

40

45

50

55

60

65

30

35

40

45

50

55

60

65

70

35

40

45

50

55

60

65

70

75

50

55

60

65

70

75

80

85

90

40

50

60

70

80

90

100

40

50

60

70

80

40

50

60

70

80

90

ag g

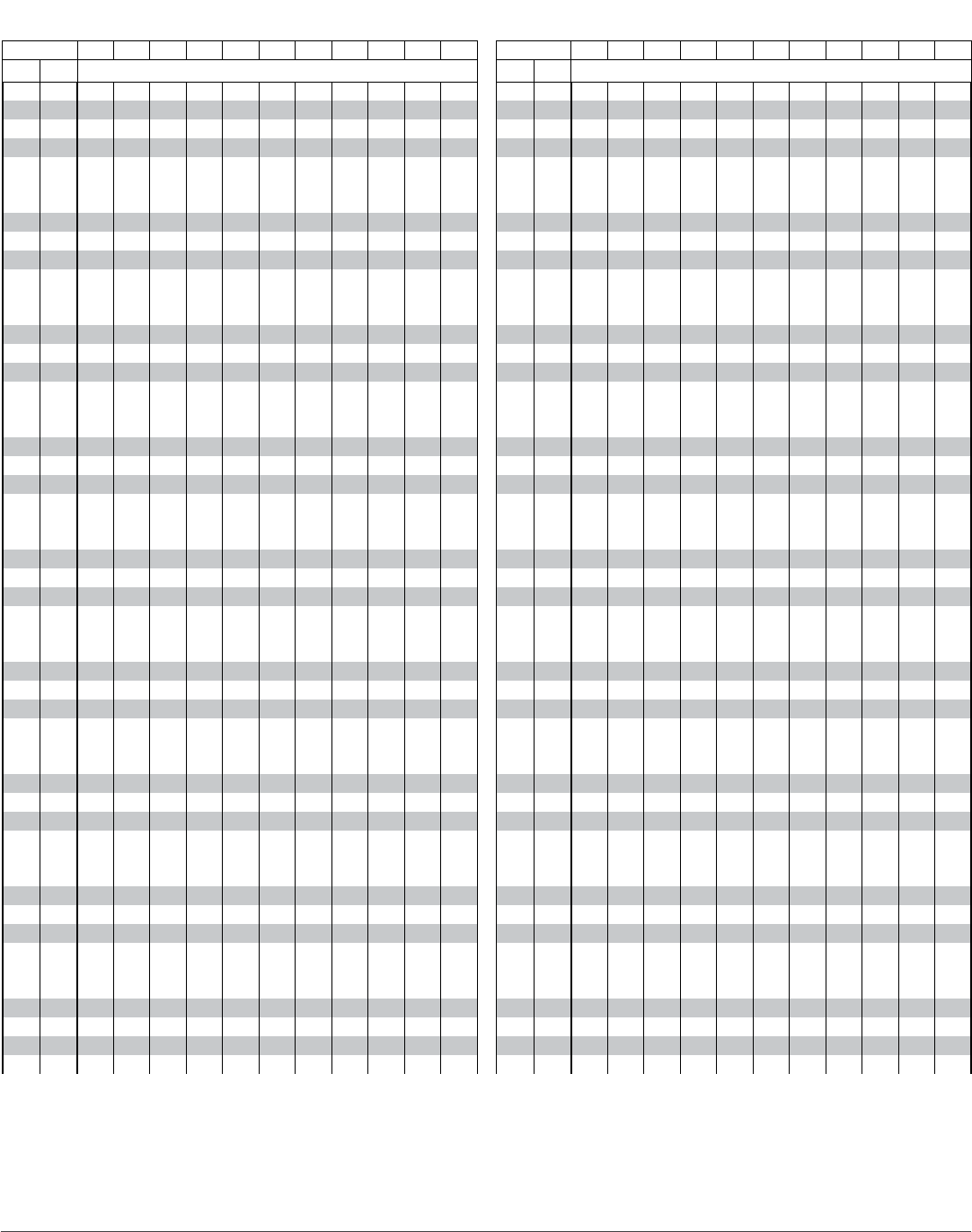

Single Biweekly Married Biweekly

Number of Exemptions Claimed

Number of Exemptions Claimed

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

1480 1510 46 39 33 27 21 14 8 2 0 0 0

1510 1540 47 34 28 22 15 9 3 0 0 0

1540 1570 48 41 35 29 23 16 4 0 0 0

1570 1600 49 42 36 30 24 17 11 0 0 0

1600

1630

1630

1660

50

51

43

44

37

38

31

32

25

26

18

19

12

13

6

7

0

1

0

0

0

0

1660 1690 52 45 39 33 27 20 14 8 2 0 0

1690 1720 53 46 34 28 21 9 3 0 0

1720 1750 54 47 41 35 29 22 16 4 0 0

1750

1780

1780

1810

55

56

48

49

42

43

36

37

30

31

23

24

17

18

11

12

5

6

0

0

0

0

1810 1840 57 44 38 32 25 19 13 7 0 0

1840 1870 58 51 45 39 33 26 14 8 1 0

1870 1900 59 52 46 40 34 27 21 9 2 0

1900

1930

1930

1960

61

63

53

54

47

48

41

42

35

36

28

29

22

23

16

17

10

11

3

4

0

0

1960 1990 65 55 49 43 37 30 24 18 12 5 0

1990 2020 67 56 44 38 31 19 13 6 0

2020 2050 69 57 51 45 39 32 26 14 7 1

2050

2080

2080

2110

71

73

58 52

53

46

47

40

41

33

34

27

28

21

22

15

16

8

9

2

3

2110 2140 75 62 54 48 42 35 29 23 17 10 4

2140 2170 77 64 55 49 43 36 24 18 11 5

2170 2200 79 66 56 50 44 37 31 19 12 6

2200

2230

2230

2260

81

83

68 57

58

51

52

45

46

38

39

32

33

26

27

20

21

13

14

7

8

2260 2290 85 72 53 47 40 34 28 22 15 9

2290 2320 86 74 62 54 48 41 29 23 16 10

2320 2350 88 76 64 55 49 42 36 24 17 11

2350

2380

2380

2410

90

92

78 66

68

56

57

50

51

43

44

37

38

31

32

25

26

18

19

12

13

2410 2440 94 82 58 52 45 39 33 27 20 14

2440 2470 96 84 72 59 53 46 34 28 21 15

2470 2500 98 86 74 61 54 47 41 29 22 16

2500

2530

2530

2560

100

102

88 76

78

63

65

55

56

48

50

42

43

36

37

30

31

24

25

17

18

2560 2590 104 92 67 57 51 44 38 32 26 19

2590 2620 106 94 82 69 58 52 39 33 27 20

2620 2650 108 96 84 71 59 53 46 34 28 21

2650

2680

2680

2710

110

112

98 86

88

73

75

61

63

54

55

47

48

41

42

35

36

29

30

22

23

2710 2740 114 102 77 65 56 49 43 37 31 24

2740 2770 116 104 92 79 67 57 44 38 32 25

2770 2800 118 106 94 81 69 58 51 39 33 26

2800 2830 120 108 96 83 71 59 52 46 40 34 27

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

1750 1780 46 39 33 27 21 14 8 2 0 0 0

1780 1810 47 34 28 22 15 9 3 0 0 0

1810 1840 48 41 29 23 16 4 0 0 0

1840 1870 49 42 36 24 17 11 0 0 0

1870

1900

1900

1930

51

43

44

37

38

31

32

26

18

19

12

13

6

7

0

1

0

0

0

0

1930 1960 52 45 39 33 27 20 14 8 2 0 0

1960 1990 53 46 34 28 21 9 3 0 0

1990 2020 54 47 41 29 22 16 4 0 0

2020

2050

2050

2080

56

48

49

42

43

36

37

31

23

24

17

18

11

12

5

6

0

0

0

0

2080 2110 57 44 38 32 25 19 13 7 0 0

2110 2140 58 51 39 33 26 14 8 1 0

2140 2170 59 52 46 34 27 21 9 2 0

2170

2200

2200

2230

61

53

54

47

48

41

42

36

28

29

22

23

16

17

10

11

3

4

0

0

2230 2260 62 55 49 43 37 30 24 18 12 5 0

2260 2290 63 56 44 38 31 19 13 6 0

2290 2320 64 57 51 39 32 26 14 7 1

2320

2350

2350

2380

66

58

59

52

53

46

47

41

33

34

27

28

21

22

15

16

8

9

2

3

2380 2410 67 54 48 42 35 29 23 17 10 4

2410 2440 68 61 49 43 36 24 18 11 5

2440 2470 69 62 56 44 37 31 19 12 6

2470

2500

2500

2530

71

63

64

57

58

51

52

46

38

39

32

33

26

27

20

21

13

14

7

8

2530 2560 72 65 59 53 47 40 34 28 22 15 9

2560 2590 73 66 54 48 41 29 23 16 10

2590 2620 74 67 61 49 42 36 24 17 11

2620

2650

2650

2680

76

68

69

62

63

56

57

51

43

44

37

38

31

32

25

26

18

19

12

13

2680 2710 77 64 58 52 45 39 33 27 20 14

2710 2740 78 71 59 53 46 34 28 21 15

2740 2770 79 72 66 54 47 41 29 22 16

2770

2800

2800

2830

81

73

74

67

68

61

62

56

48

49

42

43

36

37

30

31

23

24

17

18

2830 2860 82 75 69 63 57 50 44 38 32 25 19

2860 2890 83 76 64 58 51 39 33 26 20

2890 2920 84 77 71 59 52 46 34 27 21

2920

2950

2950

2980

86

78 72

73

66

67

61

54

55

47

48

41

42

35

36

29

30

22

23

2980 3010 87 81 74 68 62 56 49 43 37 31 24

3010 3040 88 82 69 63 57 44 38 32 25

3040 3070 89 83 76 64 58 51 39 33 26

3070 3100 84 77 71 59 52 46 40 34 27

Eecve Date: January 1, 2023 Civil union partners use Married Chart

TAX.VERMONT.GOV | 12 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

5

10

15

20

25

30

35

40

45

ag g

Single Semimonthly Married Semimonthly

Number of Exemptions Claimed

Number of Exemptions Claimed

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

0 160 0 0 0 0 0 0 0 0 0 0 0

160 190 1 0 0 0 0 0 0 0 0 0 0

190 220 2 0 0 0 0 0 0 0 0 0 0

220 250 3 0 0 0 0 0 0 0 0 0 0

250

280

280

310

4

5

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

310 340 6 0 0 0 0 0 0 0 0 0 0

340 370 7 0 0 0 0 0 0 0 0 0 0

370 400 8 1 0 0 0 0 0 0 0 0 0

400

430

430

460

9

10

2

3

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

460 490 11 4 0 0 0 0 0 0 0 0 0

490 520 12 5 0 0 0 0 0 0 0 0 0

520 550 13 6 0 0 0 0 0 0 0 0 0

550

580

580

610

14

15

7

8

1

2

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

610 640 16 9 3 0 0 0 0 0 0 0 0

640 670 17 10 4 0 0 0 0 0 0 0 0

670 700 18 11 5 0 0 0 0 0 0 0 0

700

730

730

760

19

20

12

13

6

7

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

760 790 21 14 8 1 0 0 0 0 0 0 0

790 820 22 15 9 2 0 0 0 0 0 0 0

820 850 23 16 10 3 0 0 0 0 0 0 0

850

880

880

910

24

25

17

18

11

12

4

5

0

0

0

0

0

0

0

0

0

0

0

0

0

0

910 940 26 19 13 6 0 0 0 0 0 0 0

940 970 27 20 14 7 0 0 0 0 0 0 0

970 1000 28 21 15 8 1 0 0 0 0 0 0

1000

1030

1030

1060

29

30

22

23

16

17

9

10

2

3

0

0

0

0

0

0

0

0

0

0

0

0

1060 1090 31 24 18 11 4 0 0 0 0 0 0

1090 1120 32 25 19 12 5 0 0 0 0 0 0

1120 1150 33 26 20 13 6 0 0 0 0 0 0

1150

1180

1180

1210

34

35

27

28

21

22

14

15

7

8

0

1

0

0

0

0

0

0

0

0

0

0

1210 1240 36 29 23 16 9 2 0 0 0 0 0

1240 1270 37 30 24 17 10 3 0 0 0

0 0

1270 1300 38 31 25 18 11 4 0 0 0 0 0

1300

1330

1330

1360

39

40

32

33

26

27

19

20

12

13

5

6

0

0

0

0

0

0

0

0

0

0

1360 1390 41 34 28 21 14 7 1 0 0 0 0

1390 1420 42 35 29 22 15 8 2 0 0 0 0

1420 1450 43 36 30 23 16 9 3 0 0 0 0

1450 1480 44 37 31 24 17 10 4 0 0 0 0

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

0 470 0 0 0 0 0 0 0 0 0 0 0

470 500 2 0 0 0 0 0 0 0 0 0 0

500 530 3 0 0 0 0 0 0 0 0 0 0

530 560 4 0 0 0 0 0 0 0 0 0 0

560

590

590

620 6

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

620 650 7 0 0 0 0 0 0 0 0 0 0

650 680 8 1 0 0 0 0 0 0 0 0 0

680 710 9 2 0 0 0 0 0 0 0 0 0

710

740

740

770 11

3

4

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

770 800 12 5 0 0 0 0 0 0 0 0 0

800 830 13 6 0 0 0 0 0 0 0 0 0

830 860 14 7 0 0 0 0 0 0 0 0 0

860

890

890

920 16

8

9

1

2

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

920 950 17 10 3 0 0 0 0 0 0 0 0

950 980 18 11 4 0 0 0 0 0 0 0 0

980 1010 19 12 5 0 0 0 0 0 0 0 0

1010

1040

1040

1070 21

13

14

6

7

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1070 1100 22 15 8 1 0 0 0 0 0 0 0

1100 1130 23 16 9 2 0 0 0 0 0 0 0

1130 1160 24 17 10 3 0 0 0 0 0 0 0

1160

1190

1190

1220 26

18

19

11

12

4

5

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1220 1250 27 20 13 6 0 0 0 0 0 0 0

1250 1280 28 21 14 7 1 0 0 0 0 0 0

1280 1310 29 22 15 8 2 0 0 0 0 0 0

1310

1340

1340

1370 31

23

24

16

17

9

10

3

4

0

0

0

0

0

0

0

0

0

0

0

0

1370 1400 32 25 18 11 5 0 0 0 0 0 0

1400 1430 33 26 19 12 6 0 0 0 0 0 0

1430 1460 34 27 20 13 7 0 0 0 0 0 0

1460

1490

1490

1520 36

28

29

21

22

14

15

8

9

1

2

0

0

0

0

0

0

0

0

0

0

1520 1550 37 30 23 16 10 3 0 0 0 0 0

1550 1580 38 31 24 17 11 4 0 0 0

0 0

1580 1610 39 32 25 18 12 5 0 0 0 0 0

1610

1640

1640

1670 41

33

34

26

27

19

20

13

14

6

7

0

0

0

0

0

0

0

0

0

0

1670 1700 42 35 28 21 15 8 1 0 0 0 0

1700 1730 43 36 29 22 16 9 2 0 0 0 0

1730 1760 44 37 30 23 17 10 3 0 0 0 0

1760 1790 38 31 24 18 11 4 0 0 0 0

Eecve Date: January 1, 2023 Civil union partners use Married Chart

TAX.VERMONT.GOV | 13 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

15

20

25

30

35

40

45

50

55

15

20

25

30

35

40

45

50

55

20

25

30

35

40

45

50

55

60

20

25

30

35

40

45

50

55

60

25

30

35

40

45

50

55

60

65

70

35

40

45

50

55

60

65

70

75

40

45

50

55

60

65

70

75

80

50

55

60

65

70

75

80

85

90

ag g

Single Semimonthly Married Semimonthly

Number of Exemptions Claimed Number of Exemptions Claimed

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

1480 1510 45 38 32 25 18 11 5 0 0 0 0

1510 1540 46 39 33 26 19 12 6 0 0 0 0

1540 1570 47 40 34 27 13 7 0 0 0 0

1570 1600 48 41 35 28 21 14 8 1 0 0 0

1600

1630

1630

1660

49

50

42

43

36

37

29

30

22

23

16

9

10

2

3

0

0

0

0

0

0

1660 1690 51 44 38 31 24 17 11 4 0 0 0

1690 1720 52 45 39 32 18 12 5 0 0 0

1720 1750 53 46 40 33 26 19 13 6 0 0 0

1750

1780

1780

1810

54

55

47

48

41

42

34

35

27

28

21

14

15

7

8

0

1

0

0

0

0

1810 1840 56 49 43 36 29 22 16 9 2 0 0

1840 1870 57 50 44 37 23 17 10 3 0 0

1870 1900 58 51 45 38 31 24 18 11 4 0 0

1900

1930

1930

1960

59

60

52

54

46

47

39

40

32

33

26

19

20

12

13

5

6

0

0

0

0

1960 1990 61 55 48 41 34 27 21 14 7 0 0

1990 2020 62 56 49 42 28 22 15 8 1 0

2020 2050 63 57 50 43 36 29 23 16 9 2 0

2050

2080

2080

2110

65

67

58

59

51

52

44

45

37

38

31

24

25

17

18

10

11

3

4

0

0

2110 2140 69 60 53 46 39 32 26 19 12 5 0

2140 2170 71 61 54 47 33 27 20 13 6 0

2170 2200 73 62 55 48 41 34 28 21 14 7 1

2200

2230

2230

2260

75

77

63

64

56

57

49

50

42

43

36

29

30

22

23

15

16

8

9

2

3

2260 2290 79 66 58 51 44 37 31 24 17 10 4

2290 2320 81 68 59 52 38 32 25 18 11 5

2320 2350 83 70 60 53 46 39 33 26 19 12 6

2350

2380

2380

2410

85

87

72

74

61

62

54

55

47

48

41

34

35

27

28

20

21

13

14

7

8

2410 2440 89 76 63 56 49 43 36 29 22 15 9

2440 2470 91 78 64 57 44 37 30 23 16 10

2470 2500 93 80 66 58 51 38 31 24 17 11

2500

2530

2530

2560

95

97

82

84

68

70

59

60

52

53

46

47

39

40

32

33

25

26

18

19

12

13

2560 2590 99 86 72 61 54 48 41 34 27 20 14

2590 2620 101 87 74 62 49 42 35 28 21 15

2620 2650 103 89 76 63 56 43 36 29 22 16

2650

2680

2680

2710

105

107

91

93

78

80

65

67

57

58

51

52

44

45

37

38

30

31

23

24

17

18

2710 2740 109 95 82 69 59 53 46 39 32 25 19

2740 2770 111 97 84 71 54 47 40 33 26 20

2770 2800 113 99 86 73 61 48 41 34 27 21

2800 2830 115 101 88 75 62 56 49 42 35 28 22

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

1790 1820 46 39 32 19 12 5 0 0 0 0

1820 1850 47 33 26 13 6 0 0 0 0

1850 1880 48 41 34 27 21 14 7 0 0 0 0

1880 1910 49 42 28 22 8 1 0 0 0

1910

1940

1940

1970

51

43

44

36

37

29 23

24

16

17

9

10

2

3

0

0

0

0

0

0

1970 2000 52 38 31 18 11 4 0 0 0

2000 2030 53 46 39 32 26 19 12 5 0 0 0

2030 2060 54 47 33 27 13 6 0 0 0

2060

2090

2090

2120

56

48

49

41

42

34 28

29

21

22

14

15

7

8

1

2

0

0

0

0

2120 2150 57 43 37 23 16 9 3 0 0

2150 2180 58 51 44 38 31 24 17 10 4 0 0

2180 2210 59 52 39 32 18 11 5 0 0

2210

2240

2240

2270

61

53

54

46

47

41

33

34

26

27

19

20

12

13

6

7

0

0

0

0

2270 2300 62 48 42 28 21 14 8 1 0

2300 2330 63 56 49 43 36 29 22 15 9 2 0

2330 2360 64 57 44 37 23 16 10 3 0

2360

2390

2390

2420

66

58

59

51

52

46

38

39

31

32

24

25

17

18

11

12

4

5

0

0

2420 2450 67 53 47 33 26 19 13 6 0

2450 2480 68 61 54 48 41 34 27 20 14 7 0

2480 2510 69 62 49 42 28 21 15 8 1

2510

2540

2540

2570

71

63

64

56

57

51

43

44

36

37

29

30

22

23

16

17

9

10

2

3

2570 2600 72 58 52 38 31 25 18 11 4

2600 2630 73 66 59 53 46 39 32 26 19 12 5

2630 2660 74 67 54 47 33 27 20 13 6

2660

2690

2690

2720

76

68

69

61

62

56

48

49

41

42

34

35

28

29

21

22

14

15

7

8

2720 2750 77 63 57 43 36 30 23 16 9

2750 2780 78 71 64 58 51 44 37 31 24 17 10

2780 2810 79 72 59 52 38 32 25 18 11

2810

2840

2840

2870

81

73

74

66

67

61

53

54

46

47

39

40

33

34

26

27

19

20

12

13

2870 2900 82 68 62 48 41 35 28 21 14

2900 2930 83 76 69 63 56 49 42 36 29 22 15

2930 2960 84 77 64 57 43 37 30 23 16

2960

2990

2990

3020

86

78

79

71

72

66

58

59

51

52

44

45

38

39

31

32

24

25

17

18

3020 3050 87 73 67 53 46 40 33 26 19

3050 3080 88 81 74 68 61 54 47 41 34 27 20

3080 3110 89 82 69 62 48 42 35 28 21

3110 3140 83 76 63 56 49 43 36 29 22

Eecve Date: January 1, 2023 Civil union partners use Married Chart

TAX.VERMONT.GOV | 14 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

ag g

Single Monthly Married Monthly

Number of Exemptions Claimed Number of Exemptions Claimed

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

0 320 0 0 0 0 0 0 0 0 0 0 0

320 380 2 0 0 0 0 0 0 0 0 0 0

380 440 4 0 0 0 0 0 0 0 0 0 0

440 500 6 0 0 0 0 0 0 0 0 0 0

500

560

560

620

8

10

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

620 680 12 0 0 0 0 0 0 0 0 0 0

680 740 14 0 0 0 0 0 0 0 0 0 0

740 800 16 2 0 0 0 0 0 0 0 0 0

800

860

860

920

18

20

4

7

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

920 980 22 9 0 0 0 0 0 0 0 0 0

980 1040 24 11 0 0 0 0 0 0 0 0 0

1040 1100 26 13 0 0 0 0 0 0 0 0 0

1100

1160

1160

1220

28

30

15

17

1

3

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1220 1280 32 19 5 0 0 0 0 0 0 0 0

1280 1340 34 21 7 0 0 0 0 0 0 0 0

1340 1400 36 23 9 0 0 0 0 0 0 0 0

1400

1460

1460

1520

38

40

25

27

11

13

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1520 1580 42 29 15 2 0 0 0 0 0 0 0

1580 1640 44 31 17 4 0 0 0 0 0 0 0

1640 1700 46 33 19 6 0 0 0 0 0 0 0

1700

1760

1760

1820

48

50

35

37

21

23

8

10

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1820 1880 52 39 25 12 0 0 0 0 0 0 0

1880 1940 54 41 27 14 0 0 0 0 0 0 0

1940 2000 56 43 29 16 2 0 0 0 0 0 0

2000

2060

2060

2120

58

60

45

47

31

33

18

20

4

6

0

0

0

0

0

0

0

0

0

0

0

0

2120 2180 62 49 35 22 8 0 0 0 0 0 0

2180 2240 64 51 37 24 10 0 0 0 0 0 0

2240 2300 66 53 39 26 12 0 0 0 0 0 0

2300

2360

2360

2420

68

70

55

57

41

43

28

30

14

16

1

3

0

0

0

0

0

0

0

0

0

0

2420 2480 72 59 45 32 18 5 0 0 0 0 0

2480 2540 74 61 47 34 20 7 0 0 0 0 0

2540 2600 76 63 49 36 22 9 0 0 0 0 0

2600

2660

2660

2720

78

80

65

67

51

53

38

40

24

26

11

13

0

0

0

0

0

0

0

0

0

0

2720 2780 82 69 55 42 28 15 1 0 0 0 0

2780 2840 84 71 57 44 30 17 3 0 0 0 0

2840 2900 86 73 59 46 32 19 5 0 0 0 0

2900 2960 88 75 61 48 34 21 7 0 0 0 0

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

0 940 0 0 0 0 0 0 0 0 0 0 0

940 1000 3 0 0 0 0 0 0 0 0 0 0

1000 1060 5 0 0 0 0 0 0 0 0 0 0

1060 1120 7 0 0 0 0 0 0 0 0 0 0

1120

1180

1180

1240

9

11

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1240 1300 13 0 0 0 0 0 0 0 0 0 0

1300 1360 15 2 0 0 0 0 0 0 0 0 0

1360 1420 17 4 0 0 0 0 0 0 0 0 0

1420

1480

1480

1540

19

21

6

8

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1540 1600 23 10 0 0 0 0 0 0 0 0 0

1600 1660 25 12 0 0 0 0 0 0 0 0 0

1660 1720 27 14 0 0 0 0 0 0 0 0 0

1720

1780

1780

1840

29

31

16

18

2

4

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1840 1900 33 20 6 0 0 0 0 0 0 0 0

1900 1960 35 22 8 0 0 0 0 0 0 0 0

1960 2020 37 24 10 0 0 0 0 0 0 0 0

2020

2080

2080

2140

39

41

26

28

12

14

0

1

0

0

0

0

0

0

0

0

0

0

0

0

0

0

2140 2200 43 30 16 3 0 0 0 0 0 0 0

2200 2260 45 32 18 5 0 0 0 0 0 0 0

2260 2320 47 34 20 7 0 0 0 0 0 0 0

2320

2380

2380

2440

49

51

36

38

22

24

9

11

0

0

0

0

0

0

0

0

0

0

0

0

0

0

2440 2500 53 40 26 13 0 0 0 0 0 0 0

2500 2560 55 42 28 15 1 0 0 0 0 0 0

2560 2620 57 44 30 17 3 0 0 0 0 0 0

2620

2680

2680

2740

59

61

46

48

32

34

19

21

5

7

0

0

0

0

0

0

0

0

0

0

0

0

2740 2800 63 50 36 23 9 0 0 0 0 0 0

2800 2860 65 52 38 25 11 0 0 0 0 0 0

2860 2920 67 54 40 27 13 0 0 0 0 0 0

2920

2980

2980

3040

69

71

56

58

42

44

29

31

15

17

2

4

0

0

0

0

0

0

0

0

0

0

3040 3100 73 60 46 33 19 6 0 0 0 0 0

3100 3160 75 62 48 35 21 8 0 0 0 0 0

3160 3220 77 64 50 37 23 10 0 0 0 0 0

3220

3280

3280

3340

79

81

66

68

52

54

39

41

25

27

12

14

0

0

0

0

0

0

0

0

0

0

3340 3400 83 70 56 43 29 16 2 0 0 0 0

3400 3460 85 72 58 45 31 18 4 0 0 0 0

3460 3520 87 74 60 47 33 20 6 0 0 0 0

3520 3580 90 76 62 49 35 22 8 0 0 0 0

Eecve Date: January 1, 2023 Civil union partners use Married Chart

TAX.VERMONT.GOV | 15 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

ag g

Single Monthly Married Monthly

Number of Exemptions Claimed Number of Exemptions Claimed

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

2960 3020 90 77 63 50 36 23 9 0 0 0 0

3020 3080 92 79 65 52 38 25 11 0 0 0 0

3080 3140 94 81 67 54 40 27 13 0 0 0 0

3140 3200 96 83 69 56 42 29 15 2 0 0 0

3200

3260

3260

3320

98

100

85

87

71

73

58

60

44

46

31

33

17

19

4

6

0

0

0

0

0

0

3320 3380 102 89 75 62 48 35 21 8 0 0 0

3380 3440 104 91 77 64 50 37 23 10 0 0 0

3440 3500 106 93 79 66 52 39 25 12 0 0 0

3500

3560

3560

3620

108

110

95

97

81

83

68

70

54

56

41

43

27

29

14

16

0

2

0

0

0

0

3620 3680 113 99 85 72 58 45 31 18 4 0 0

3680 3740 115

101 87 74 60 47 33 20 6 0 0

3740 3800 117 103 89 76 62 49 35 22 8 0 0

3800

3860

3860

3920

119

121

105

107

91

93

78

80

64

66

51

53

37

39

24

26

10

12

0

0

0

0

3920 3980 123 109 95 82 68 55 41 28 14 1 0

3980

4040

4100

4160

4040

4100

4160

4220

125

127

130

134

111

113

115

117

97

99

102

104

84

86

88

90

70

72

74

76

57

59

61

63

43

45

47

49

30

32

34

36

16

18

20

22

3

5

7

9

0

0

0

0

4220 4280 138 119 106 92 78 65 51 38 24 11 0

4280

4340

4400

4460

4340

4400

4460

4520

142

146

150

154

121

123

125

127

108

110

112

114

94

96

98

100

80

82

84

86

67

69

71

73

53

55

57

59

40

42

44

46

26

28

30

32

13

15

17

19

0

1

3

5

4520 4580 158 131 116 102 88 75 61 48 34 21 7

4580

4640

4700

4760

4640

4700

4760

4820

162

166

170

174

135

139

143

147

118

120

122

124

104

106

108

110

91

93

95

97

77

79

81

83

63

65

67

69

50

52

54

56

36

38

40

42

23

25

27

29

9

11

13

15

4820 4880 178 151 126 112 99 85 71 58 44 31 17

4880

4940

5000

5060

4940

5000

5060

5120

182

186

190

194

155

159

163

167

129

132

136

140

114

116

118

120

101

103

105

107

87

89

91

93

73

75

77

80

60

62

64

66

46

48

50

52

33

35

37

39

19

21

23

25

5120 5180 198 171 144 122 109 95 82 68 54 41 27

5180

5240

5300

5360

5240

5300

5360

5420

202

206

210

214

175

179

183

187

148

152

156

160

124

126

130

134

111

113

115

117

97

99

101

103

84

86

88

90

70

72

74

76

56

58

60

62

43

45

47

49

29

31

33

35

5420 5480 217 191 164 137 119 105 92 78 64 51 37

5480 5540 221 195 168 141 121 107 94 80 66 53 39

5540 5600 225 199 172 145 123 109 96 82 69 55 41

5600 5660 229 203 176 149 125 111 98 84 71 57 43

Payment 0 1 2 3 4 5 6 7 8 9 10

at least

but less

than

Vermont Withholding is:

3580 3640 92 78 64 51 37 24 10 0 0 0 0

3640 3700 94 80 66 53 39 26 12 0 0 0 0

3700 3760 96 82 68 55 41 28 14 1 0 0 0

3760 3820 98 84 70 57 43 30 16 3 0 0 0

3820

3880

3880

3940

100

102

86

88

72

74

59

61

45

47

32

34

18

20

5

7

0

0

0

0

0

0

3940 4000 104 90 76 63 49 36 22 9 0 0 0

4000 4060 106 92 79 65 51 38 24 11 0 0 0

4060 4120 108 94 81 67 53 40 26 13 0 0 0

4120

4180

4180

4240

110

112

96

98

83

85

69

71

55

57

42

44

28

30

15

17

1

3

0

0

0

0

4240 4300 114 100 87 73 59 46 32 19 5 0 0

4300 4360 116

102 89 75 61 48 34 21 7 0 0

4360 4420 118 104 91 77 63 50 36 23 9 0 0

4420

4480

4480

4540

120

122

106

108

93

95

79

81

65

68

52

54

38

40

25

27

11

13

0

0

0

0

4540 4600 124 110 97 83 70 56 42 29 15 2 0

4600

4660

4720

4780

4660

4720

4780

4840

126

128

130

132

112

114

116

118

99

101

103

105

85

87

89

91

72

74

76

78

58

60

62

64

44

46

48

50

31

33

35

37

17

19

21

23

4

6

8

10

0

0

0

0

4840 4900 134 120 107 93 80 66 52 39 25 12 0

4900

4960

5020

5080

4960

5020

5080

5140

136

138

140

142

122

124

126

128

109

111

113

115

95

97

99

101

82

84

86

88

68

70

72

74

55

57

59

61

41

43

45

47

27

29

31

33

14

16

18

20

0

2

4

6

5140 5200 144 130 117 103 90 76 63 49 35 22 8

5200

5260

5320

5380

5260

5320

5380

5440

146

148

150

152

132

134

136

138

119

121

123

125

105

107

109

111

92

94

96

98

78

80

82

84

65

67

69

71

51

53

55

57

37

39

41

44

24

26

28

30

10

12

14

16

5440 5500 154 140 127 113 100 86 73 59 46 32 18

5500

5560

5620

5680

5560

5620

5680

5740

156

158

160

162

142

144

146

148

129

131

133

135

115

117

119

121

102

104

106

108

88

90

92

94

75

77

79

81

61

63

65

67

48

50

52

54

34

36

38

40

20

22

24

26

5740 5800 164 150 137 123 110 96 83 69 56 42 28

5800

5860

5920

5980

5860

5920

5980

6040

166

168

170

172

152

154

156

158

139

141

143

145

125

127

129

131

112

114

116

118

98

100

102

104

85

87

89

91

71

73

75

77

58

60

62

64

44

46

48

50

30

33

35

37

6040 6100 174 160 147 133 120 106 93 79 66 52 39

6100 6160 176 162 149 135 122 108 95 81 68 54 41

6160 6220 178 164 151 137 124 110 97 83 70 56 43

6220 6280 180 166 153 139 126 112 99 85 72 58 45

Eecve Date: January 1, 2023 Civil union partners use Married Chart

TAX.VERMONT.GOV | 16 2023 INCOME TAX WITHHOLDING INSTRUCTIONS, TABLES, AND CHARTS - GB-1210

ag g

Single Daily or Miscellaneous Married Daily or Miscellaneous

Number of Exemptions Claimed Number of Exemptions Claimed

Payment

(per day)

0 1 2 3 4 5 6 7 8 9 10

but less

at least

than

Vermont Withholding is:

0 16 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

16 19 0.14 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

19 22 0.24 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

22 25 0.34 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

25 28 0.44 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

28 31 0.54 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

31 34 0.64 0.01 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

34 37 0.74 0.11 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

37 40 0.84 0.21 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

40 43 0.94 0.31 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

43 46 1.04 0.41 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

46 49 1.14 0.52 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

49 52 1.24 0.62 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

52 55 1.34 0.72 0.09 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

55 58 1.44 0.82 0.19 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

58 61 1.54 0.92 0.29 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00

61 64 1.64 1.02 0.39 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

64 67 1.74 1.12 0.49 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

67 70 1.84 1.22 0.59 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

70 73 1.94 1.32 0.69 0.07 0.00 0.00 0.00 0.00 0.00 0.00 0.00

73 76 2.04 1.42 0.79 0.17 0.00 0.00 0.00 0.00 0.00 0.00 0.00

76 79 2.15 1.52 0.90 0.27 0.00 0.00 0.00 0.00 0.00 0.00 0.00

79 82 2.25 1.62 1.00 0.37 0.00 0.00 0.00 0.00 0.00 0.00 0.00

82 85 2.35 1.72 1.10 0.47 0.00 0.00 0.00 0.00 0.00 0.00 0.00

85 88 2.45 1.82 1.20 0.57 0.00 0.00 0.00 0.00 0.00 0.00 0.00

88 91 2.55 1.92 1.30 0.67 0.05 0.00 0.00 0.00 0.00 0.00 0.00

91 94 2.65 2.02 1.40 0.77 0.15 0.00 0.00 0.00 0.00 0.00 0.00

94 97 2.75 2.12 1.50 0.87 0.25 0.00 0.00 0.00 0.00 0.00 0.00

97 100 2.85 2.22 1.60 0.97 0.35 0.00 0.00 0.00 0.00 0.00 0.00

100 103 2.95 2.32 1.70 1.07 0.45 0.00 0.00 0.00 0.00 0.00 0.00

103 106 3.05 2.42 1.80 1.18 0.55 0.00 0.00 0.00 0.00 0.00 0.00

106 109 3.15 2.53 1.90 1.28 0.65 0.03 0.00 0.00 0.00 0.00 0.00

109 112 3.25 2.63 2.00 1.38 0.75 0.13 0.00 0.00 0.00 0.00 0.00

112 115 3.35 2.73 2.10 1.48 0.85 0.23 0.00 0.00 0.00 0.00 0.00

115 118 3.45 2.83 2.20 1.58 0.95 0.33 0.00 0.00 0.00 0.00 0.00

118 121 3.55 2.93 2.30 1.68 1.05 0.43 0.00 0.00 0.00 0.00 0.00

121 124 3.65 3.03 2.40 1.78 1.15 0.53 0.00 0.00 0.00 0.00 0.00

124 127 3.75 3.13 2.50 1.88 1.25 0.63 0.00 0.00 0.00 0.00 0.00

127 130 3.85 3.23 2.60 1.98 1.35 0.73 0.10 0.00 0.00 0.00 0.00

130 133 3.95 3.33 2.70 2.08 1.45 0.83 0.20 0.00 0.00 0.00 0.00

133 136 4.05 3.43 2.80 2.18 1.56 0.93 0.31 0.00 0.00 0.00 0.00

136 139 4.16 3.53 2.91 2.28 1.66 1.03 0.41 0.00 0.00 0.00 0.00

139 142 4.26 3.63 3.01 2.38 1.76 1.13 0.51 0.00 0.00 0.00 0.00

142 145 4.36 3.73 3.11 2.48 1.86 1.23 0.61 0.00 0.00 0.00 0.00

145 148 4.46 3.83 3.21 2.58 1.96 1.33 0.71 0.08 0.00 0.00 0.00

Payment

(per day)

0 1 2 3 4 5 6 7 8 9 10

but less

at least

than

Vermont Withholding is:

0 43 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

43 46 0.13 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

46 49 0.23 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

49 52 0.33 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

52 55 0.43 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

55 58 0.54 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

58 61 0.64 0.01 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

61 64 0.74 0.11 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

64 67 0.84 0.21 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

67 70 0.94 0.31 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00